This edition of ApplyInsights is the second in a series of articles looking at the international education market in Canada province by province. In this article, I’ll be examining trends in study permits issued in British Columbia (BC). Check out my previous article for a deep dive on study permit trends in Ontario.

Here’s what this blog post will include:

- A comparison of study permit trends in BC and Canada’s other provinces

- A breakdown of study permit holders in BC by study level

- Top source countries for study permit holders in BC, including the study levels and schools at which those students are studying

- A summary of my findings and thoughts about the future

Let’s start by looking at how international student enrollment in British Columbia compares to the rest of Canada.

Study Permit Holders: BC vs. All of Canada

British Columbia has long been a leader in international education in Canada, helped in recruiting by its proximity to Asia and more recently by the British Columbia Council for International Education (BCCIE), BC’s international education marketing body.

Today, BC is the second most popular destination for international students in Canada, with 86,185 study permits holders in 2019. This represented 21.3% of all Canadian study permit holders that year.

Let’s take a look at the year-over-year growth in study permit holders:

| Growth 2015–2016 | Growth 2016–2017 | Growth 2017–2018 | Growth 2018–2019 | 4-Year Growth | |

|---|---|---|---|---|---|

| British Columbia | 14.0% | 16.4% | 6.9% | 5.5% | 49.6% |

| All of Canada | 20.7% | 19.2% | 12.6% | 13.8% | 84.5% |

From 2015 to 2019, the total number of study permit holders in BC increased by just under 50%. While impressive, this trailed the growth in Canada as a whole over the same period.

The booming Ontario market drove much of Canada’s 84.5% growth over the four-year period. Yet even omitting Ontario, BC lagged behind Canada as a whole in growth in all but one year (2016-2017). And while both rates declined between 2015 and 2019, BC’s declined more significantly.

This slowdown reflects the maturity of the British Columbia market. Many BC schools have large international student populations already and are not looking to grow them further. In contrast, many of Canada’s other provinces are just now beginning to recruit international students as aggressively as BC did in the previous ten to fifteen years.

BC Study Permit Holders by Study Level

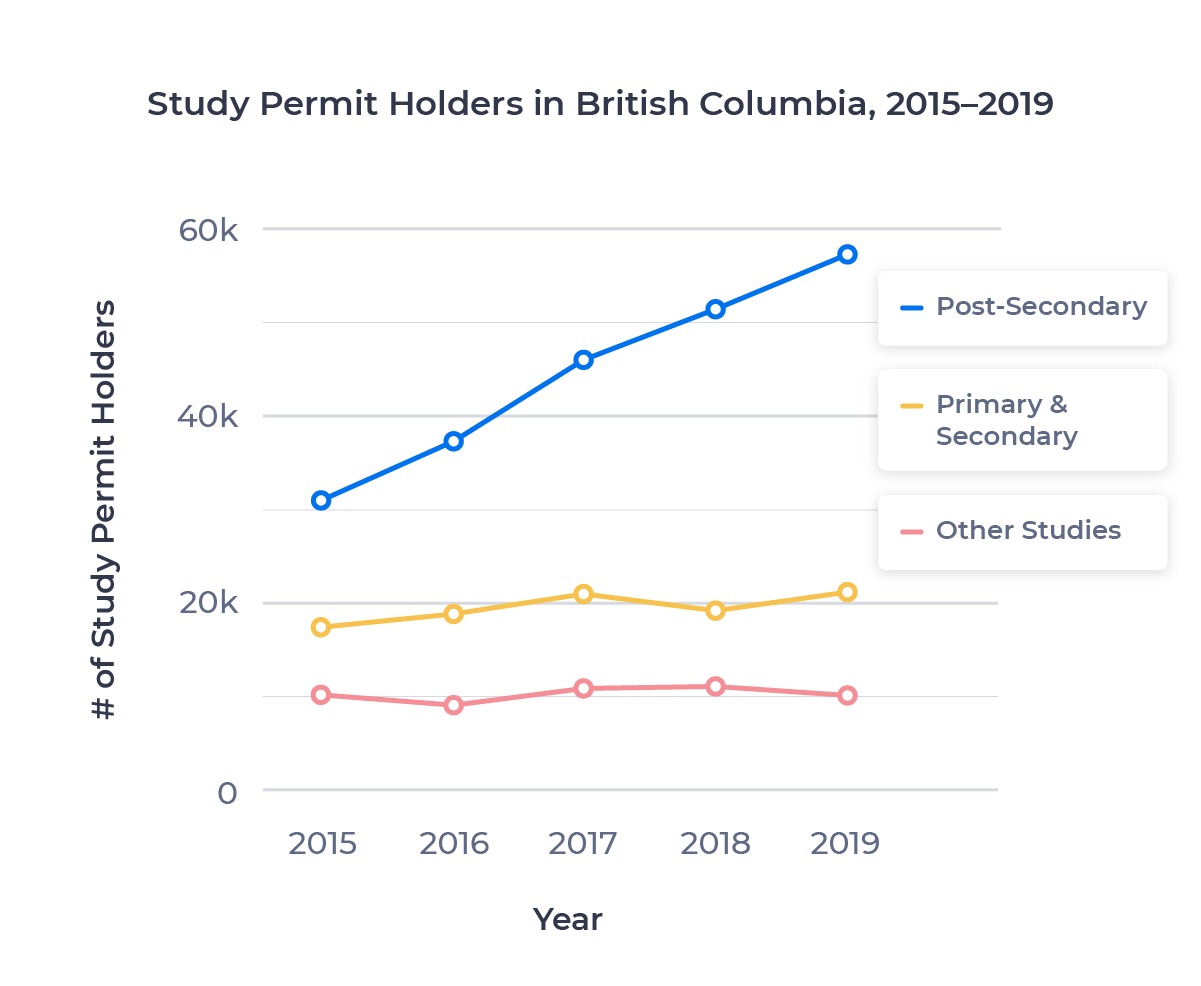

The growth in study permit holders in British Columbia was not uniform across study levels, as the chart below shows:

As we can see in the data, the post-secondary sector grew 86.1% to account for almost all growth in the province. In fact, the other studies sector, which includes language training programs and any spouses or children of international students that hold a study permit themselves, contracted on net. Primary and secondary growth was a modest 14.1% over the period.

