In this edition of ApplyInsights, I’ll be examining trends in Canadian study permits issued in Quebec.1 This article is the third in a series looking at the international education market in Canada by province. Check out my previous articles in the series for a deep dive on study permit trends in Ontario and a close look at study permit trends in British Columbia.

Here’s what this blog post will include:

- A comparison of study permit trends in Quebec and Canada as a whole

- A breakdown of study permit holders in Quebec by study level

- Top source countries for study permit holders in Quebec

- The distribution of students from those countries by study level

- A summary of my findings and thoughts about the future

Quebec is distinct from the rest of Canada in many areas, including international education. This article will only touch on some of the differences between Quebec’s education and immigration systems and the rest of Canada. For more information on international education in Quebec, keep an eye on the ApplyBoard main blog.

Let’s start by looking at how international student enrollment in Quebec compares to the rest of Canada.

Study Permit Holders: Quebec vs. All of Canada

Quebec is the third most popular destination for international students in Canada, with 56,550 study permit holders in 2019.2 This represented 14.0% of all Canadian study permit holders.

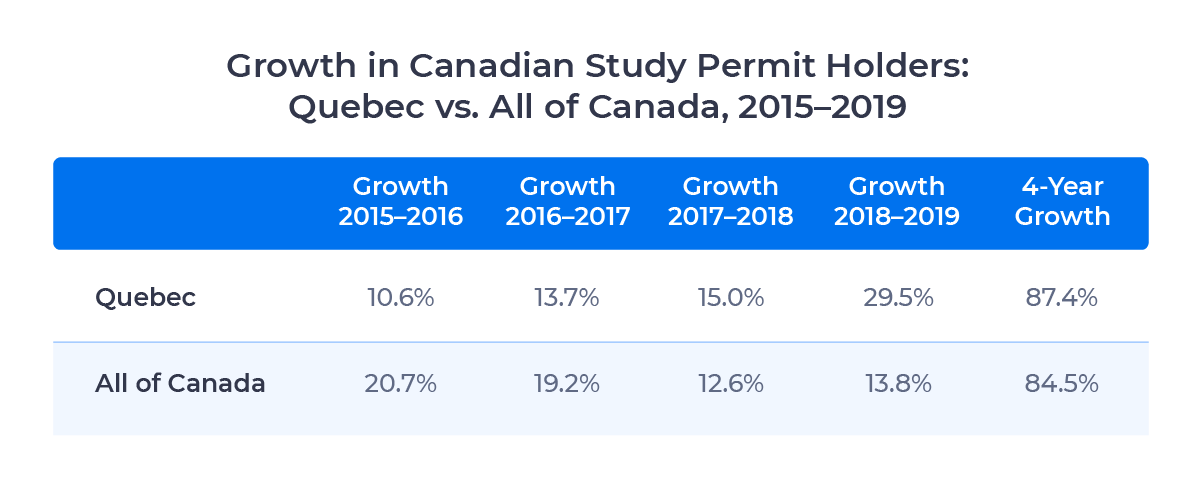

The following table examines the year-over-year growth in study permit holders:

We see that Quebec and Canada as a whole saw significant (and roughly equal) growth between 2015 and 2019. However, they came to this growth in different ways. The country averaged around 20% growth year-over-year between 2015 and 2017, driven by a massive expansion of the Ontario market. But Quebec’s growth outpaced Canada’s from 2017 to 2019, accelerating each year.

Quebec’s international student market grew 29.5% from 2018 to 2019, the largest jump of any province.

Study Permit Holders in Quebec by Study Level

Let’s take a look at the growth in study permit holders in Quebec by study level:

Post-secondary studies are the dominant force in Quebec, accounting for just under 80% of the international students in the province. The sector grew 81.7% over the four-year period, and that growth is accelerating. Post-secondary growth hit a four-year high of 29.9% in 2019.

Post-secondary growth was actually surpassed on a percentage basis between 2015 and 2019 by both the primary and secondary sector and the other studies sector, which includes language training programs, certain Quebec-specific training and vocational programs, and any spouses or children of international students that hold a study permit themselves. Primary and secondary enrollment grew 116.4% between 2015 and 2019, while other studies enrollment increased 106.8%.

