Before the pandemic hit, Australian institutions were achieving consistent international student growth. From 2015/16 to 2018/19, the number of new Australian student visas granted to international students rose by 30%.1 Institutions in Australia’s three most populous states—New South Wales, Victoria, and Queensland—accounted for over 90% of that growth. But prolonged border closures and travel restrictions caused the number of new student visas granted to decline 18% from 2018/19 to 2019/20.

In today’s ApplyInsights, I’ll be looking at trends in international education for Australia’s most populous states over the past five years to predict how the Australian market will recover post-COVID. I’ll take a look at student visa grant data for each state by study level, and I’ll also dig into trends among major source markets for each state.

Key Insights at a Glance

- Institutions in New South Wales, Victoria, and Queensland have seen a larger share of international students from China and India as the pandemic has continued.

- The Northern Territory and South Australia were the only regions to experience granted student visa growth from 2018/19 to 2019/20.

- More new international students have enrolled in VET studies at Queensland institutions than higher ed studies thus far in 2020/21, a first for a major Australian state.

Let’s start by taking a brief look at international education2 trends across Australia over the past five years.

Australian State and Territory Student Visa Comparison

In 2018/19 and 2019/20, around 83% of students who applied for Australia student visas looked to enroll at institutions in New South Wales, Queensland, or Victoria.3 Due to Australia’s high student visa approval rates, the distribution of granted student visas by state or territory was parallel to application volumes over those two years.