Top Source Countries for BC Students

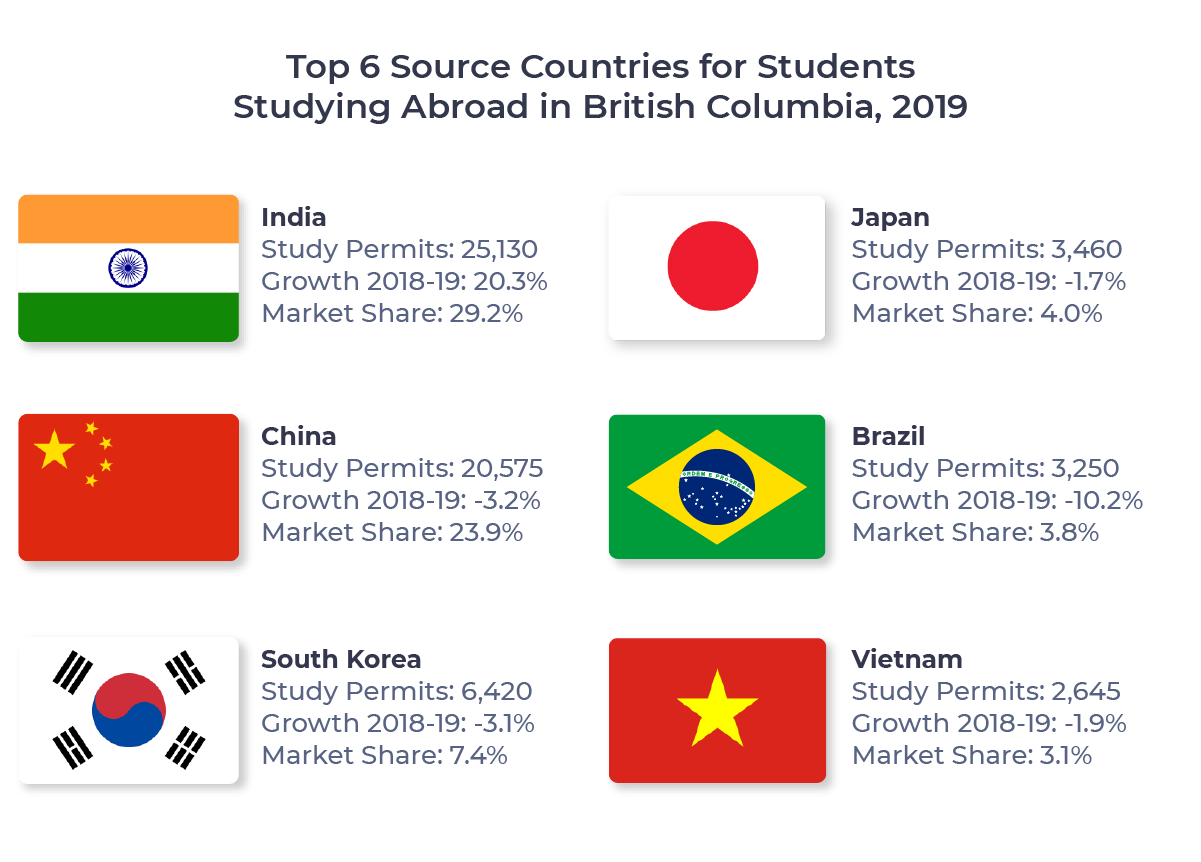

I’d now like to take a look at the source countries that are sending the most international students to study abroad in British Columbia. The following figure provides a summary:

Led by India and China at 29.2% and 23.9%, respectively, these six countries together supplied over 70% of BC’s international student population in 2019, 61,480 students in total.

Let’s take a look at each source country in detail.

India

In 2019, India passed China to become the new leader in supplying international students to BC. 25,130 Indian students held study permits in the province in 2019, good for a 29.2% market share. This ran slightly behind India’s share of the full Canadian market, where it is also the number one source country, with 34.6% of the market. 18.0% of Indian students in Canada chose BC as their destination in 2019, just behind the all-countries average of 21.3%.

India’s dominance of the BC market looks primed to increase. It was the only country among the top six to add students on net between 2018 and 2019, adding almost 4% market share.

Indian Students in BC by Study Level

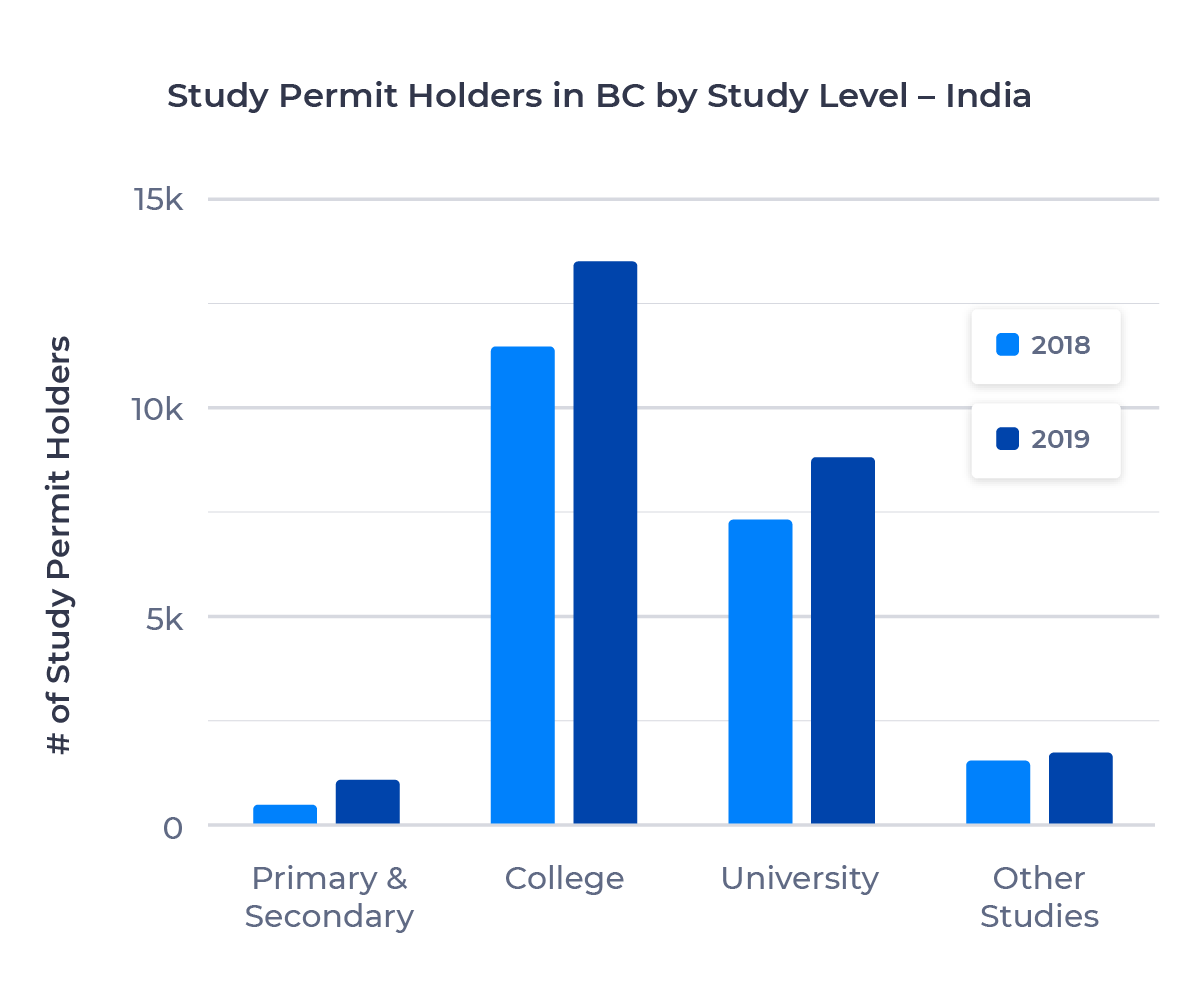

The figure below shows the breakdown of Indian students in BC by study level:

Post-secondary study was the main draw for Indian students to BC in 2019, with college and university students together accounting for almost 90% of the market. College study permits were up 18.3% and university study permits were up 19.2% year-over-year.

Primary and secondary students made up just 4.5% of Indian students in BC in 2019, but there was robust growth in the sector—almost 120% over 2018.