Top Source Countries for Quebec Students

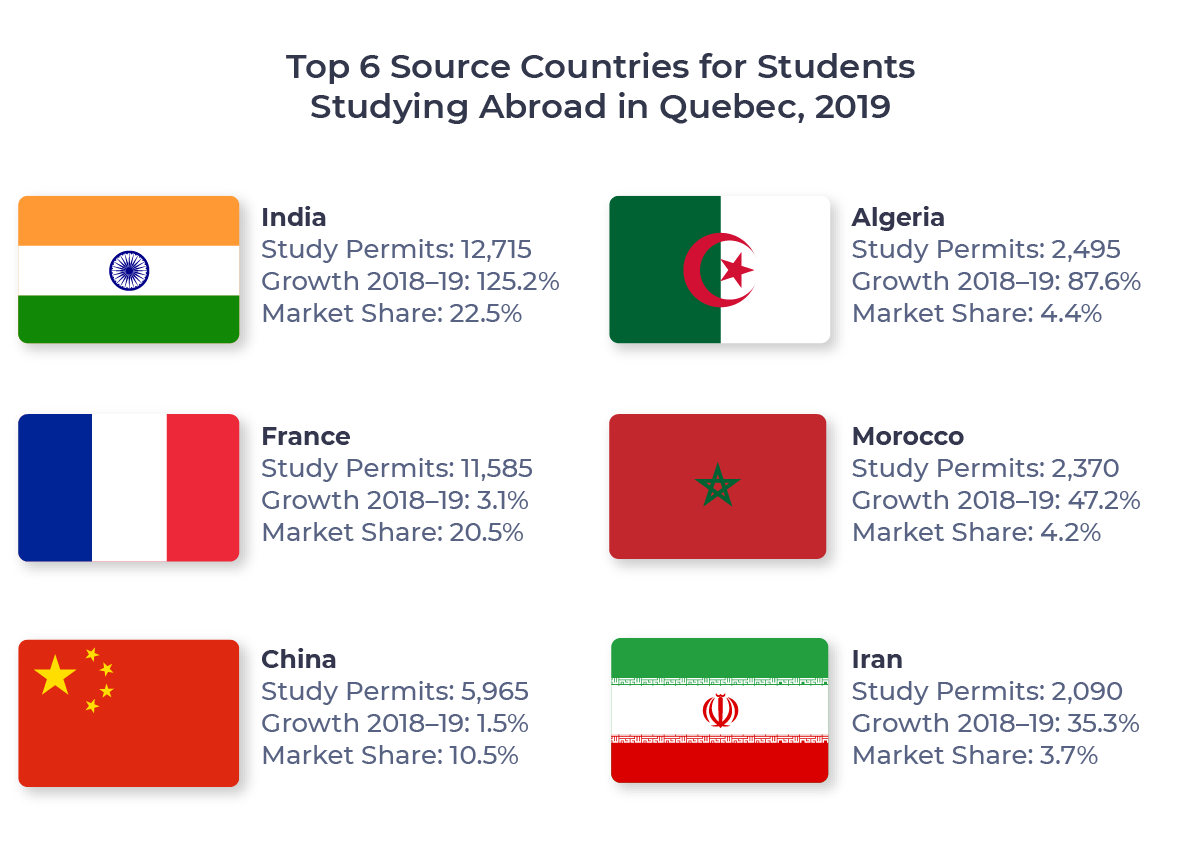

I’d now like to examine the countries that are sending the most international students to study abroad in Quebec. The following figure provides a summary:

Led by India and France at 22.5% and 20.5%, respectively, these six countries together supplied over 65% of Quebec’s international student population in 2019, or 37,220 students in total.

Let’s take a look at each country in detail.

India

In 2019, India stormed past both China and France to become the new leader in supplying international students to Quebec. 12,715 Indian students held study permits in the province in 2019, good for a 22.2% market share. This actually ran well behind India’s share of the larger Canadian market, where it is the dominant player at 34.6%.

Just 9.1% of Indian students in Canada chose Quebec as their destination in 2019, below the average of 14.0% for all countries. That’s up from 5.3% in 2018, thanks to a massive 125% increase in Indian students in Quebec in 2019.