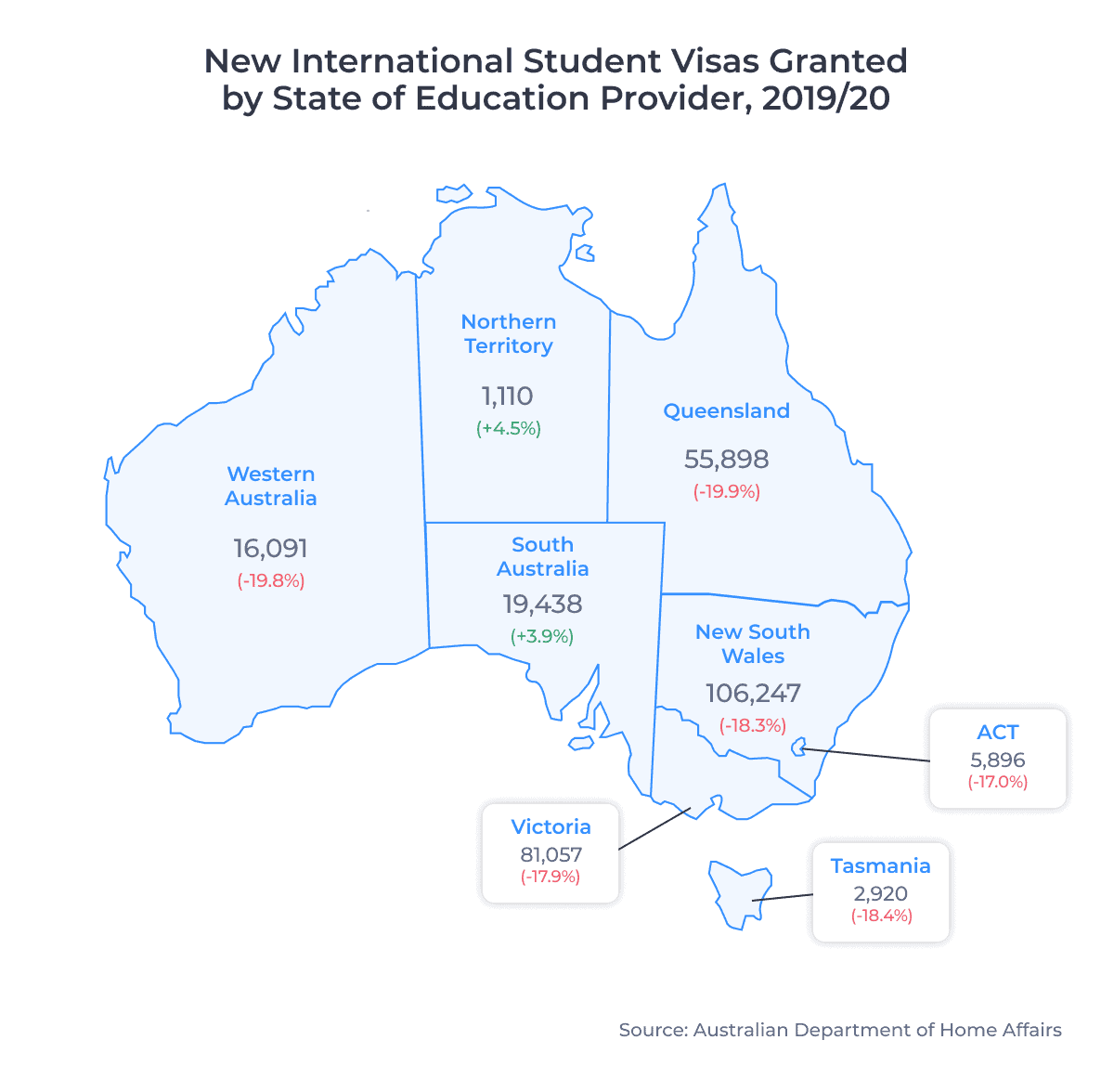

The map below shows the distribution of student visas granted to international students throughout Australia based on the location of their approved education provider in 2019/20:

Most states and territories experienced a 17 to 20% decline in new international students from 2018/19 to 2019/20. However, both the Northern Territory and South Australia saw marginal growth, despite the onset of the pandemic in mid-2019/20. As a result of this growth, South Australia passed Western Australia as the fourth most popular regional destination for international students in 2019/20.

Post-secondary education was the main draw for international students in 2019/20, with 54% of student visas granted for higher education4 studies and 28% granted for Vocational Education and Training (VET)5 programs.

While full-year data is not yet available for 2020/21, current student visa data6 shows a significant decline in student visas across all regions from 2019/20. From July 2019 to March 2020, more than 254,000 new student visas were granted to international students. By comparison, around 151,000 visas were granted from July 2020 to March 2021. This represents a 40.4% decline between those nine month periods.

Student Visa Trends in New South Wales

Australia’s most populous state, New South Wales, is also the top destination for international students looking to study in Australia. Over half a million new student visas have been granted to international students enrolled at institutions in New South Wales since 2016/17. Over this period, institutions in New South Wales accounted for more than 43% of all student visas granted each year.