Top BC Schools for Indian Students

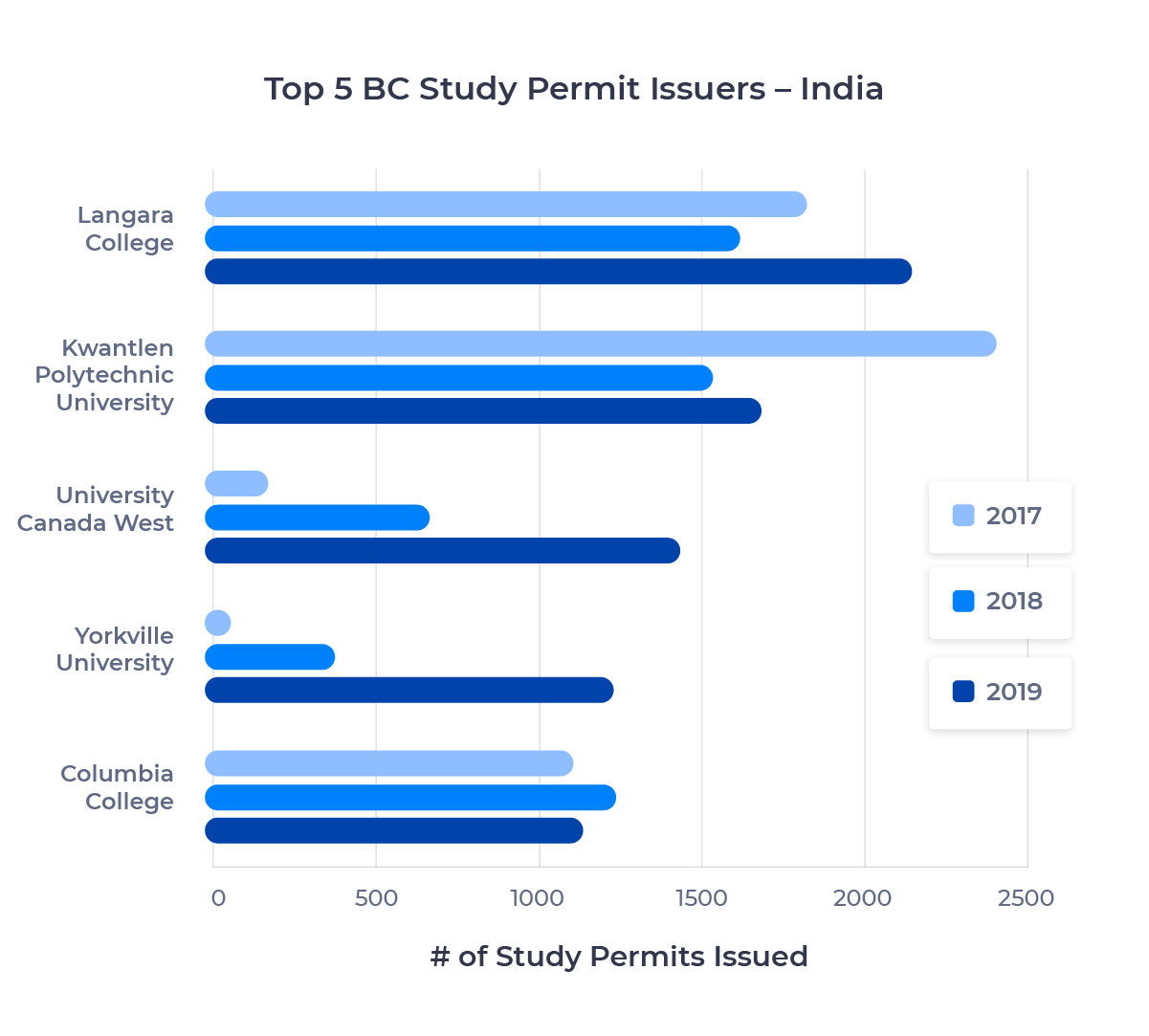

The figure below shows the top five schools in British Columbia by study permits issued to Indian nationals:

Vancouver’s Langara College led the way with 2,140 study permits issued. Kwantlen Polytechnic University was second overall and the top university, though its Indian enrollment shrank almost 30% between 2017 and 2019.

A pair of private universities, University Canada West and Yorkville University, saw explosive growth over the last two years to climb into the top five. Yorkville grew from just 7 students in 2017 to 1,227 last year.

For a wider look at trends in the Indian student population across Canada, check out the in-depth look I took back in March in ApplyInsights: India.

China

Though passed by India last year, China is comfortably the number two provider of international students to BC. 20,575 Chinese students studied in the province in 2019. This accounted for a 23.9% market share, just ahead of China’s share of the full Canadian market (21.0%). 24.3% of all Chinese students in Canada came to BC to study, slightly above the all-countries average of 21.3%.

BC’s Chinese enrollment declined 3.2% from 2018 to 2019. This was slightly larger than the 0.5% decline in Chinese enrollment Canada-wide. Both trends reflect a shrinking demand for foreign student credentials within China, as well as growing competition among destination countries.

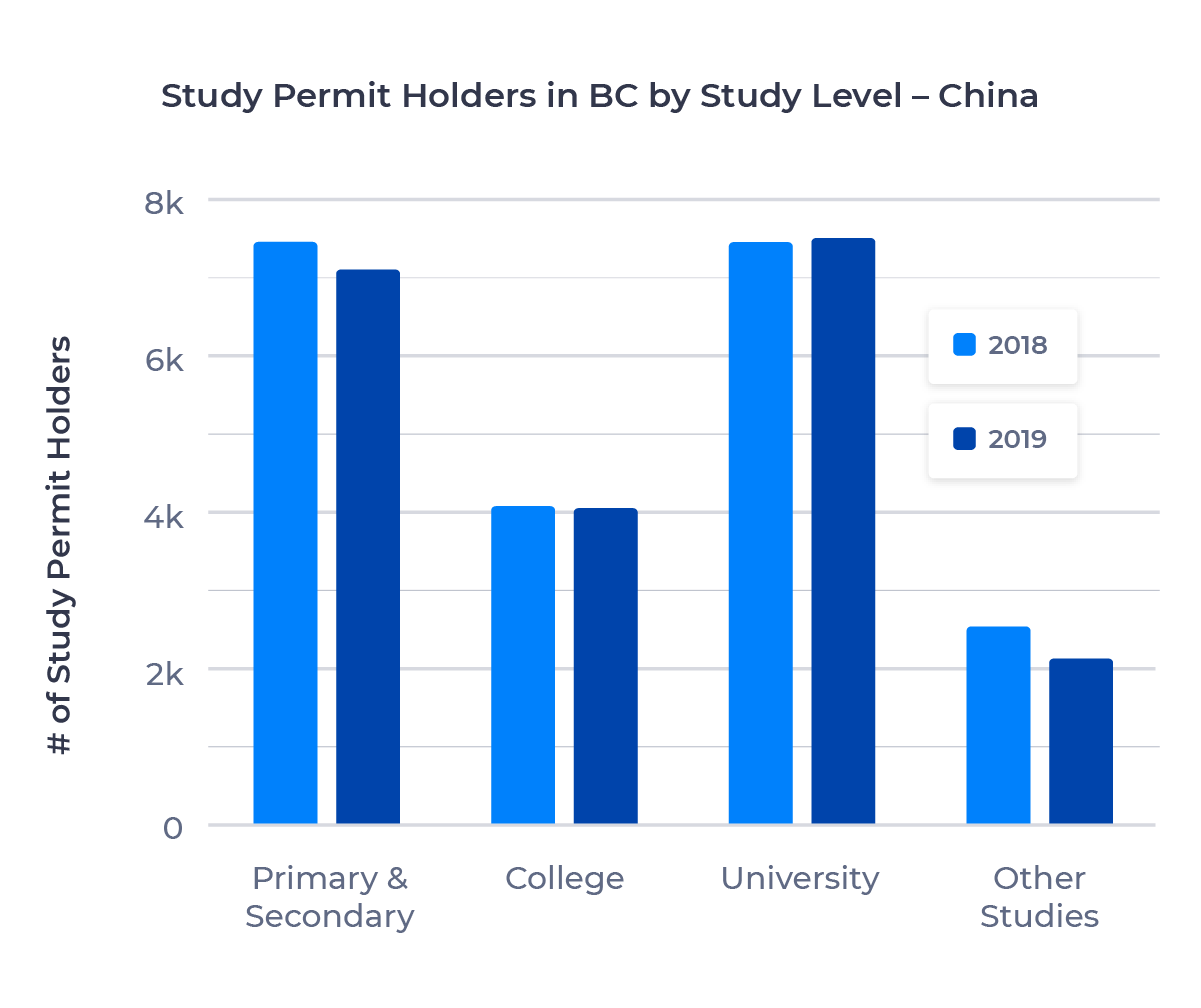

Chinese Students in BC by Study Level

The figure below breaks down Chinese students in BC by study level:

Chinese students in BC have a clear preference for university over college studies, something we saw in our examination of the Ontario data a few weeks ago. Though the difference isn’t quite as pronounced here, it’s worth noting that university was the only sector that grew its Chinese enrollment year-over-year.

