In this edition of ApplyInsights, I’m going Down Under to look at the top source markets for international students at Australian tertiary education schools. Australia is the world’s third most popular study abroad destination, and ApplyBoard recently launched in Australia.

This article will be the first of many on the Australian market. For our first few articles about Australia, we’ll look at broader international students trends over the past five years to help frame more specific analysis down the road. We’re excited to start digging deep into study trends for the land of the long weekend.

Here’s what this blog post will cover:

- A breakdown of 2019/20 Australian student visas1 by education sector

- Top 20 source markets for Australian Vocational Education and Training (VET) courses2 by student visas issued in 2019/20

- Top 20 source markets for Australian higher education courses by student visas issued in 2019/20

- A brief overview of 2020/21 Australian student visa data from July 2020 to January 2021

- My thoughts on tertiary education for international students in Australia in 2021 and beyond

We’re going to take a look at which source markets sent the most students over the past three years. While student visa applicants (primary applicants) can include their partners or dependent children on their visa application (secondary applicants), I’ll only be looking at primary applicant visas in the sections below.

For more information about the Australian education system and the Australia student visa system, check out the Australia 101 posts on the ApplyBoard Blog.

It should be noted that the 2019/20 year included the start of the COVID-19 pandemic, which negatively impacted international student enrollment around the world.

Australian Student Visas by Sector

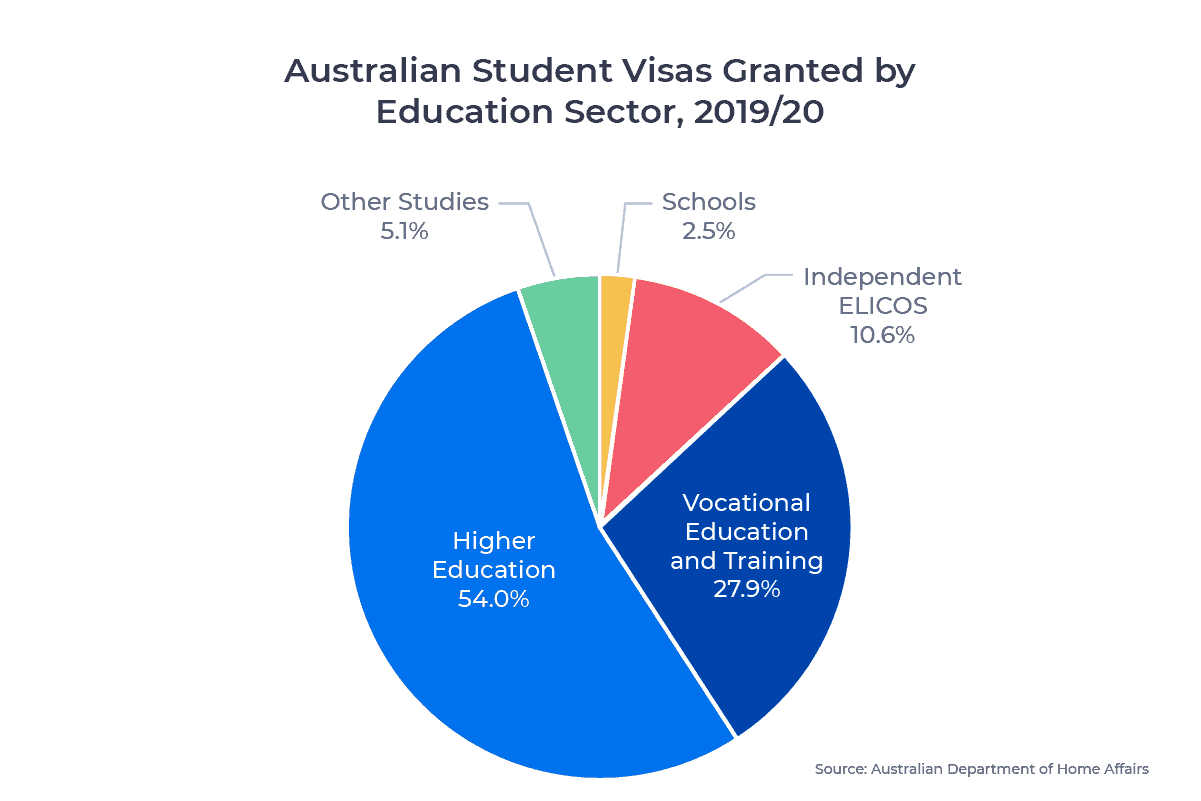

The chart below shows the distribution of Australian student visas in 2019/20 by education sector:

Australian student visas are highly weighted towards post-secondary education. International students enrolled in tertiary study courses3 received 81.8% of all Australian student visas in 2019/20. The independent English Language Intensive Courses for Overseas Students (ELICOS) sector, which often includes those looking to pursue tertiary education in Australia, comprised 10.6% of student visas in 2019/20. This was well ahead of the Other Studies4 and Schools5 sectors.

Within the tertiary study sector, more than half (54.0%) of all new student visas granted in 2019/20 were for higher education6 courses. Let’s take a closer look at the top source markets for these students in 2019/20.

Top Source Markets for Australian Higher Education courses

The number of higher education student visas granted in 2019/20 dropped by 20.3% from 2018/19, primarily due to pandemic-related travel restrictions. Previously, from 2015/16 to 2018/19, the number of higher education student visas increased 35.4%.

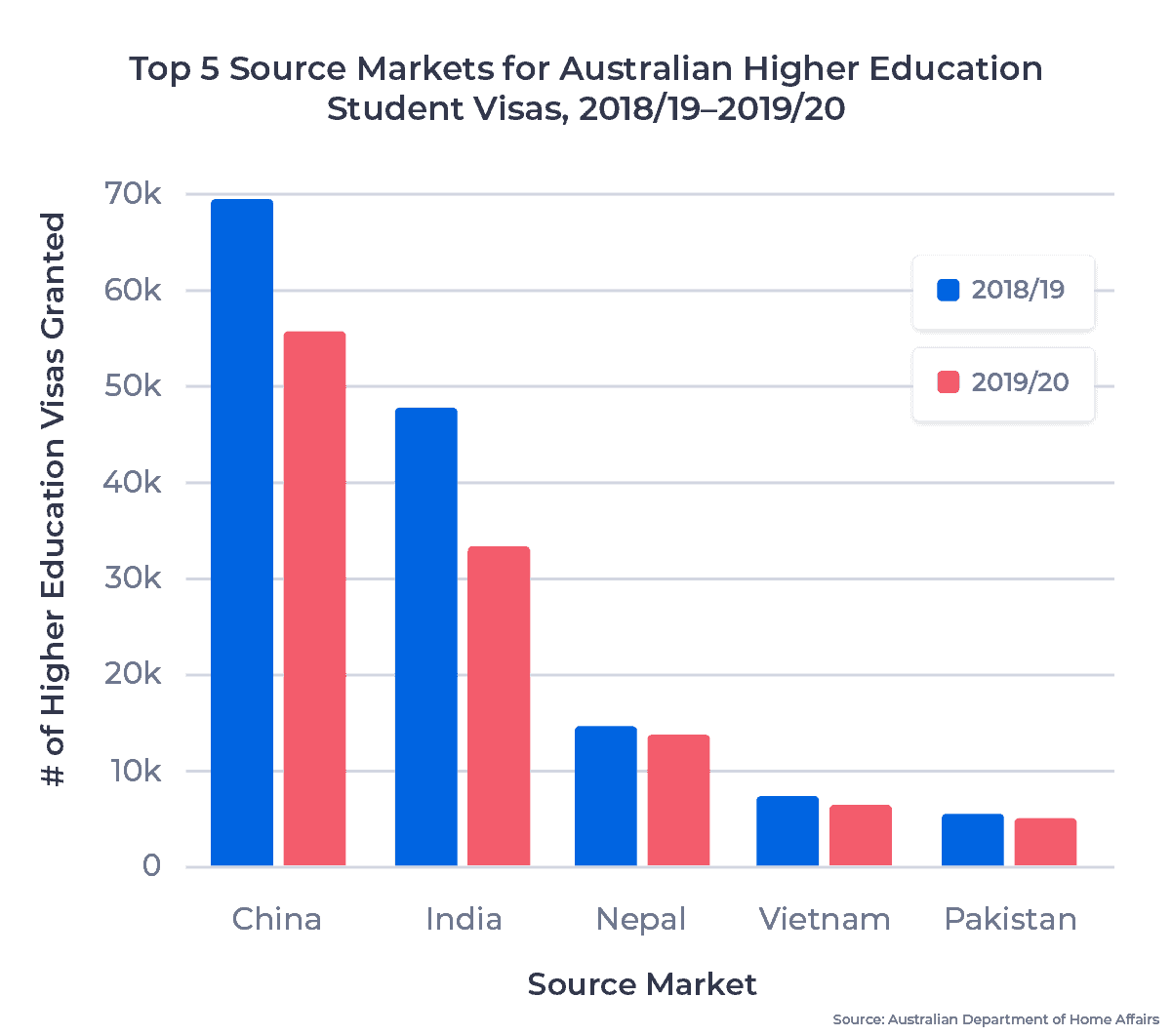

The chart below shows the number of visas granted to higher education students from the top five source markets in 2018/19 and 2019/20:

China has been the top source market for all tertiary education student visas for the past five years, and Chinese students secured 35.9% of all Australian higher education student visas in 2019/20. This was well ahead of China’s proportion of student visas across all sectors (22.3%). The total number of higher education visas granted to Chinese nationals dropped 20.4% from 2018/19, in line with the all-markets average.

India was the second largest source market, with Indian students accounting for 21.5% of higher education visas in 2019/20. This was higher than their all-sectors share (14.8%) but represented a 30.8% decline from 2018/19. Despite this drop, the Indian market for Australian higher education has grown in recent years. 135% more Indian nationals were granted student visas to attend higher education institutions in Australia in 2018/19 than in 2015/16.