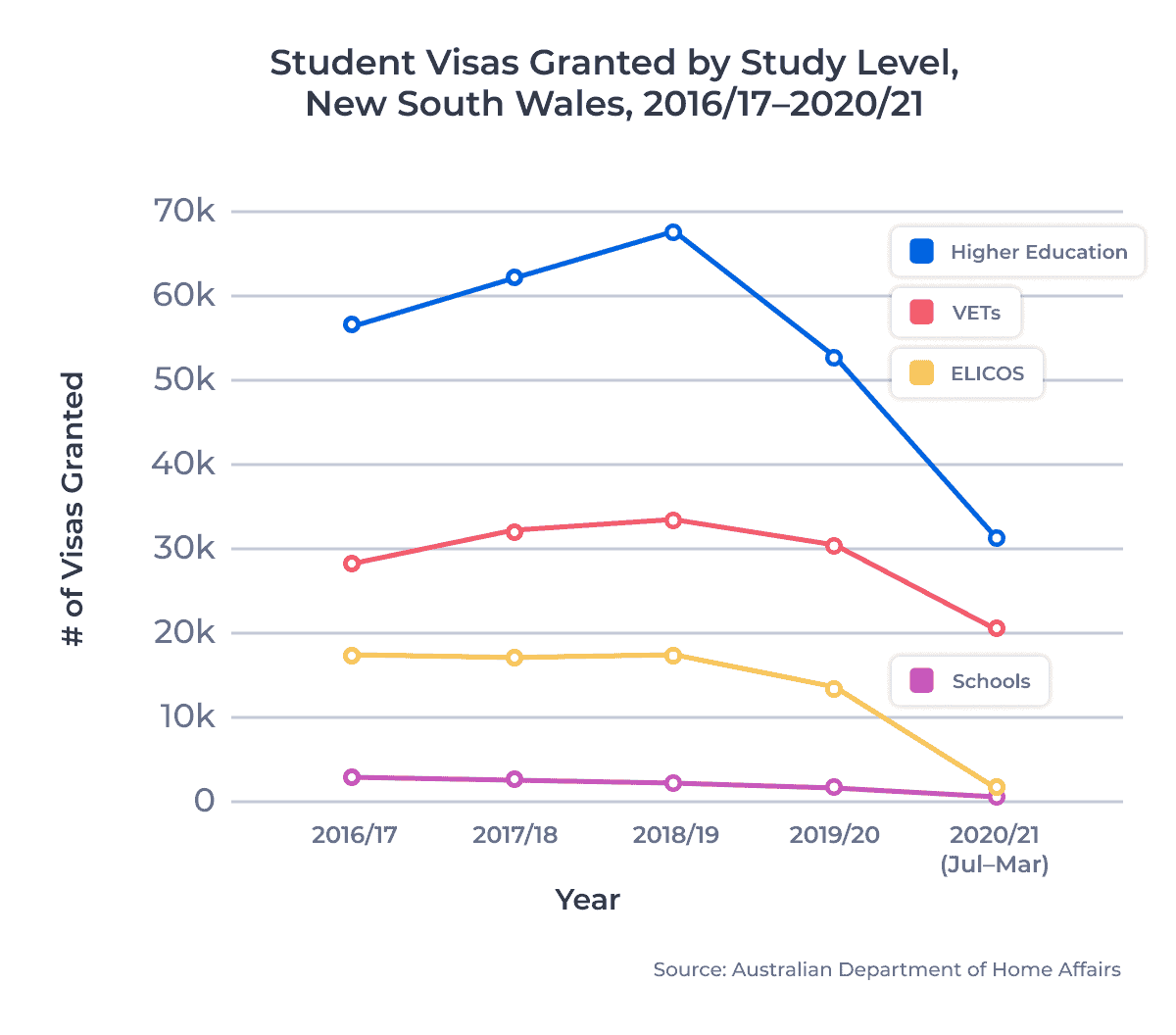

The line chart below shows the number of student visas granted for New South Wales institutions by study level from 2016/17 through the first nine months of 2020/21:

Pre-pandemic, New South Wales saw promising growth, with granted visa numbers increasing by 13.3% from 2016/17 to 2018/19. The majority of this growth came from higher education and VET programs, as expected, with each sector growing by around 20% over that period. But the pandemic caused a significant decline at all study levels, with visas granted dropping by 56.7% from 2018/19 through the first three quarters of 2020/21.