China is also far and away the top supplier of primary and secondary students in the province. 5,955 Chinese students enrolled in BC high schools in 2019. This represented a 4% drop from 2018.

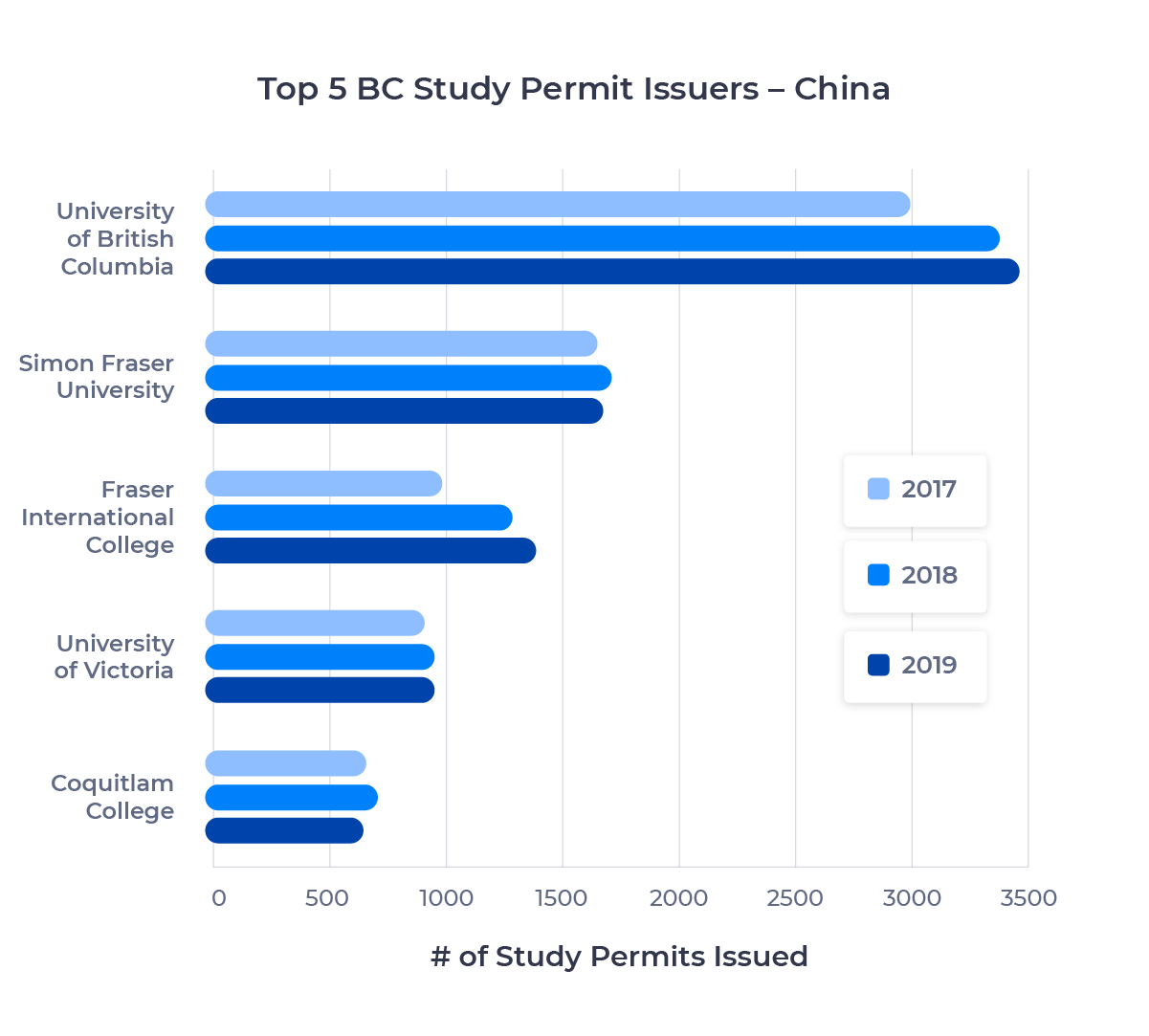

Top BC Schools for Chinese Students

Here are the top five institutions for Chinese students in 2019:

The University of British Columbia (UBC) led all BC schools for Chinese enrollment by a two to one margin. With 3,429 students, UBC’s Chinese contingent formed the largest segment of international students at any BC institution. Fraser International College was the only other school in the top five to post steady growth between 2017 and 2019.

In the Ontario article, we noted that in choosing where in Canada they want to study, Chinese students are driven by location and school ranking. We see that here as well. UBC was the second-ranked Canadian school in ShanghaiRanking’s recent ARWU 2020 list, while eight of the top ten institutions for Chinese students in BC are located in Metro Vancouver.

For more observations and analysis on Chinese students studying in Canada, check out my recent deep dive on the topic, ApplyInsights: China.

South Korea

As source countries for international students, India and China are a cut above the rest, together supplying more than half of British Columbia’s study permit holders. South Korea leads the next tier of source countries. It sent 6,420 students in 2019, good for a 7.4% market share. 37.6%% of South Korean students in Canada studied in BC in 2019, far above the all-countries average of 21.3%.

South Korean enrollment in BC schools shrank 3.1% in 2019.