Indian Students in Quebec by Study Level

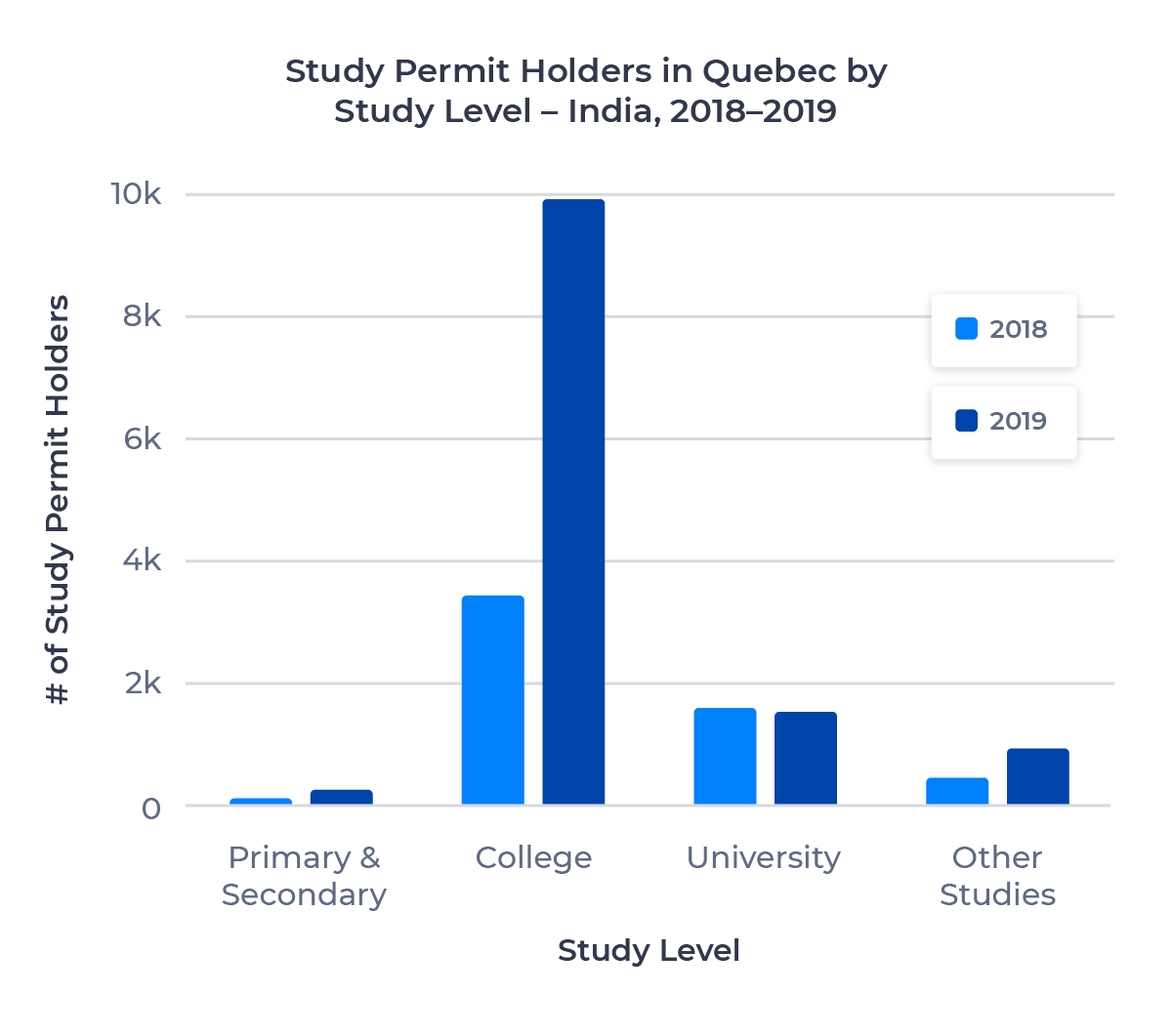

The figure below shows the breakdown of Indian students in Quebec by study level:

The number of Indian students studying at Quebec colleges nearly tripled in 2019. 78.0% of Indian students in Quebec attended college last year, while only 12.3% attended university.3 And with Indian university enrollment down 3.4% year-over-year, the sector looks primed to lose further market share to the college sector.

India is a college-oriented source market across Canada, with around 70% of Indian students studying at that level country-wide. But the additional popularity of Quebec colleges likely stems from the fact that international students studying at private career colleges in Quebec are eligible for the post-graduate work permit (PGWP) program. With a few exceptions, this is not the case in other provinces.

The PGWP program is a key piece of the value proposition of studying abroad in Canada for Indian students, and its extension to private colleges gives those students more options for study in Quebec.

Turning to the other sectors, primary and secondary students made up just 2.2% of Indian students in Quebec in 2019, but the sector more than doubled in size, growing 111.5% year-over-year. Indian enrollment in other studies increased 97.9% over the same period.

France

Though passed by India last year, France has historically been the largest source market for international students in Quebec. Its 11,585 study permit holders in 2019 represented 20.5% of the Quebec market. Though this accounted for almost 80% of French students in Canada, it was enough to make France Canada’s fourth-largest source country nationally.

Quebec is a highly desirable study abroad destination for French citizens. Beyond the linguistic and historical connections between France and Quebec, an agreement between the French and Quebec governments allows French nationals to pay reduced tuition fees to attend post-secondary education in Quebec. For bachelor’s programs, these fees are equivalent to fees for Canadian students who are not Quebec residents. French students in master’s or doctoral programs, or undertaking technical or vocational training, qualify for tuition fees identical to those of Quebec residents.

These agreements have been in place for some time, and until 2015 were even more generous to French undergraduates. It’s no surprise, then, that France is a mature source market for Quebec. The province’s French enrollment saw modest 3.1% growth between 2018 and 2019.