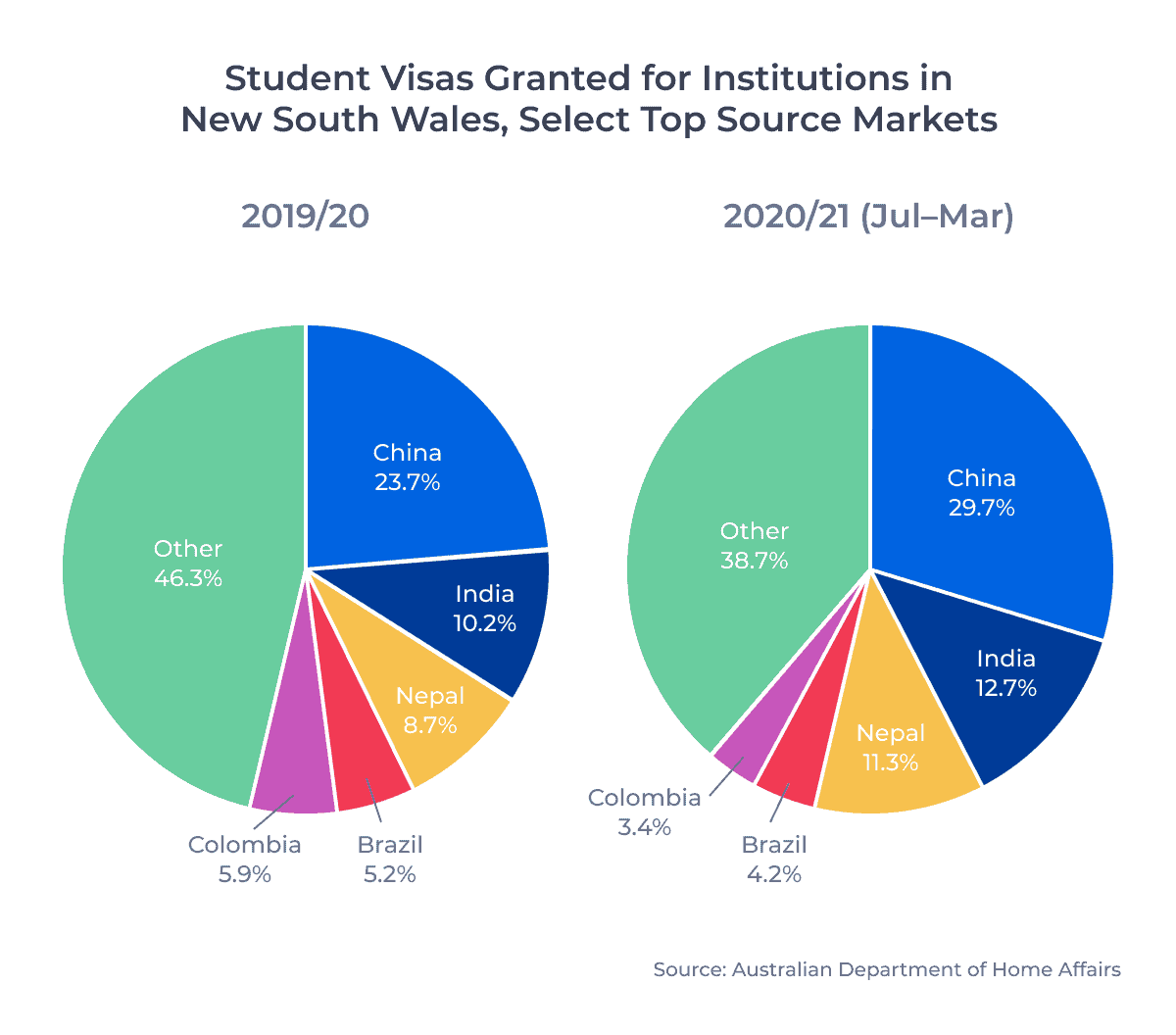

The pandemic has caused a significant shift in the number of visas granted for students enrolled at New South Wales institutions from key source markets. The circle charts below show the market shares of the top five source markets7 in 2019/20 and through the end of March in 2020/21:

New South Wales institutions have seen a greater share of students come from China, India, and Nepal so far in 2020/21. Collectively, the market share of these three markets grew from 42.3% in 2019/20 to 53.7% through March 2021. These three markets also accounted for 71.7% of higher education student visas in New South Wales in 2019/20. China and India are the largest two source markets for New South Wales institutions, and the Australian government has signed collaboration agreements with the Chinese and India governments to maintain student flow. Nepal, on the other hand, emerged as a strong new source market in 2016/17 and saw large market growth in 2018/19.

The relative strength of these three markets may allow the higher ed sector to recover quickly post-pandemic. However, Brazil and Colombia are within the top three source markets for the New South Wales ELICOS and VET sectors. New visa declines from these South American markets have already contributed to the collapse of Australia’s ELICOS sector. The ELICOS sector is not expected to recover until at least 2023, and the VET sector in New South Wales could also experience a prolonged recovery.

Student Visa Trends in Victoria

The state of Victoria is the second most popular Australian destination for study abroad students. Nearly 400,000 student visas have been granted to international students for institutions in Victoria since 2016/17. Over this time, Victoria has accounted for around one third of all granted student visas. Victoria was also the top schools8 destination for international students throughout this period. The city of Melbourne also ranked as the third most student-friendly city, according to student respondents in a 2019 QS survey.

