Before the pandemic, Canadian universities benefited from growing international student populations. From 2016 to 2019, the number of student visas issued to international students for Canadian university studies grew by 35%.1 These students not only brought greater diversity to Canadian campuses, they also became a key source of revenue for their institutions. But the pandemic caused many students to delay or pause their study abroad plans in 2020 and 2021. And, according to a recent Statistics Canada report, Canadian universities may have lost significant international student tuition revenues in 2020/21 as a result.

In today’s ApplyInsights, I’ll be leveraging this Statistics Canada report to provide my thoughts on the economic impact of the COVID-19 pandemic on Canadian universities for the 2020/21 academic year. I’ll be specifically focusing on the influence of lower international student enrollment on overall university revenue, though I’ll also provide my thoughts on what 2021/22 has in store for Canadian universities and what these institutions can do to recover post-pandemic.

Key Insights at a Glance

- Canadian universities likely lost around $1.1B in projected tuition revenue for the 2020/21 academic year due to lower international student enrollment.

- International student tuition fees account for a larger portion of overall revenue for universities in Ontario and British Columbia compared to institutions in other provinces.

- Economic challenges around the world mean that raising international tuition fees could hamper post-pandemic enrollment and delay revenue recovery.

Projecting International Student Populations in 2020/21

International student populations in Canada boomed pre-pandemic. Students were drawn to the high-quality education offered by Canadian institutions, as well as the strong employment and permanent residency (PR) pathways they could access post-graduation. From 2010/11 to 2018/19, the number of international students enrolled at Canadian universities more than doubled. At the same time, domestic student populations remained stable.

To account for these differences, Statistics Canada projects both international and domestic university student populations in 2020/21 in their report. Based on issued study permit data covering August 2013 to October 2020 and other government data, the authors of the report outline three possible scenarios for international student enrollment in 2020/21.2 All three scenarios include international student enrollment declines from 2019/20:

- Low loss (-12.5% nationally)

- Medium loss (-21.8% nationally)

- High loss (-41.6% nationally)