French Students in Quebec by Study Level

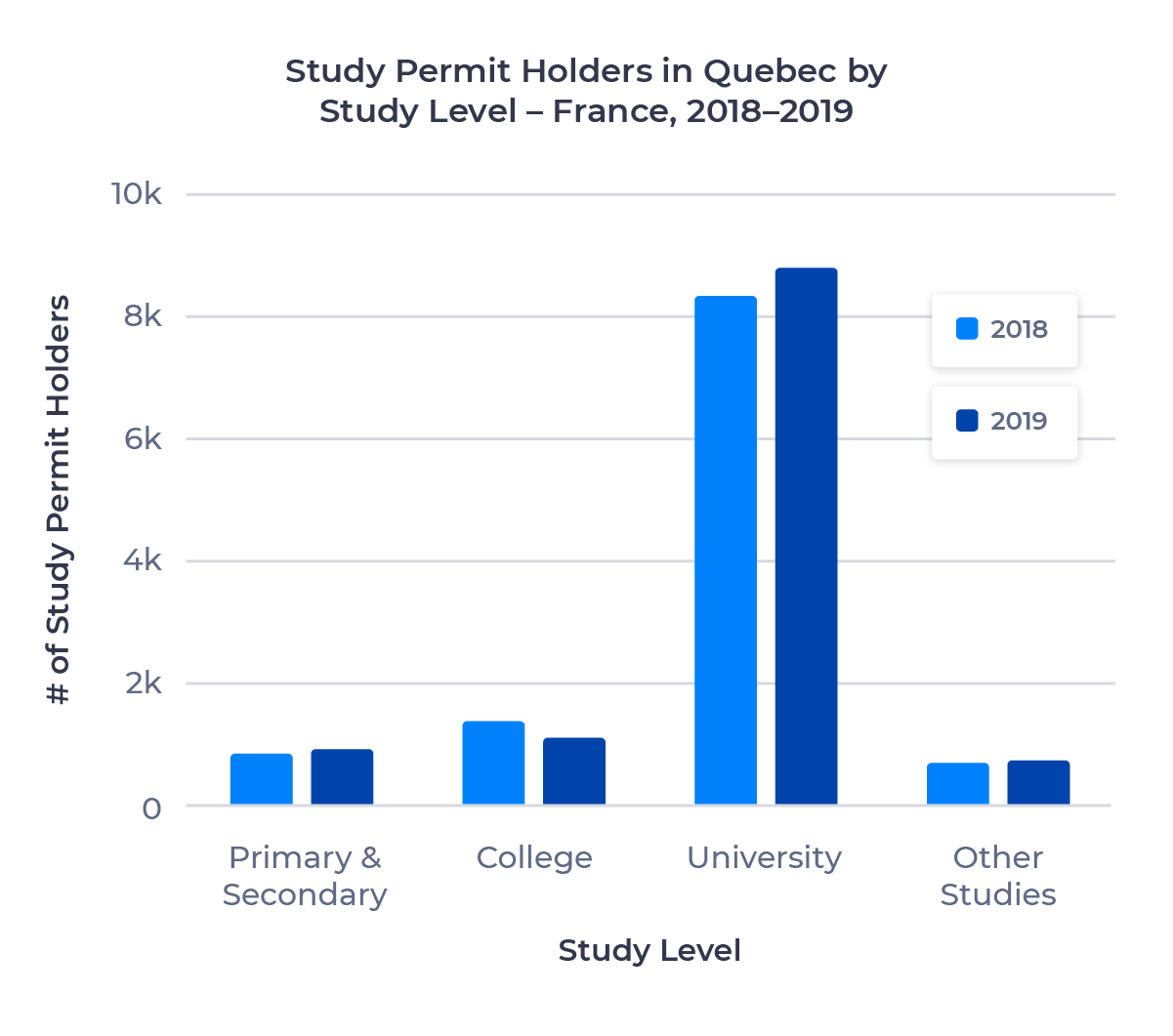

The figure below shows the distribution of French students in Quebec by study level:

We see the clear success of the tuition fee exceptions in enticing university students to Quebec. Over 75% of French students in Quebec attend university. For all countries, that number is 50%.

College enrollment, in contrast, constitutes just 10.1% of the market, and declined in 2019. The primary and secondary sector and other studies sector comprise even smaller pieces of the market but grew modestly year-over-year.

China

China is comfortably the number three provider of international students to Quebec, sending 5,965 students to study in the province in 2019. This accounted for a 10.5% market share, half of China’s share of the full Canadian market. Just 7% of Chinese students in Canada came to Quebec to study, around half the all-countries average.

Like France, China is a mature source market for international students. Quebec’s Chinese enrollment saw modest 2% growth between 2018 and 2019. This ran ahead of the trend Canada-wide, where the Chinese market contracted by half a percent.