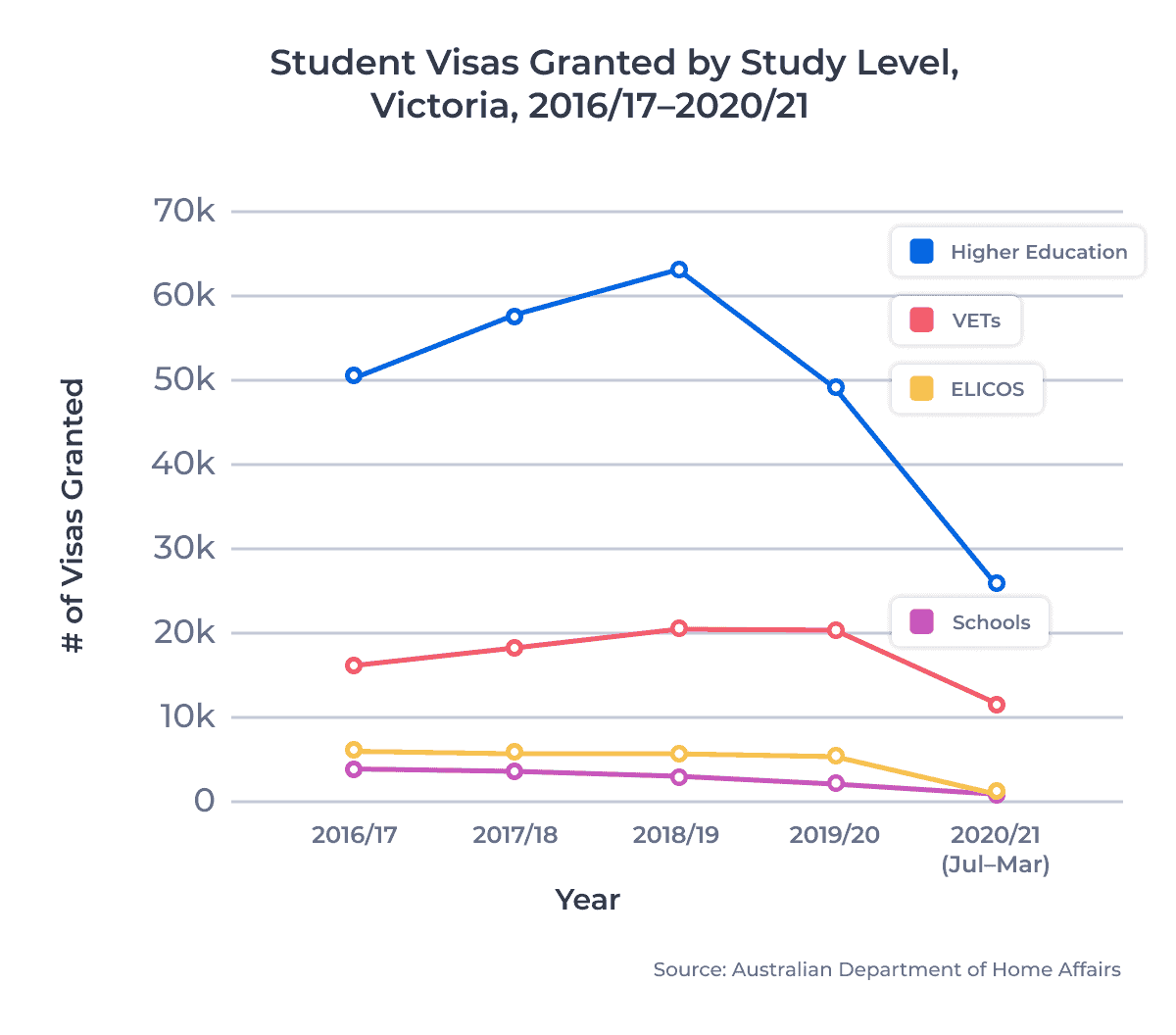

Looking at the line chart below, we can see the number of student visas granted for institutions in Victoria by study level from 2016/17 through the first three quarters of 2020/21:

The number of student visas granted for higher ed institutions in Victoria rose by 25.9% from 2016/17 to 2018/19. VETs in Victoria saw student visa growth of 26.5%. But the schools and ELICOS sectors in Victoria actually experienced student visa declines, collectively dropping by 9.6% over the same period. The pandemic only served to worsen this trend, with student visas granted across all sectors falling by 59.5% from 2018/19 through the first nine months of 2020/21.

