The international student market felt the full impact of COVID-19 in 2020, with study permit numbers falling across the board. New government policies and regulations in response to the pandemic also affected study permit approval rates, but not all source markets were impacted equally.

In this edition of ApplyInsights, I’m examining Canadian study permit approval rates1 and how they changed between 2019 and 2020. The trends we see in these changes can tell us a lot about what Canadian international education might look like in 2021.

Here’s what this article will cover:

- Changes in key Canadian study permit statistics between 2019 and 2020

- The four source markets that saw the largest year-over-year increase in approval rate, and which study levels drove those changes

- The four source markets that saw the largest year-over-year drop in approval rate, and what factors could have caused those decreases

In this article, I’ll only be looking at new study permit numbers, rather than study permit extensions.

Overview: Canadian Study Permit Approval Rates

The pandemic caused significant declines in application numbers and approval volumes. The table below highlights changes in key study permit statistics over that period:

| 2019 | 2020 | % Change | |

|---|---|---|---|

| Applications | 425,990 | 220,932 | -48.1% |

| Approvals | 256,216 | 113,304 | -55.8% |

| Approval Rate | 60.2% | 51.3% | -8.9% |

The 8.9% drop in study permit approval rate has been expected since early on in the pandemic. Between March and July 2020, study permit rejection rates increased substantially as international students found it increasingly difficult to secure the necessary documentation for study permit approval. While some eligibility changes were made in the spring of 2020, it wasn’t until July that the government implemented a temporary COVID-19 policy for study permit applications.

This new policy introduced an approved-in-principle (AIP) stage for applications submitted before September 15, 2020, and for applications for the Winter 2021 intake submitted before December 15, 2020. This policy allowed government staff to review incomplete applications if the student submitted a letter explaining why some required documents were missing.