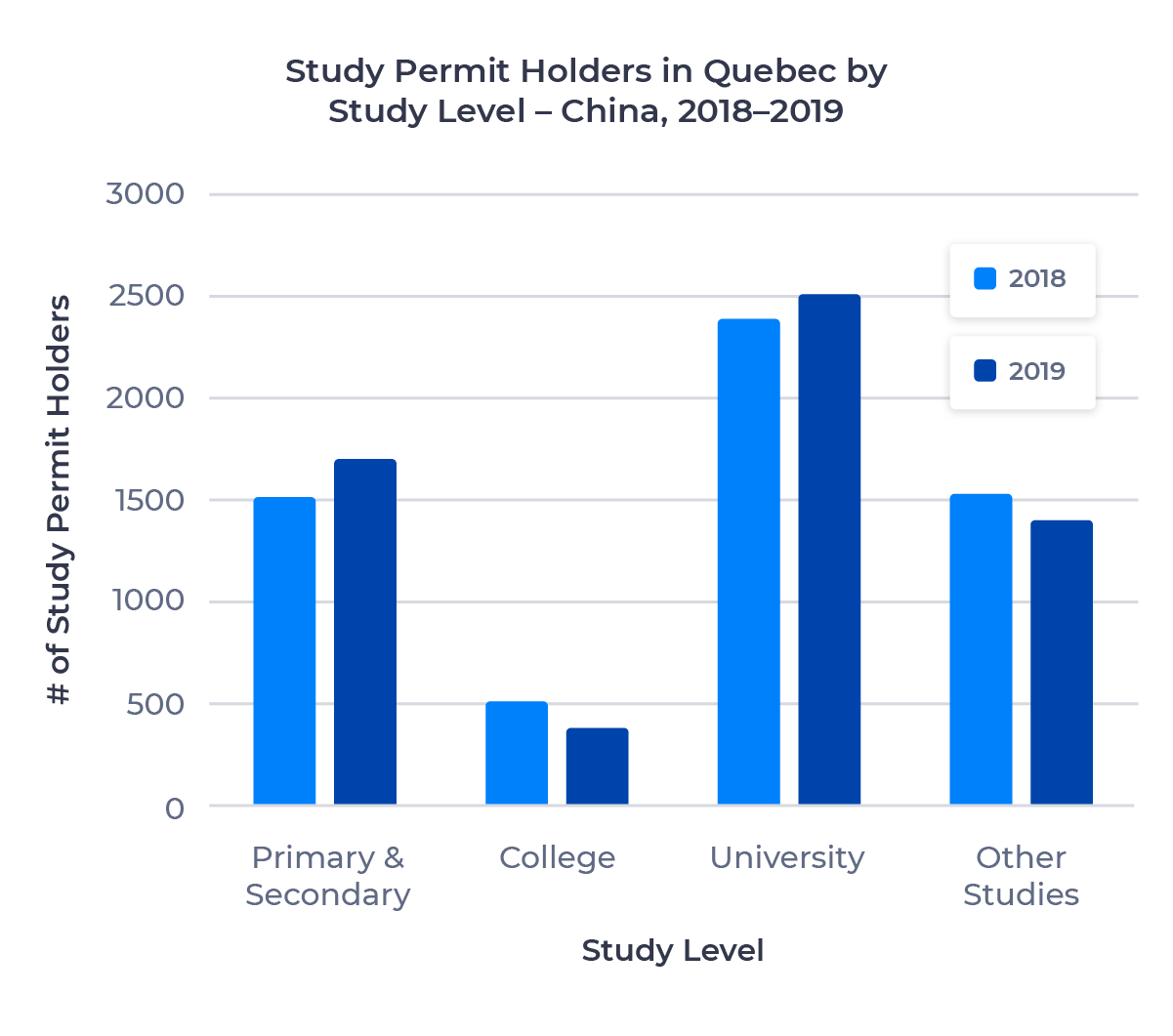

Chinese Students in Quebec by Study Level

The figure below breaks down Chinese students in Quebec by study level:

University is the top draw, accounting for 2,535 study permits and 42.1% of all Chinese students in Quebec. The sector grew 6% year-over-year, which suggests that the market isn’t quite maxed out. The primary and secondary school systems are both strong recruiters of Chinese students and together accounted for 1,700 students and 28.2% of Chinese enrollment in Quebec. They grew 12.6% from 2018 to 2019.

In contrast, the college sector shrank to just 6.3% of the market, half the national average for college enrollment among Chinese students. Other studies numbers also fell, though that sector remains a key player in the market. Chinese enrollment there is largely driven by training and vocational programs.

Algeria

2,495 students from Algeria studied in Quebec in 2019. This represented 93.8% of Algerian students in Canada, reflecting the North African nation’s large French-speaking population.

The Algerian student population in Quebec exploded between 2018 to 2019, up 87.6%. This growth pushed Algeria past Morocco and Iran to become the fourth-largest supplier of international students to Quebec. The country accounted for 4.4% of the Quebec international student market in 2019.