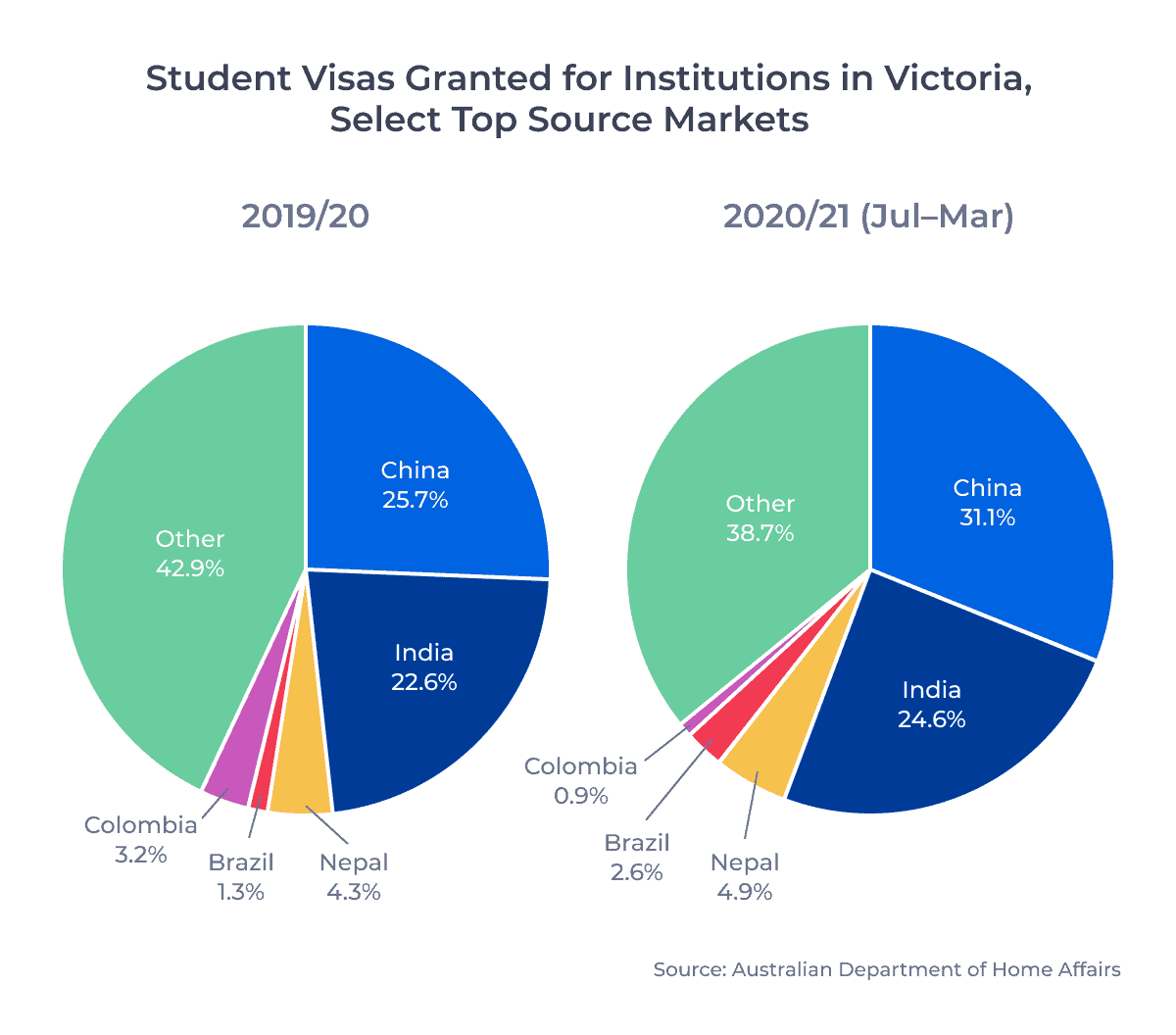

The market shares of the top five source markets in 2019/20 and through the end of March in 2020/21 are shown in the circle charts below:

As with institutions in New South Wales, institutions in Victoria became more reliant on students from India and China through the first nine months of the 2021/21. In fact, Chinese and Indian students accounted for more than half of the student visas granted for institutions in Victoria by the end of March 2021. China and India were also the largest source markets for higher ed, VET, and schools students in Victoria over that period. This could result in a quicker recovery for international education in Victoria compared to other Australian states and territories post-pandemic.

Student Visa Trends in Queensland

Institutions in Queensland saw the third largest volume of new international students over the last five years. Since 2016/17, almost 275,000 international students have been granted student visas for institutions in Queensland. This accounts for around 23% of all student visas granted over the same period. Queensland was the second most popular destination for international schools students in 2018/19. Queensland also surpassed Victoria as the second largest VET market for international students in 2017/18.