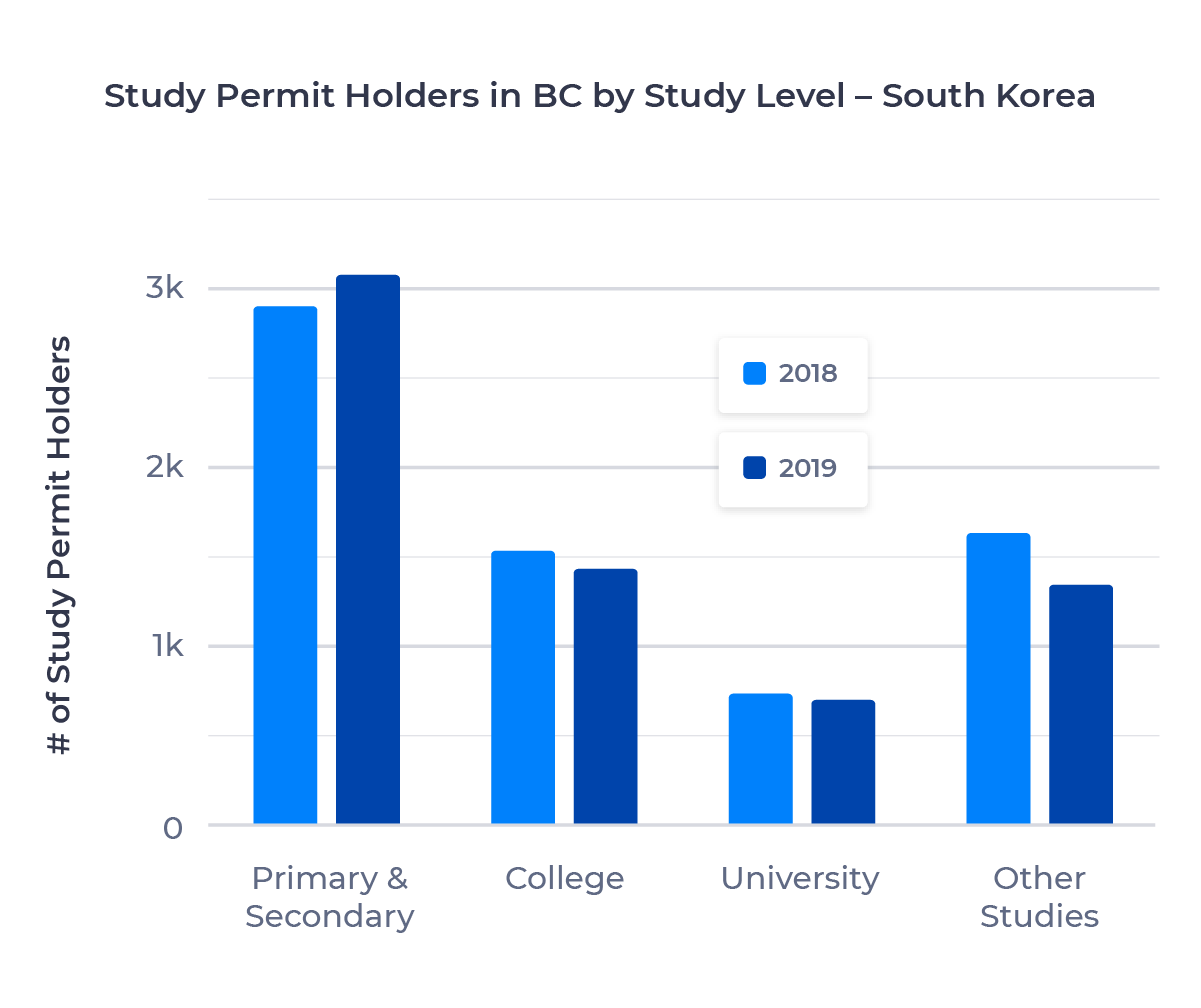

South Korean Students in BC by Study Level

For a breakdown of South Korean students by study level, see the figure below:

Almost half of the South Korean study permit holders in BC in 2019 were primary or secondary students. These students were evenly distributed between the primary and secondary levels. This was the largest proportion of primary and secondary students among the top six source countries, and it was the only sector that grew its South Korean enrollment from 2018 to 2019.

Post-secondary enrollment among South Korean nationals was modest and decreased year-over-year. Aggressive recruitment among post-secondary institutions in South Korea to keep students in their home country may be partly to blame. Other studies enrollment for South Korean nationals dropped 17.5% year-over-year, driven by a decline in language training program enrollment.

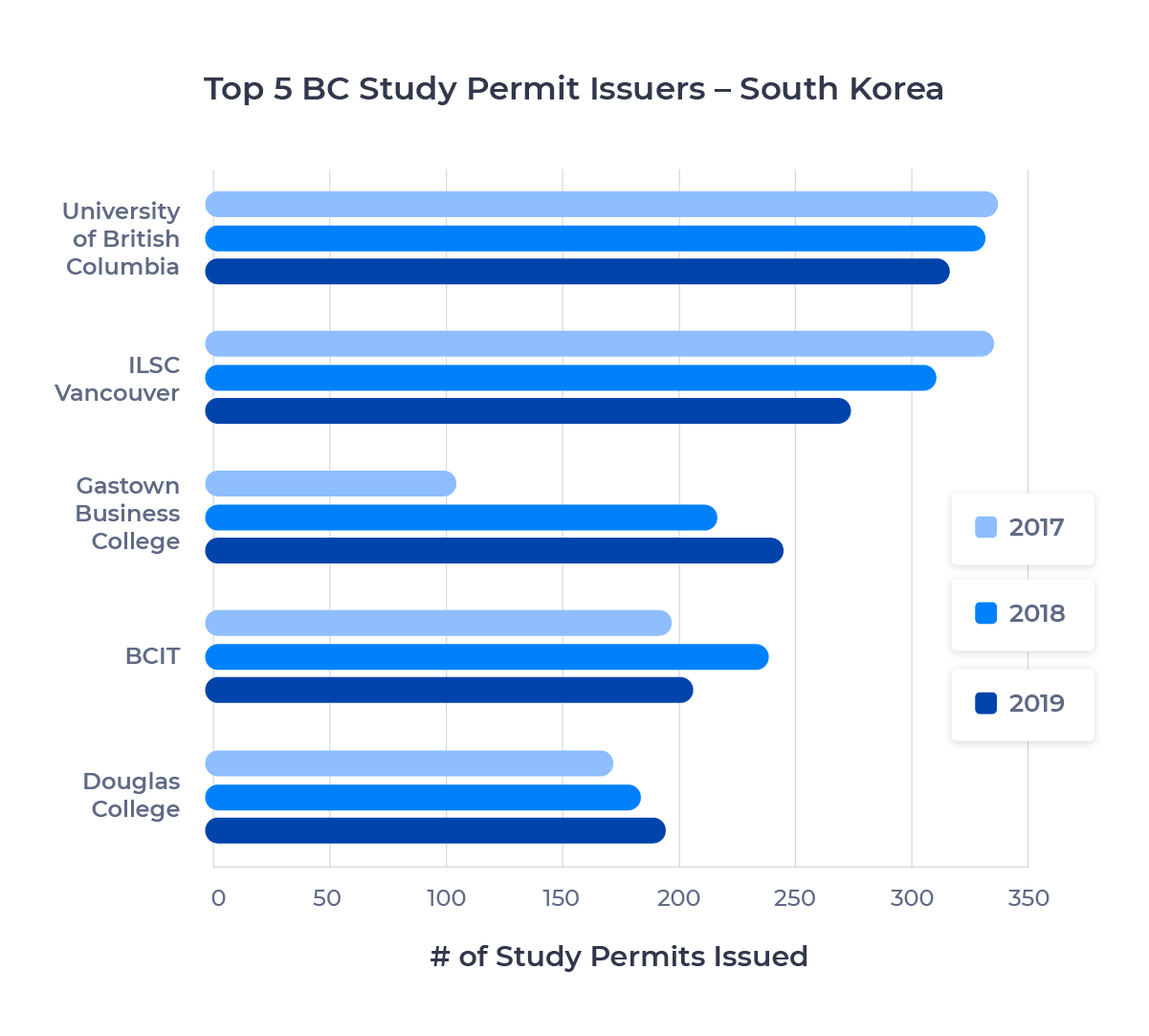

Top BC Schools for South Korean Students

The top five schools for South Korean students in 2019 were as follows:

Once again, we see UBC, British Columbia’s number one school for international student enrollment, on top. ILSC Vancouver was next. Together with ILSC Toronto, ILSC language schools accounted for more than 500 South Korean study permit holders in 2019. Both UBC and ILSC Vancouver lost South Korean students on net between 2017 and 2019.

Gastown Business College, a private international business school located in Vancouver’s historic Gastown district, grew its enrollment by more than 130% over the period to move into the third spot. Douglas College, the largest degree-granting college in BC, led all public colleges in the province with 189 study permits issued to South Korean nationals in 2019.

Japan

3,460 Japanese students came to British Columbia to study in 2019. That made Japan the fourth-largest source country for international students in BC, but it represented a 1.7% decline in students. Despite the decline, BC is the number one destination for Japanese students in Canada. 51.8% of Japanese holders of Canadian study permits studied in the province in 2019.

Japan’s share of the BC market was 4.0%, down from 4.3% in 2018.