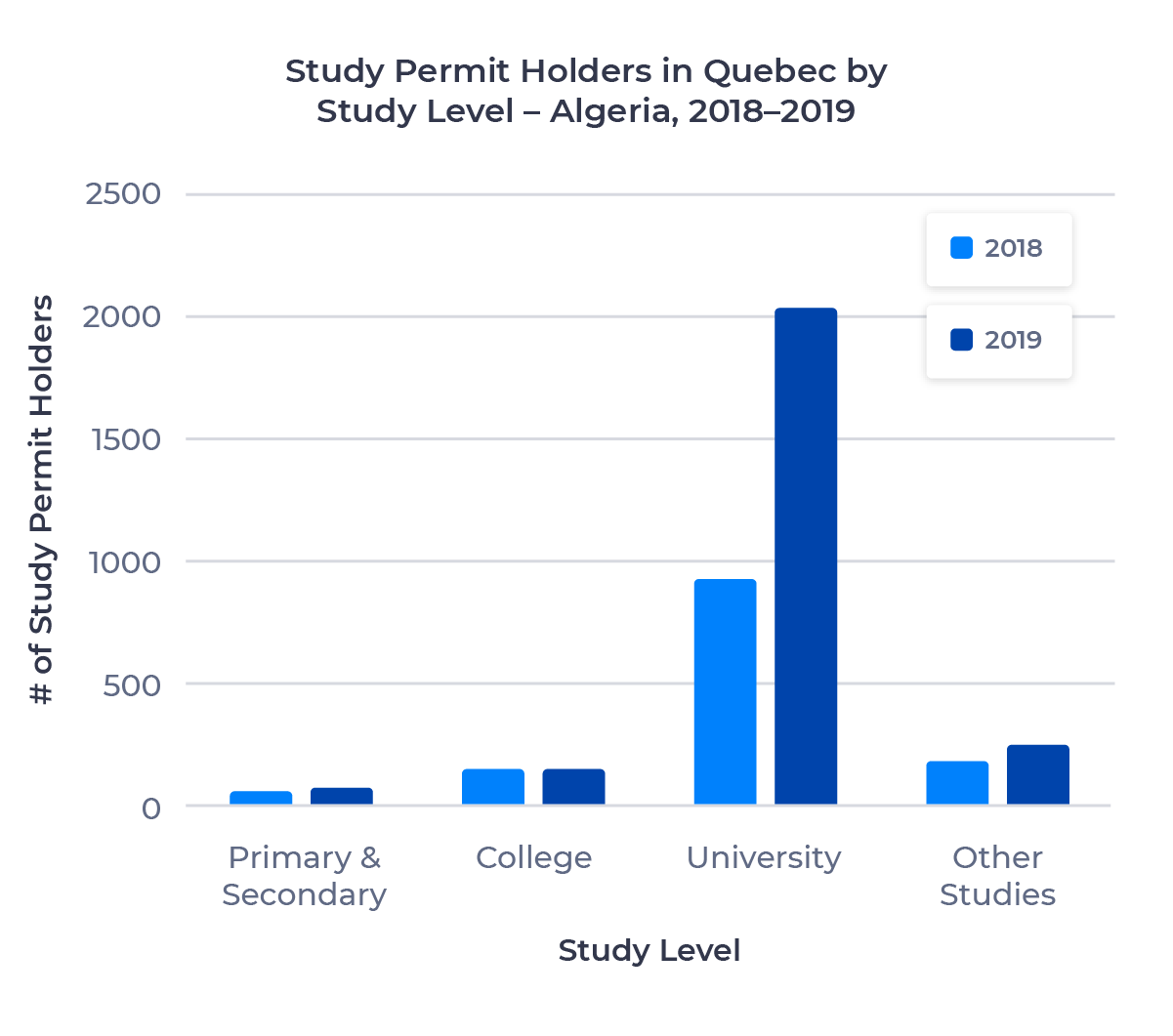

Algerian Students in Quebec by Study Level

The figure below shows Algerian students in Quebec by study level:

University students dominate the Algeria market in Quebec. The university sector posted nearly 120% growth year-over-year and comprised 81.2% of the market in 2019. The primary and secondary sector and the college sector are minor factors in the market and saw minimal growth. Other studies, also a bit player, added 55 students, primarily in training and vocational programs.

While Algerian nationals typically pay full tuition in Quebec, an agreement between the Algerian and Quebec governments provides exceptions for 83 university students to pay Quebec residential fees.

Morocco

Like Algeria, Morocco has a significant French-speaking population. 2,370 Moroccan students studied in Quebec in 2019, representing 76.9% of Moroccan holders of Canadian study permits. The Moroccan student population in Quebec grew 47.2% from 2018 to 2019, helped by a 4.2% uptick in study permit approval rate. This was the second-highest increase in study permit approval rate among the top 25 source countries for Canadian international students.

The expansion of the Student Direct Stream (SDS) to Morocco in September 2019 likely drove both the growth in students and the increase in approval rate. SDS is a more efficient study permit processing system available only to citizens of specific source countries. By making the study permit application process less onerous, SDS typically attracts stronger applicants.

Morocco’s share of the Quebec market was 4.2% in 2019.