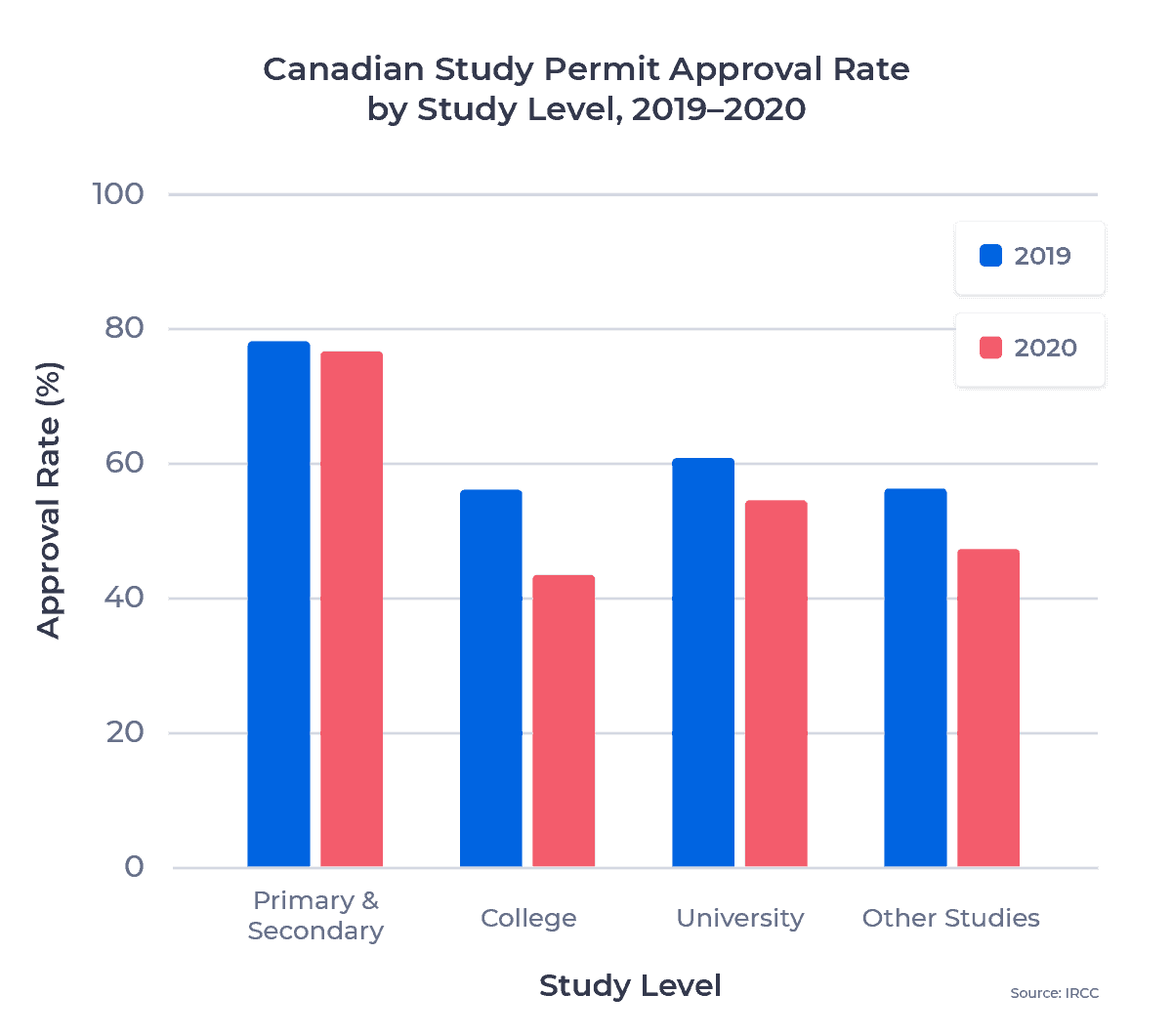

The approval rate decline did not impact all study levels equally. The chart below breaks down study permit approval rates by study level in 2019 and 2020:

Approval rates decreased for all study levels. Study permits for primary and secondary studies were the most likely to be approved in both 2019 and 2020. Their approval rate dropped by only 1.4% from 2019 to 2020, remaining above 75% in both years.

University and Other Studies2 fell slightly further, by 6.2% and 9.1%, respectively. In contrast, college study permit approval rates fell by 11.7%, to 43.4%.

This is especially significant as Canadian colleges have been the main draw for new international students since 2017. 42.8% of all study permit applications in 2020 were for college studies, down just 0.1% from 2019. The large drop in approval rate suggests study permit documentation roadblocks may have impacted this sector more than others. Low approval rates may dampen student confidence in 2021, and we could see slower recovery than expected for the college sector as a result.

Canadian Study Permit Approval Rates by Source Market

Pandemic-related volatility was apparent in most large source markets. Approval rate declines were not uniform across all source markets. Of the top 20 source markets in 2020, only six saw study permit approval rate changes of less than 2%.

There were some significant outliers on both the positive and negative side. Let’s look more in-depth at those source markets and what factors may have influenced approval rate changes. In the next two sections, I’ll be exclusively analyzing source markets that had at least 1,000 approved study permits in 2019.