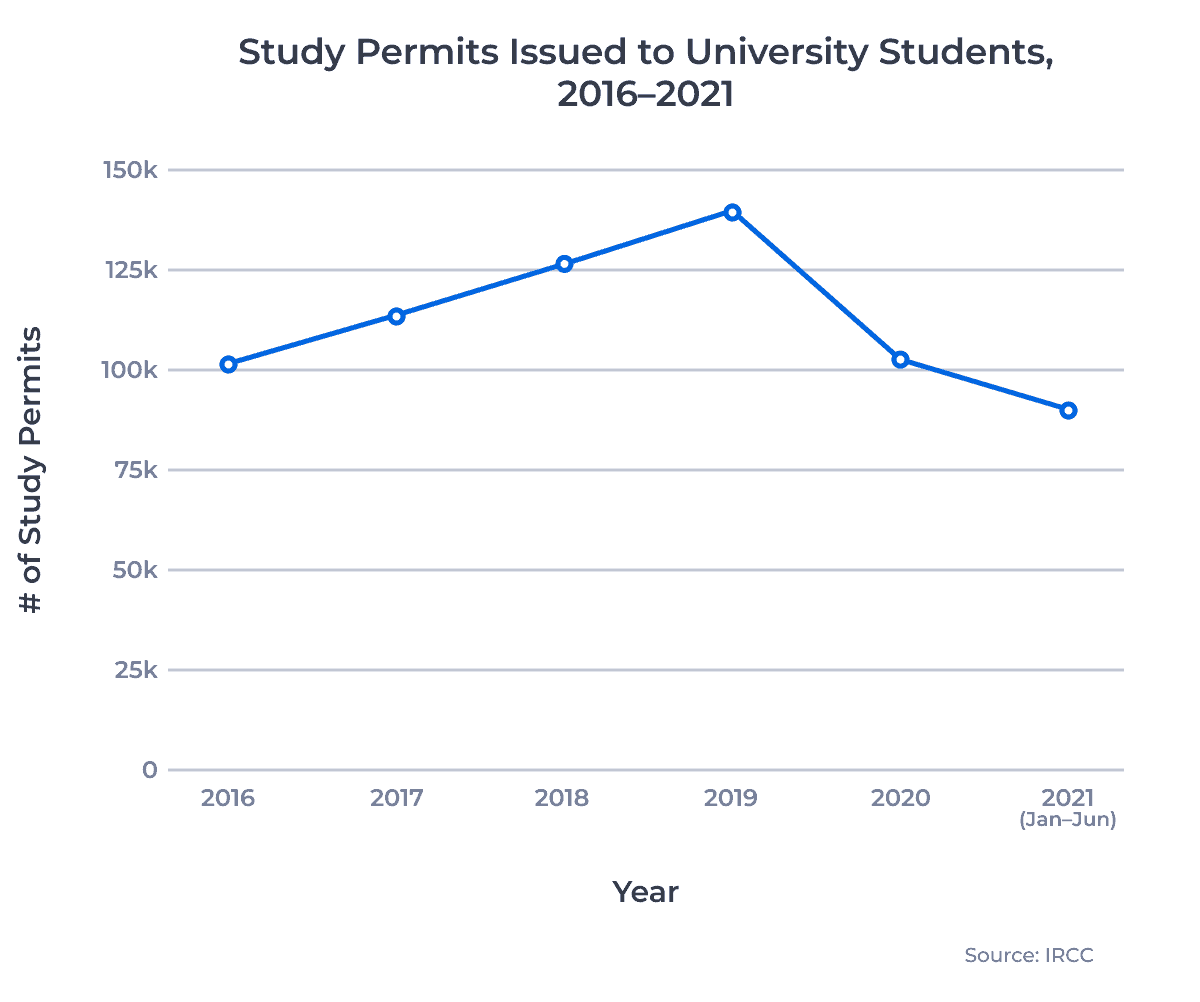

While these assumptions were made with the most recent information available at the time, we now have access to study permit data up to June 2021. Looking at this data, we can see which of the report’s scenarios most closely resembles actual study permit trends from 2020/21. The chart below shows the number of study permits issued to university students from 2016 through the first half of 2021:

The Canadian international ed market is poised for a strong recovery in 2021. In the first six months of 2021, over 90,000 study permits were issued to university students, surpassing 90% of the full-year 2020 total.

To provide a more complete picture of Canadian university enrollment in 2020/21, Statistics Canada also provides different scenarios regarding domestic student enrollment. Given the historical stability of the domestic market, we’ll assume that domestic student enrollment will remain consistent. This will also help highlight the impacts of lower international student enrollment during the pandemic.

The Financial Impact

Over the past ten years, international students have paid higher tuition rates than their domestic classmates.4 Over that period, average undergraduate tuition for an international student rose by over 25%. By comparison, domestic student tuition fees stayed relatively stable over this ten-year period, making Canadian universities more reliant on international student tuition fees to balance their budgets.

According to Statistics Canada, while international students accounted for just 15% of all university enrollments in 2018/19, they accounted for over 33% of tuition fees paid by students nationally.

So how does the projected international student loss impact the bottom line of Canadian universities? Statistics Canada projects that this loss scenario would result in a 2.5% decline in projected university revenues, equalling $1.1B. Though the report outlines high loss scenarios of up to $2.5B, this sum is still significant. Universities will be faced with difficult choices to determine how to account for these losses and how to regain a stable footing moving forward.