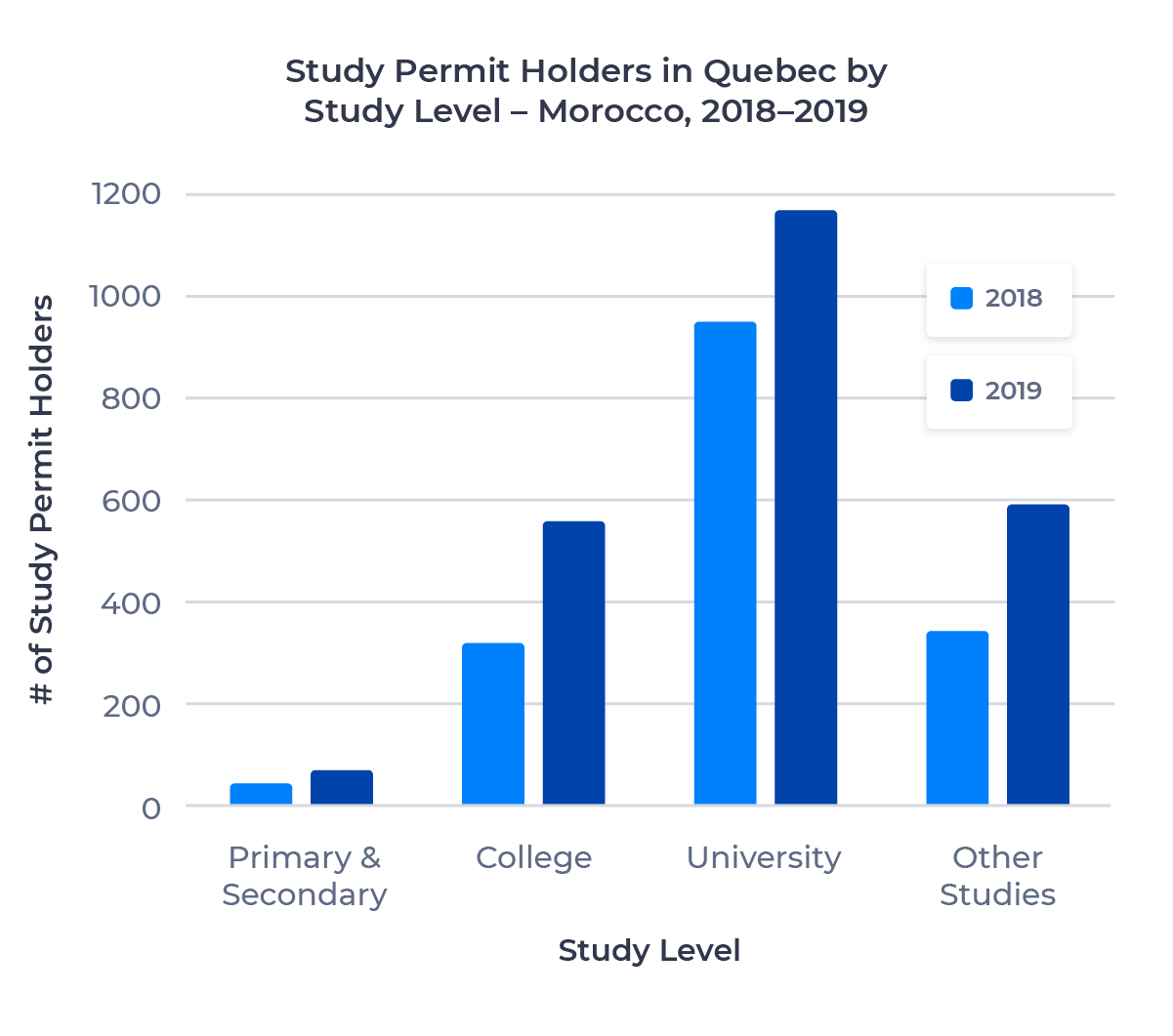

Moroccan Students in Quebec by Study Level

Let’s take a look at Moroccan students in Quebec by study level:

What’s notable here is the strong growth across study levels.

As we’ve seen for many of these top source countries, the university sector is the biggest draw for Moroccan students in Quebec. But it actually lost market share in 2019 despite growing by 23.2%. The college and other studies sectors both grew by more than 70%, with the other studies growth driven by an increase in enrollment in training and vocational programs.

Similar to Algeria, an agreement between the Moroccan and Quebec governments carves out exceptions for 90 Moroccan university students to pay Quebec residential fees to study in the province.

Iran

Iran sent 2,090 students to study in Quebec in 2019, up 35.3% year-over-year. While impressive, this actually ran behind Iran’s Canada-wide increase of 38.8%, which was driven by a spike in Ontario enrollment. 21.3% of Iranian students in Canada studied in Quebec in 2019. This was well ahead of the all-countries average of 14.0% and the highest percentage among non-Francophone countries in the top six. Iran accounted for 3.7% of the Quebec market in 2019.

With the political situation between Iran and the United States deteriorating over the past few years, it’s no surprise to see that Iranian enrollment in Quebec, and Canada as a whole, grew rapidly between 2018 and 2019, continuing a trend we’ve seen since the beginning of 2016.