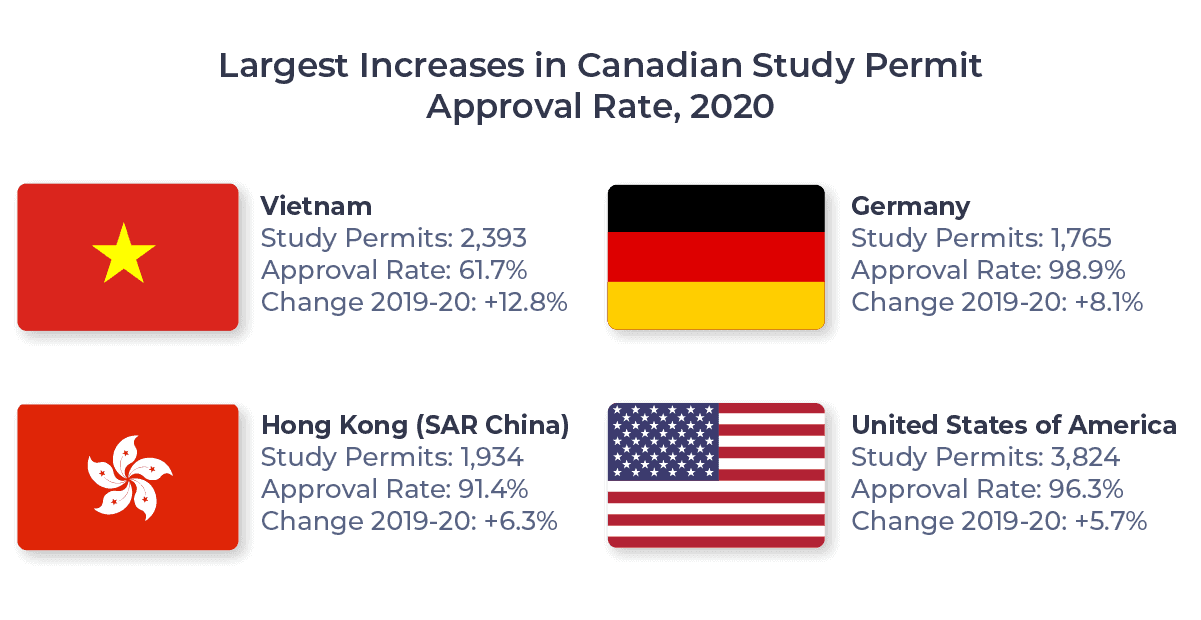

Largest Increases in Approval Rate

Despite the overall drop in approval rates, over half (11 of 20) of the largest source markets saw study permit approval rate increases in 2020. The figure below shows the top four:

Let’s take a look at each of these source markets more closely.

Vietnam

Study permit approval rates for Vietnamese students recovered substantially in 2020 after a drop of 21.0% in 2019. The approval rate for Vietnamese nationals increased 12.8% year-over-year, the largest increase among the top 20. Rates went up across all study levels, and Vietnamese college and university students were 10% more likely to be approved than college and university students across all other markets. By contrast, Vietnamese primary and secondary student approval rates were 10% below the all-markets average.

Germany

The approval rate for German nationals increased by 8.1% in 2020, rising from 90.8% in 2019 to 98.9% in 2020. The German market was also especially resilient, with study permit applications declining only 17.1% year-over-year. The main driver of increased approvals for Germans was an 8.5% increase in approvals for primary and secondary students, from 90.7% in 2019 to 99.2% in 2020. K-12 students accounted for over 80% of all study permit applications and approvals from German nationals in 2020.

Hong Kong (SAR China)

Hong Kong was, by far, the most resilient source market for Canadian international students in 2020. In fact, Hong Kong students submitted 58.3% more study permit applications in 2019 than 2020. Combined with a 6.3% approval rate increase over that period, 70.1% more study permits for students from Hong Kong were approved year-over-year. Only 11 other source markets of any size saw increased approved permit volumes in 2020, and only one other (Italy) had over 1,000 applications in 2019.

USA

For the first time since 2016, study permit approval rates for US students rose above 95% in 2020, reaching 96.3%. Study permit approvals for American college students rose the most, increasing by 9.3%.