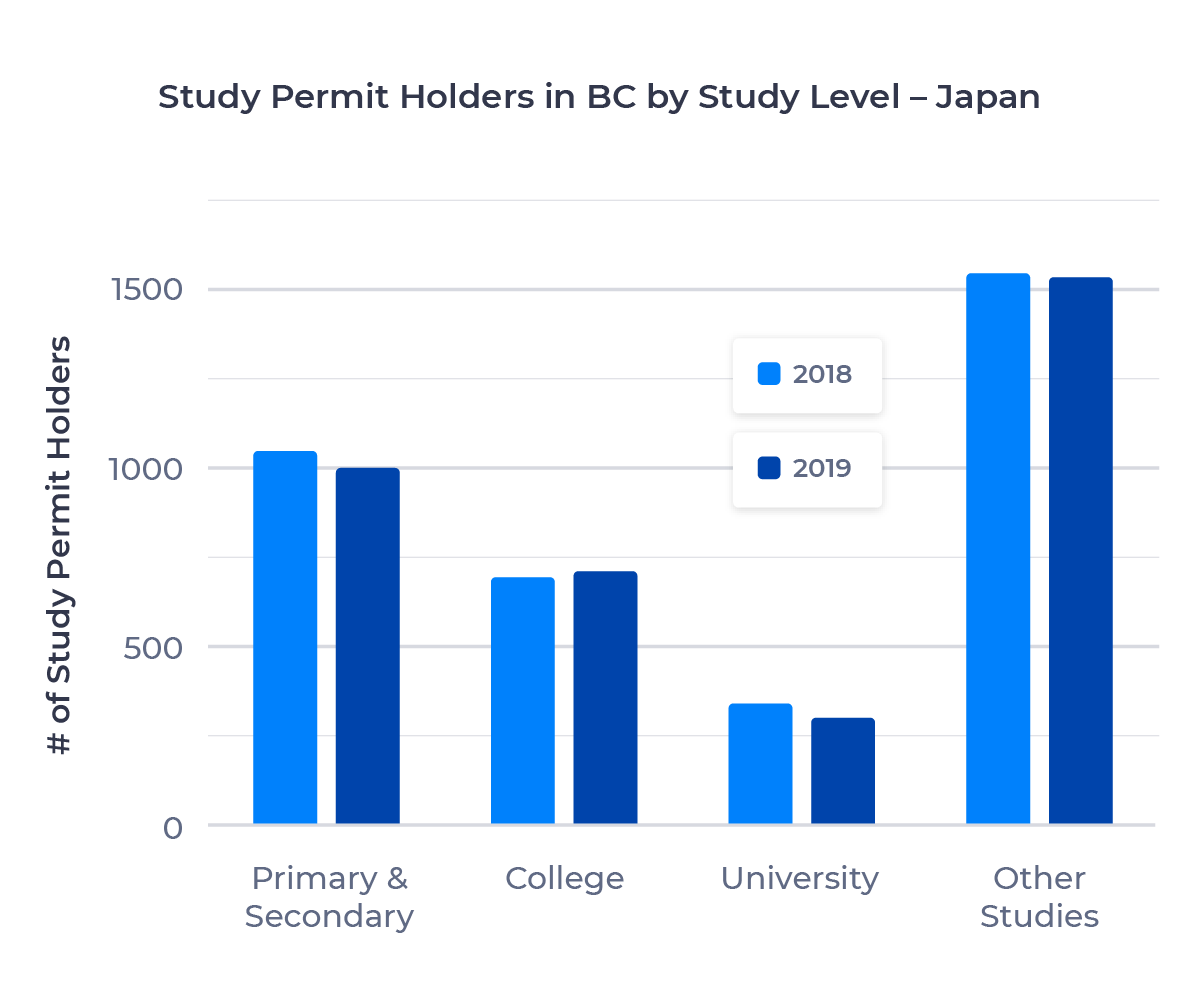

Japanese Students in BC by Study Level

The figure below shows Japanese students in BC by study level:

We see a large number of Japanese students in BC enrolled in the other studies sector—more than 40% of the student population, easily the largest proportion of other studies students among the top six source countries. This is driven by significant Japanese enrollment in language training programs.

Top BC Schools for Japanese Students

Unfortunately, school-by-school study permit data for the Japanese market isn’t available. However, based on the study level data, we can surmise that the many strong language schools in the Metro Vancouver area, such as ILSC Vancouver, VGC International College’s School of English Language, and EC Vancouver’s English Language School, boast strong enrollment numbers.

Brazil

Brazil sent 3,250 students to British Columbia in 2019, good for fifth on our list. The Brazilian market shrunk 10.2% from 2018 to 2019, easily the largest decline among the top six source countries. Canada-wide, the Brazilian market was largely flat year-over-year.

Brazil’s share of the BC market was 3.8% in 2019, down from 4.4% in 2018. 31.6% of Brazilian students in Canada studied in BC, well above the 21.3% all-countries benchmark.

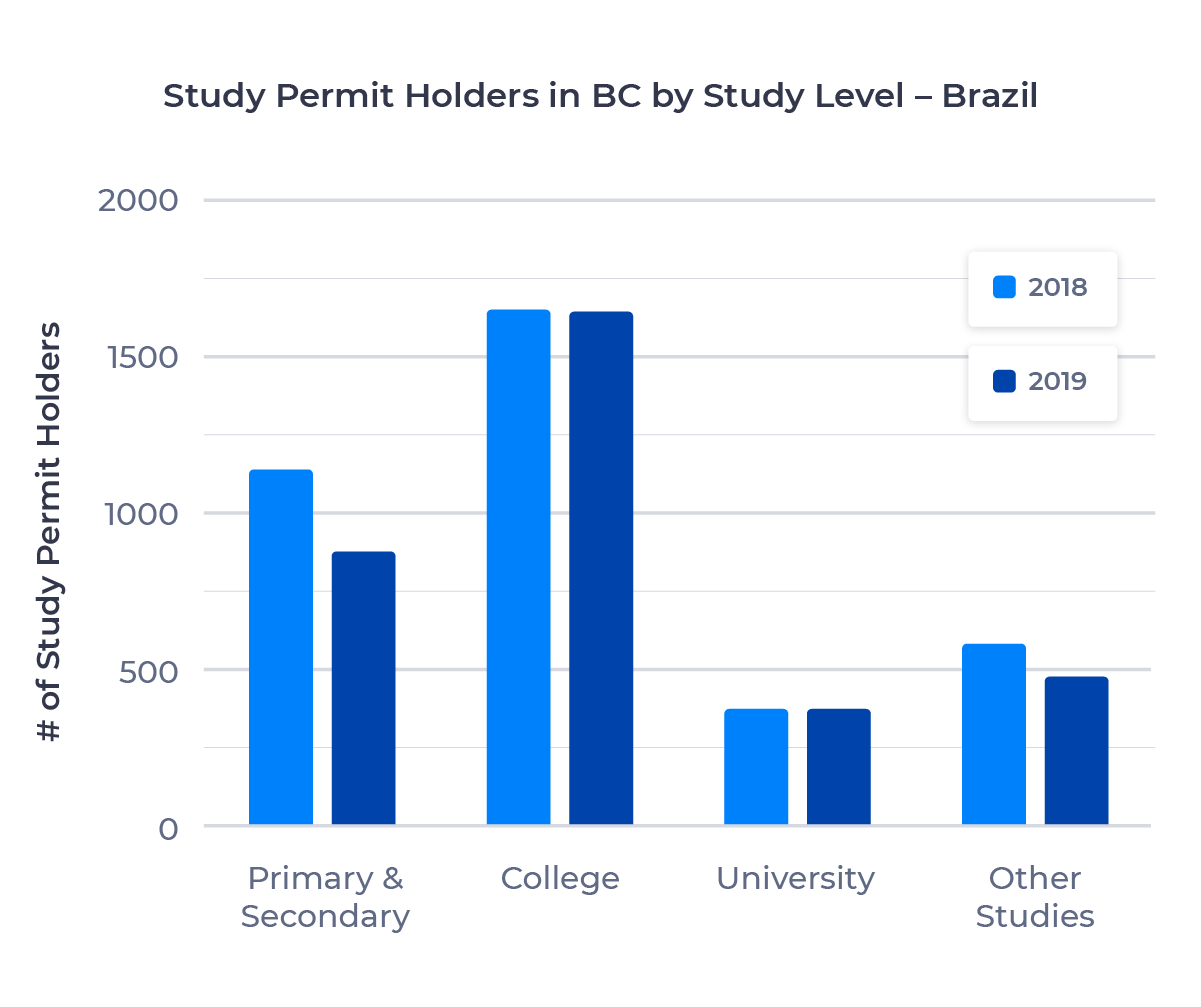

Brazilian Students in BC by Study Level

The figure below shows the breakdown of Brazilian students in BC by study level:

In the Brazil data, we see a clear preference for college over university studies, with college students outnumbering university students four to one in 2019. Among the top six source countries for international students, Brazil had the second highest proportion of college students after India, at 48.6%. 25.9% of BC’s Brazilian students were enrolled in primary or secondary schools, the second lowest proportion after India. This number declined by almost 25% year-over-year.