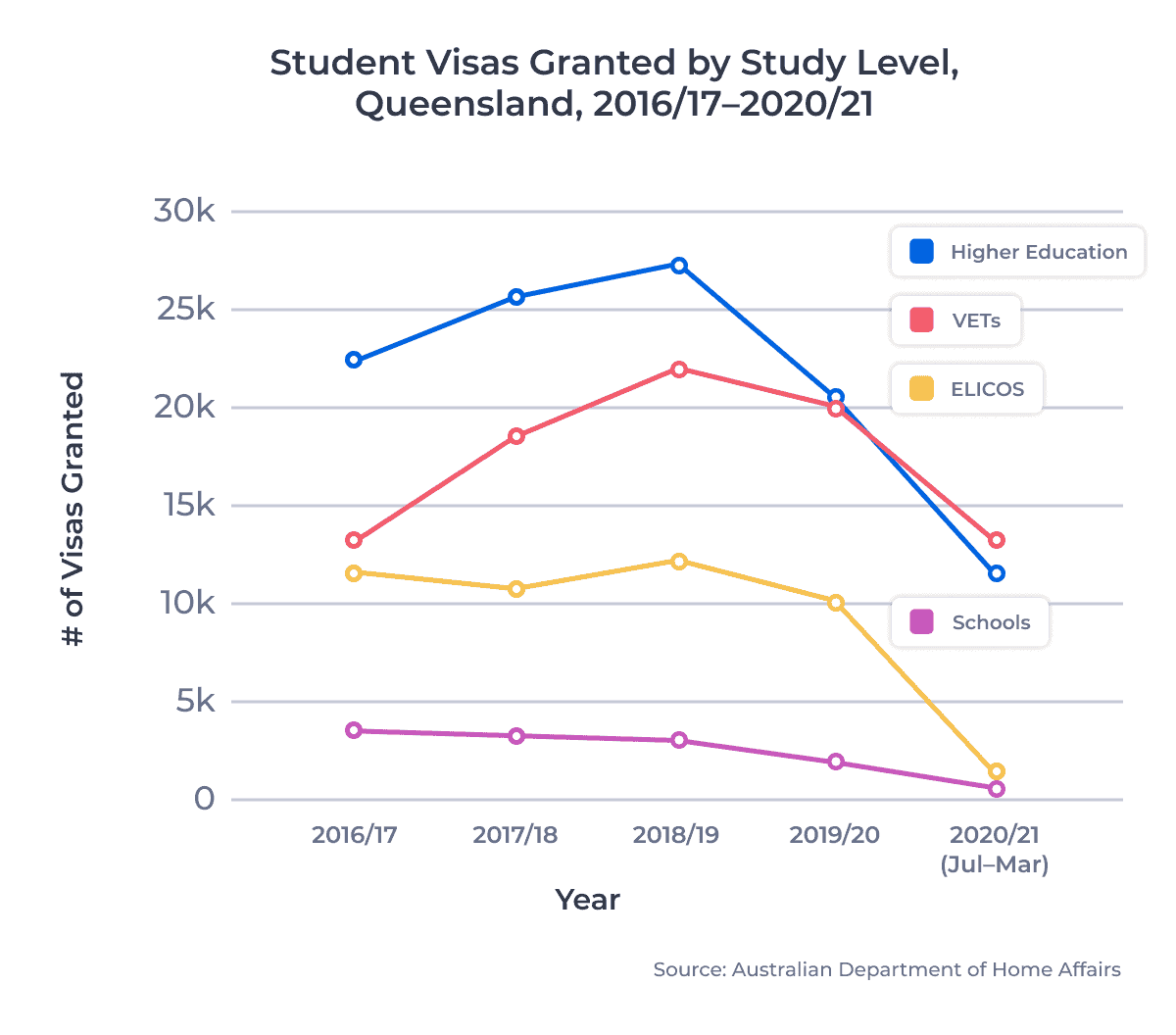

The line chart below shows the number of student visas granted for institutions in Queensland by study level from 2016/17 through the first nine months of 2020/21:

Student visas granted for tertiary studies in Queensland grew substantially pre-pandemic, rising 39.0% between 2016/17 and 2018/19. Most sectors experienced significant pandemic-related decline, with the number of visas granted for Queensland institutions falling 61.2% from 2018/19 through March 2021. However, Queensland’s VET sector has remained relatively strong. For the first time ever within Australia’s largest states, student visas for VET studies are on track to exceed higher ed student visas in 2020/21 in Queensland. This may be, in part, thanks to Study Queensland’s global marketing campaign throughout the pandemic to promote Queensland as a top destination for international students.