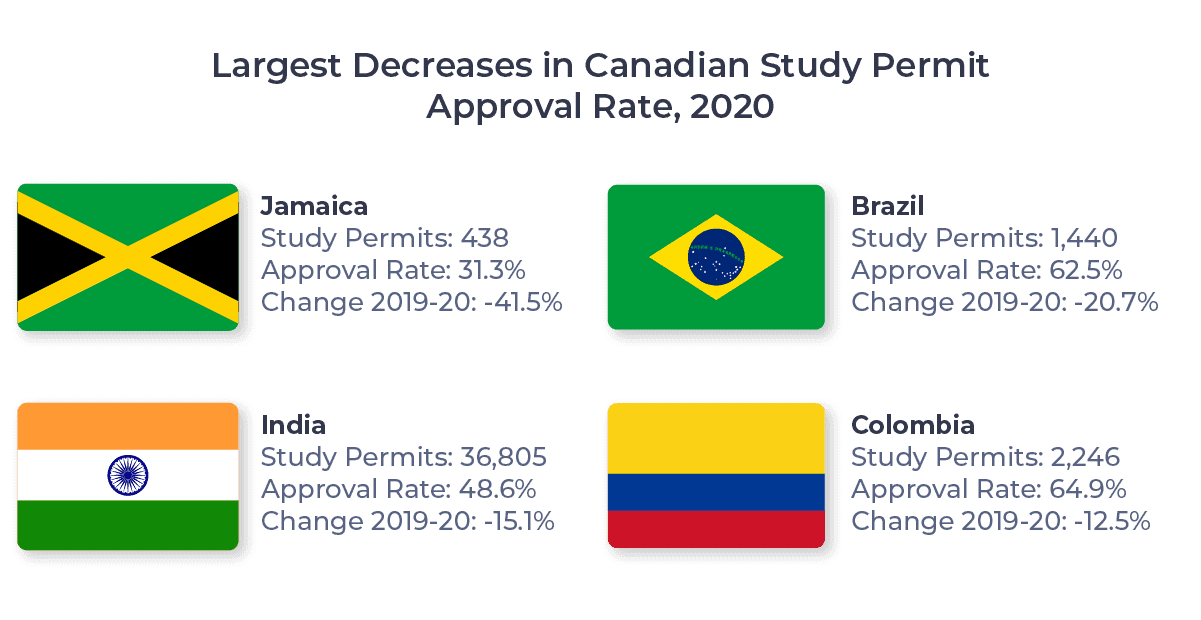

Largest Decreases in Approval Rate

There were four major source markets that saw approval rates decline more than 11% in 2020:

Let’s look at these source markets in greater detail.

Jamaica

Study permit approval rates for Jamaican students decreased by 41.5% in 2020, falling to 31.3%. Approval rates fell across all study levels, but college students were especially impacted, seeing their approval rates fall from 71.7% in 2019 to 26.8% in 2020. There are signs that a failure to demonstrate sufficient financial support has been a primary cause for falling approval rates. The reliance of the Jamaican economy on income from tourism means this could be an issue well into 2021.

Brazil

Approval rates for Brazilian nationals fell by 20.7% from 2019 to 2020. Unlike other source countries, this decrease was seen equally across all study levels. Approval rate declines ranged from -17.3% for university students to -23.6% for primary and secondary studies. The largest limiting factor for Brazilian students was proof of financial support. Political, financial, and pandemic instabilities have caused the Brazilian real to fall nearly 50% against the Canadian dollar since 2019.

India

Despite a 15.1% decrease in study permit approval rates for Indian students from 2019 to 2020, India remains the largest source market for Canadian schools. The main source of approval rate decline was a 16.9% drop in college study permit approvals for Indian nationals year-over-year. 73.3% of all applications from Indian students were for college studies in 2020. As with other source markets, India’s economy was hit hard by COVID-19, impacting student financial stability and making it harder to meet necessary financial support thresholds.

Colombia

Though Colombian study permit applications fell only 25.0% from 2019 to 2020, approved study permits for Colombian students declined by 37.2%. Permit approval rates for Colombian nationals were down 12.5% year-over-year, mainly due to a 22.4% drop in approval rates for Colombian primary and secondary students. Colombia’s economy was particularly affected by the pandemic, with national unemployment spiking to nearly 20%. Travel restrictions, visa issues, and low incomes were a perfect storm for Colombia international students.

Summary

2020 was a difficult year for international students. Economic downturns and difficulties in obtaining necessary documentation due to pandemic-related closures led to lower Canadian study permit approval rates. Students were less likely to have their Canadian study permit application approved in 2020 than in any other year in the past decade. But there are a lot of promising developments on the horizon.

Changes to Canada’s study permit application requirements have restored some confidence in the market. We’ve seen a definite increase in approvals in the later half of 2020, and I expect many source markets to see their approval rates increase in 2021. The Canadian government’s announcement that international students who complete their studies online are still eligible for the Post-Graduate Work Permit Program (PGWPP) will also keep Canada competitive as a desirable study abroad destination. Canada’s slower vaccination roll-out could negatively impact market recovery time. But more Canadian colleges and universities are offering unique assistance plans to international students, including facilitating on-campus quarantines.

Check back with ApplyInsights in a few weeks when we’ll examine specific growing source markets for Canadian schools.

Published: March 22, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of Immigration, Refugees and Citizenship Canada (IRCC).

2. Includes language training programs and other study programs.