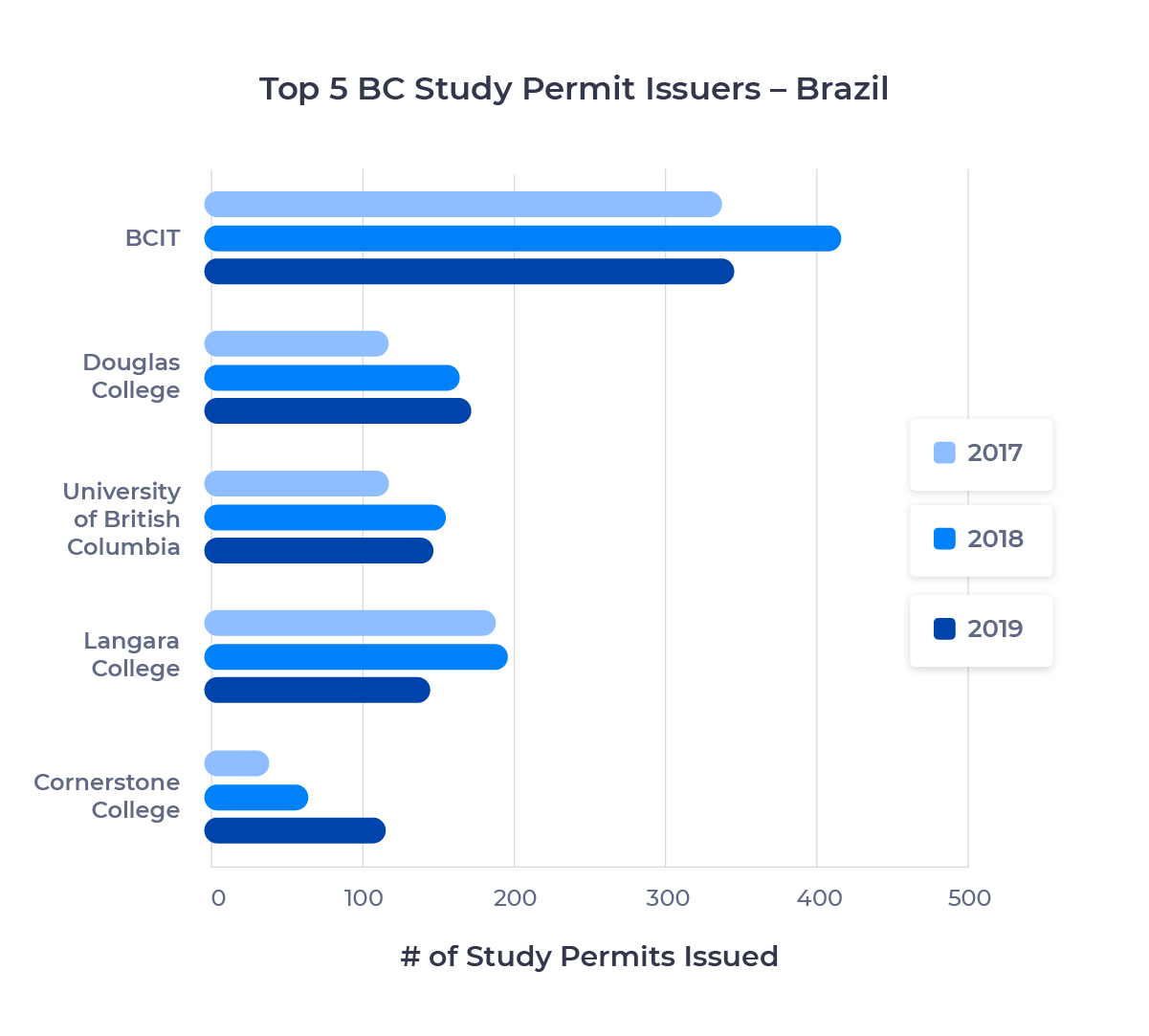

Top BC Schools for Brazilian Students

Let’s move to the top five institutions in BC for Brazilian students in 2019:

The excellent college numbers are borne out in this school-by-school comparison, with four colleges in the top five. The British Columbia Institute of Technology (BCIT) is the dominant player in the Brazilian market, with more than double the Brazilian enrollment of the number two school, Douglas College. The Cornerstone International Community College of Canada, a private career college geared toward international students, grew its Brazilian enrollment by almost 200% from 2017 to 2019.

For more observations and analysis about Brazilian students in Canada, check out ApplyInsights: Brazil.

Vietnam

Rounding out the top 6 providers of international students in British Columbia is Vietnam. 2,645 Vietnamese nationals studied in BC in 2019, a 1.9% decrease from 2018. That was still good for a 3.1% share of the BC market. 22.6% of the study permits issued to Vietnamese students in Canada last year came from BC institutions, in line with the average of 21.3% for all countries.

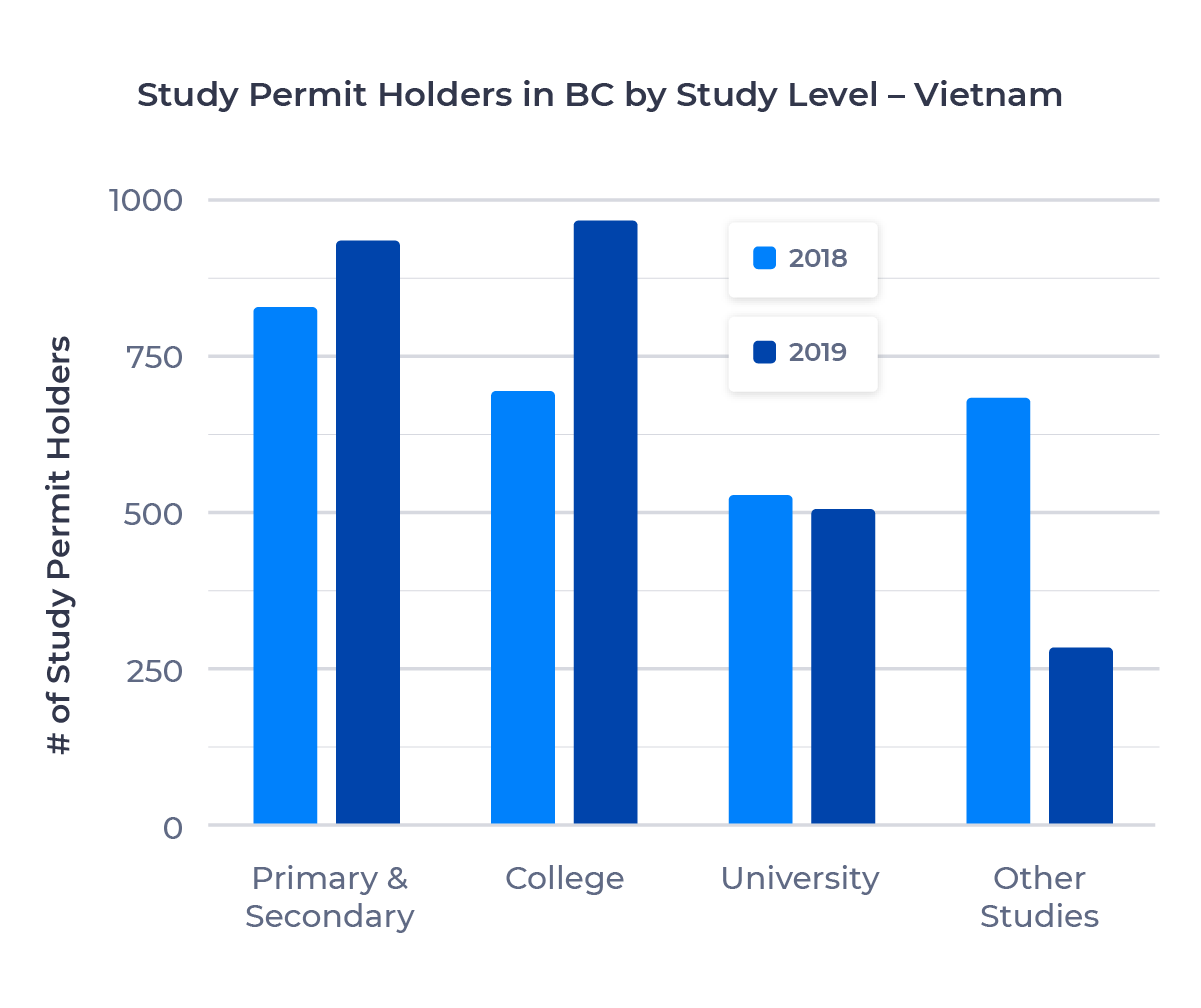

Vietnamese Students in BC by Study Level

Breaking down Vietnamese students in BC by study level, we have the following:

We see strong primary and secondary numbers from Vietnam relative to the other study levels, driven almost entirely by high school enrollment. Study permits issued to college students spiked by almost 40% in 2019, widening the gap between college and university studies.