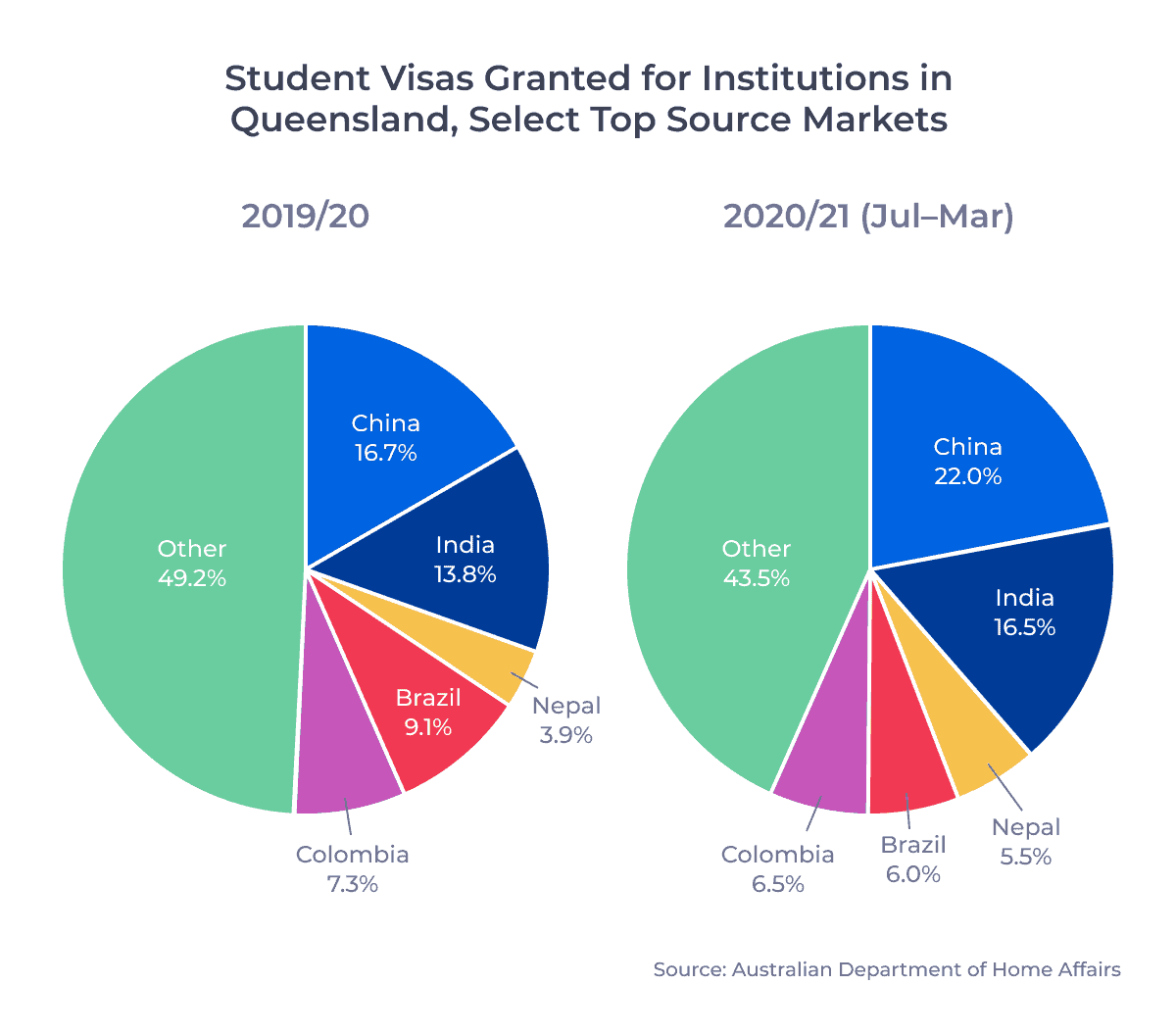

Turning to top source markets, the circle charts below show the market shares of the top five Australian source markets in 2019/20 and by the end of March 2021:

Institutions in Queensland followed the national trend of becoming more reliant on students from China, India, and Nepal so far in 2020/21. However, of the three major destination states, Queensland is the least reliant on these markets. Queensland has a higher percentage of students from other source markets, which could partially explain the strength of the VET sector in the state. The Colombian market has also remained particularly stable for Queensland institutions, compared to those in Victoria and New South Wales.

Looking Ahead

The largest roadblock for these institutions remains the Australian government’s response to the COVID-19 pandemic. Even as vaccination rates rise around the world, the Australian government has stated that international students are unlikely to return until mid-2022. Key industry players have also argued that the Australian government has failed to provide sufficient recovery funding to the higher ed sector.

But institutions in these three major Australian states are already laying the groundwork for industry recovery post-pandemic once travel restrictions are lifted. All three states have established plans in recent weeks to welcome international students before the end of 2021:

- The New South Wales government has pushed for a plan to bring international students to the state by August 2021 using a purpose-built, 600-bed quarantine site.

- In Victoria, there have been moves to begin accepting 120 international students a week through a sector-specific quarantine plan.

- Queensland institutions have also established a plan to charter flights for international students and allow them to quarantine in Australia.

I’ll be keeping an eye on the Australian international education sector in the weeks to come to see if these plans influence further action by the Australian government.

Published: May 26, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of the Australian Department of Home Affairs. All data reported according to Australian governmental financial years, which run from July to June. (For example, July 2019 to June 2020 was the 2019/20 year.) The data used for this article includes subclass 500 visas granted to primary applicants only, unless otherwise specified.

2. Check out the Australia 101 posts on the ApplyBoard Blog for more information about the Australian education system and the Australia student visa system.

3. This aligns closely with Australia’s overall population distribution, with nearly 78% of the population living in those three states as of September 2020.

4. The higher education sector includes studies at Australian universities leading to the awarding of an associate’s degree, bachelor’s degree, graduate certificate, graduate diploma, coursework-based master’s degree, or higher education diploma/advanced diploma.

5. The Vocational Education and Training (VET) sector includes studies leading to the awarding of a VET diploma, advanced VET diploma, vocational graduate certificate, vocational graduate diploma, or certificate I-IV.

6. From July 1, 2020 to March 31, 2021.

7. For each state, I will be analyzing the market share of the top five source markets for all Australian institutions over the past five years, namely China, India, Nepal, Brazil, and Colombia.

8. The schools sector includes primary, secondary, and senior secondary schools.