Projected Financial Impacts by Province

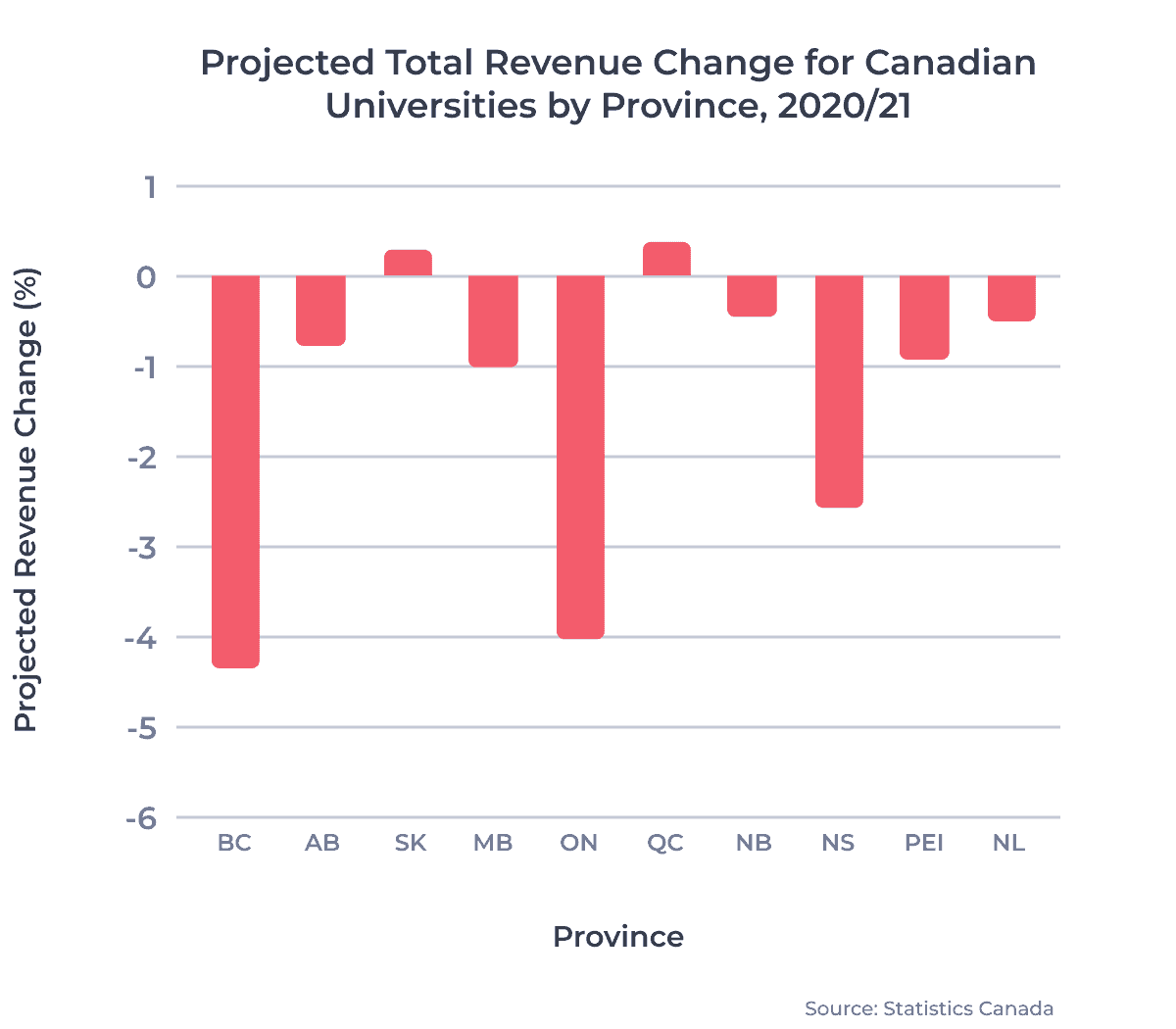

It’s important to note that this loss of revenue will be felt differently by universities across Canada. Institutions in some provinces, such as Ontario and British Columbia, have much larger international student populations. Each province also provides a different level of funding to their universities, and international student tuition fees vary greatly from coast to coast. For example, international student tuition revenue was expected to account for 21% of total university revenue in Ontario in 2020/21 but only 5% of total revenue for universities in Newfoundland and Labrador.