Other studies numbers tumbled by almost 60% year-over-year, driven by a drop in enrollment in ESL college programs. Vietnam had previously been the leading source country for these programs in BC, but dropped to fourth in 2019.

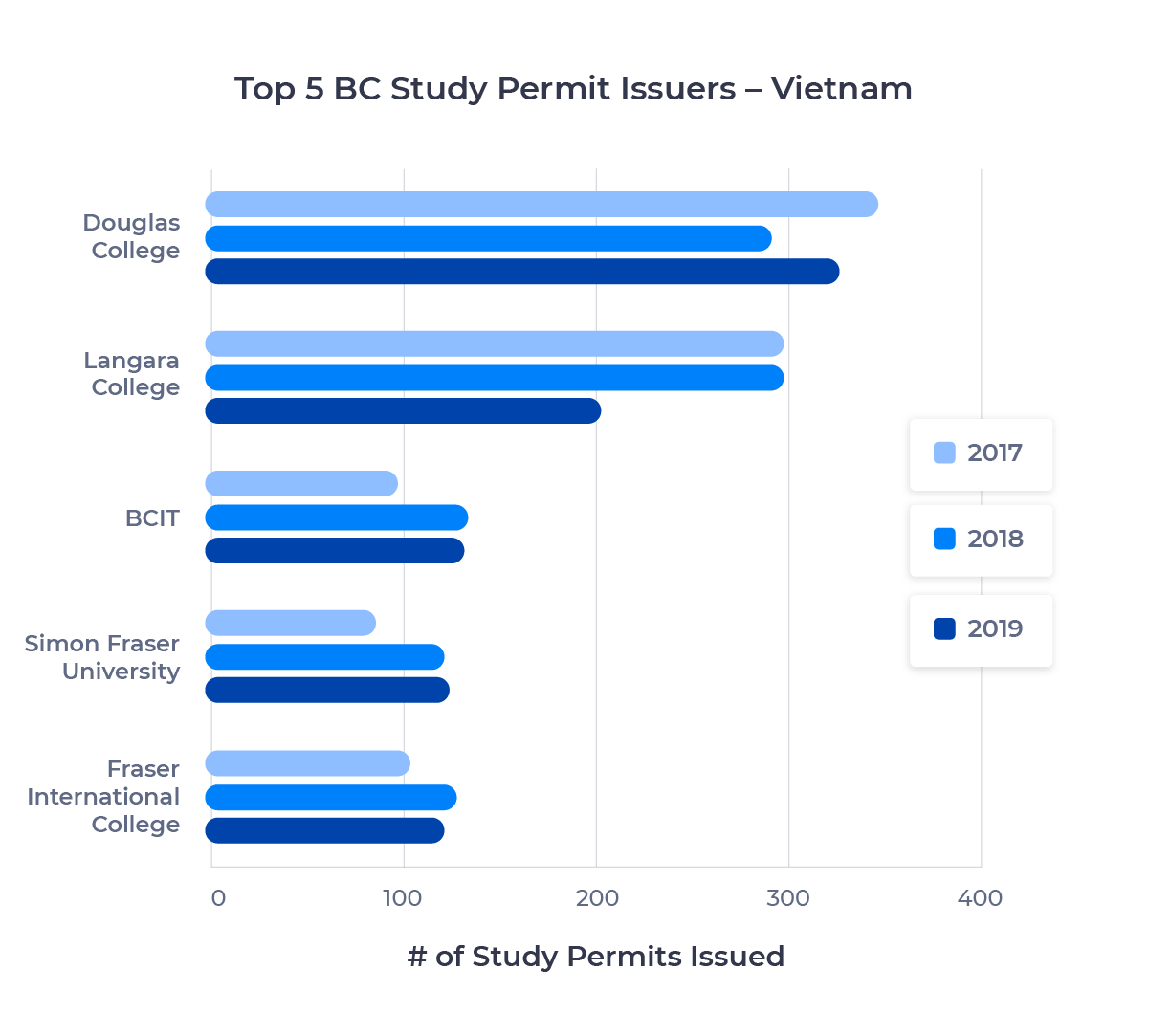

Top BC Schools for Vietnamese Students

Here are the top five institutions for Vietnamese students in 2019:

It’s a list dominated by Vancouver-area colleges, including Douglas, Langara, and Fraser International College, which is affiliated with Simon Fraser University and provides international students a direct pathway into year two of university studies.

As with the Chinese market, 8 of the top 10 schools are located in Metro Vancouver. This aligns with what we observed in the Ontario data, where a large percentage of students chose to study in the Greater Toronto Area. Vietnamese students appear attracted to large, cosmopolitan cities in choosing where to study abroad—though it’s worth noting that Metro Vancouver has both the most post-secondary institutions and the largest institutions in the province.

Study Permit Trends in BC – Summary

There’s a lot of data here, so I’d like to quickly review some of our key findings:

- BC is the number two destination for international students in Canada, but other provinces outpaced its growth, reflecting the maturity of the BC market.

- The post-secondary sector accounted for almost all growth in the province, but growth in that sector is tapering off, with many schools already boasting large international student populations.

- The Indian market has grown rapidly and is responsible for almost all growth in the province. In 2019, India passed China to become the number one supplier of international students in BC.

- Nevertheless, China remains a critical provider of international students to the province. It’s the leading source country for secondary students.

- South Korea, Japan, Brazil, and Vietnam are also key source countries for BC, but enrollment numbers from these countries are declining.

The Future of International Education in BC

It’s difficult to forecast which of these trends will continue due to the disruption of the pandemic. In my conversations with our partner schools in BC and our recruitment partners around the world, I’m hearing that most international students that were planning to study in the province have deferred their studies to January 2021 or beyond, rather than cancelling. This is an encouraging sign for the market.

Just as important, BC, and Canada as a whole, remains an attractive destination for studying abroad for many foreign nationals due to the pathway to citizenship. At ApplyBoard, we’ve seen an uptick in applications on our platform in the past two weeks following changes to post-graduation work permit (PGWP) eligibility. This tells me that students remain motivated by the opportunity to work in Canada and are optimistic about the country’s economic future.

I see little reason the BC international student market won’t return to 2019 levels, but it will take time. As for additional growth, the possibility is there, but it will require either Metro Vancouver schools making the active decision to increase international enrollment, or some of the smaller schools in the BC interior marketing (or continuing to market) their excellent institutions and appealing locations internationally. The potential for growth in the Indian market, in particular, is still large.

Regardless of what the future holds, BC remains a shining example of international education in Canada, somewhere expanding markets can turn to for a roadmap for success. I’ll turn to one of those growing markets, Quebec, in the next few weeks. Check back then!

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,200+ educational institutions across North America and the United Kingdom. Working with over 4,000 international recruitment partners, ApplyBoard has assisted over 100,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.