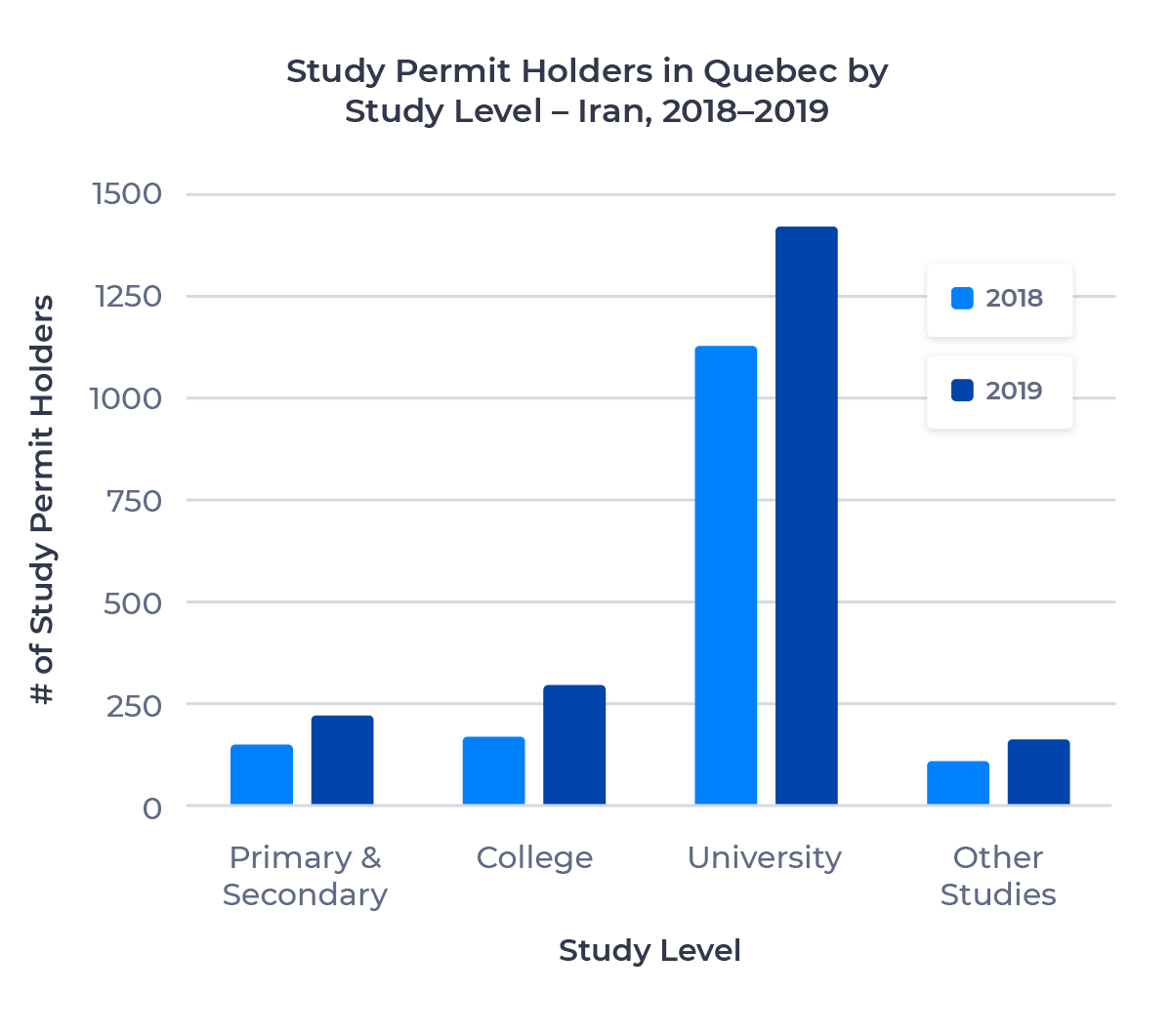

Iranian Students in Quebec by Study Level

Breaking down Iranian students in Quebec by study level, we have the following:

As with Morocco, we see strong growth across study levels. Iran is a highly university-oriented market: 54.4% of Iranian students in Canada studied at university in 2019. With Quebec being a high draw for university students, it’s no surprise we saw strong numbers for Iranian university students last year (67.7%). Interestingly, the university sector actually lost market share due to the growth in other sectors. College, in particular, was up 78.8% year-over-year, a great result for the sector.

Study Permit Trends in Quebec – Summary

There’s a lot of data here, so I’d like to quickly review some of our key findings:

- Quebec is the third most popular destination for international students in Canada, and its growth was roughly on par with Canada’s from 2015 to 2019.

- Post-secondary study accounts for around 80% of the Quebec market, and its growth accelerated over the past four years, driven by the university sector.

- India blew past China and France in 2019 to become the leading supplier of international students in Quebec. Unique among top source countries, India is a college-oriented market.

- France is Quebec’s leading supplier of university students, enticed by tuition fee discounts offered through an agreement between France and Quebec.

- Two Francophone nations in North Africa, Algeria and Morocco, are among the top contributors to international education in Quebec. Both are growing rapidly.

- China and Iran are also key source countries for Quebec.

The Future of International Education in Quebec

With growth at all study levels and accelerating growth province-wide, the Quebec market was humming along at the end of 2019. Of course, with the onset of 2020, COVID-19 reshaped the international education landscape around the world.

Immigration, Refugees and Citizenship Canada (IRCC) has released limited data for this year, making it difficult to assess the impact of the pandemic on Quebec. Canada’s relative success at handling the pandemic—something our survey of recruitment agents surfaced—points to a strong recovery for the country. But Quebec has struggled to combat the virus as well as the rest of Canada. As of blog posting, the province accounted for more than 60% of COVID-19 deaths in the country despite containing just a fifth of its population.4

Because of this, we may see a slower recovery for English-language institutions as students from countries like India and China look to other provinces to study. I’m much more optimistic about a quick recovery for the French-language market, as it has less competition both within Canada and internationally.

Despite these concerns, Quebec remains an attractive destination for international students for many reasons, from its world-class institutions, to its low tuition rates, to its unique culture. With this in mind, coupled with the excellent growth we’ve seen in the last five years, I believe the long-term future for international education in Quebec remains bright.

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,200+ educational institutions across North America and the United Kingdom. Working with over 4,000 international recruitment partners, ApplyBoard has assisted over 100,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All references to study permits include both new permits and extensions.

2. All data courtesy of Immigration, Refugees and Citizenship Canada (IRCC). Please note that IRCC rounds all values to the nearest multiple of 5 to protect student privacy. As a result, some numbers may not sum to the totals indicated.

3. Includes numbers for CEGEP technical programs. CEGEP pre-university programs included in university statistics.

4. Source: Google News, September 24, 2020.