The following chart shows the projected change in revenue for Canadian universities by province in 2020/21:

The Canadian federal government created the Canada Research Continuity Emergency Fund to provide $450M to Canadian universities to support ongoing research and health studies during the pandemic. Additionally, the Nova Scotia government announced a special grant totalling $25M for universities impacted by COVID-19 to offset revenue losses.

I was surprised to see that universities in Quebec and Saskatchewan are projected to increase their revenue in 2020/21 despite international student declines. For Quebec, this is directly tied to the provincial government’s decision to award public funding based on 2018/19 enrollment numbers. By contrast, universities in Saskatchewan were the least reliant on international student tuition, providing limited growth due to increased government funding.

Roadmap for Recovery

Canadian universities have already avoided the worst-case financial scenarios in 2020/21. Overall, Canada’s international ed sector is on track for strong recovery in 2021 thanks to higher visa approval rates and growing demand for Canada’s Post-Graduation Work Permit Program (PGWPP). While a projected loss of $1.1B in revenue is significant, I anticipate that Canadian universities will be able to recover quickly post-pandemic.

But Canadian universities should also be careful about how they address these revenue losses. Some universities may be considering increasing tuition for international students in 2022, even if they kept tuition rates stable in 2021. Such increases might help recover lost revenue, but I would instead encourage Canadian universities to keep their tuition rates stable throughout the early post-pandemic period.

International Student Tuition and Support

I know firsthand that success stories from friends and family play a huge role in influencing where and what students study abroad. Our recruitment partners around the world encounter these stories every day. Both positive and negative experiences for one student can have a ripple effect on the decisions of other students in their family or community.

In growing markets like Bangladesh, Nepal, and Sri Lanka, word of mouth is often the main factor that pushes a student to attend a specific school or program.

By keeping tuition rates stable, Canadian universities can demonstrate that they are more interested in bringing students back to campus rather than balancing their books. This same principle applies to universities considering their student support strategies in the coming months. By continuing to provide enhanced support for international students, whether in Canada or at home, universities will build goodwill with their students.

Looking Forward

I anticipate that many international students will restart their study abroad plans by the summer of 2022, barring any new travel restrictions caused by the COVID-19 Delta variant.

Over the next 12 months, Canadian universities should dedicate additional resources to international student support and recruitment. This could include developing additional scholarships for international students impacted by the pandemic, or offsetting student quarantine costs.

These additional costs may prolong the financial recovery period for Canadian universities. But the positive impact of these measures will only increase the demand for Canadian studies in the years to come. Canadian schools have a critical opportunity to create a silver lining from the pandemic by confirming that Canada is a safe, welcoming, and supportive study abroad destination.

Published: September 22, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United States, the United Kingdom, and Australia. Working with over 7,500 international recruitment partners, ApplyBoard has assisted more than 200,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. The terms student visa and study permit are generally used interchangeably for Canadian international students. Rather than student visas, Canada provides accepted international students with study permits, which allow those students to enroll in classes at Canadian institutions. When a student is accepted for a study permit, they are also usually provided with a visitor visa, which allows that student to enter Canada for their studies. Study permit data in this article includes new study permits and study permit extensions, unless otherwise noted. Historical study permit statistics used in this article are courtesy of Immigration, Refugees and Citizenship Canada (IRCC), except where noted.

2. Statistics Canada projections generated based on data from the IRCC as well as survey and administrative data from Financial Information of Universities and Colleges (FIUC), Post-Secondary Information System (PSIS), Tuition and Living Accommodations Costs, and Labour Force Survey datasets.

3. Data for the full 2020/21 academic year (September 2020 to August 2021) is not yet available.

4. According to Statistics Canada’s International Undergraduate Tuition Fees by Field of Study dataset.