Nepal, Vietnam, and Pakistan rounded out the top five source markets. Nepal accounted for 8.9% of new higher education international students in 2019/20, with their student visa numbers declining only 6.0% from the previous year. Vietnam and Pakistan accounted for 4.1% and 3.2% of higher education student visas, respectively, with both markets remaining stable over the past five years.

The table below shows the full list of the top 20 source markets for Australian higher education student visas in 2019/20:

| Rank 2019/20 | Rank 2018/19 | Source Market | # of Student Visas 2019/20 | Change 2018/19–2019/20 |

|---|---|---|---|---|

| 1 | 1 | China | 54,346 | -13,902 |

| 2 | 2 | India | 32,603 | -14,494 |

| 3 | 3 | Nepal | 13,560 | -910 |

| 4 | 4 | Vietnam | 6,160 | -949 |

| 5 | 5 | Pakistan | 4,886 | -419 |

| 6 | 6 | Sri Lanka | 4,028 | -810 |

| 7 | 7 | Malaysia | 3,664 | -1,163 |

| 8 | 9 | Hong Kong (SAR China) | 3,091 | +270 |

| 9 | 8 | Indonesia | 3,034 | -1,028 |

| 10 | 14 | Bangladesh | 2,072 | -154 |

| 11 | 11 | South Korea | 1,955 | -397 |

| 12 | 10 | Singapore | 1,948 | -597 |

| 13 | 13 | Philippines | 1,822 | -434 |

| 14 | 15 | Taiwan | 1,367 | -177 |

| 15 | 12 | Saudi Arabia | 1,355 | -909 |

| 16 | 19 | Bhutan | 965 | -31 |

| 17 | 16 | Kenya | 938 | -221 |

| 18 | 18 | United States | 852 | -195 |

| 19 | 17 | Thailand | 835 | -214 |

| 20 | 20 | Canada | 834 | -151 |

Top Source Markets for Australian VET courses

VET courses have become increasingly popular for international students over the past five years. The market share for VET courses compared to all other study levels increased by 6.1% from 2015/16 to 2019/20, rising from 21.8% to 27.9%. This translated to a 36.9% increase in total student visas granted for students enrolled in VET courses over that time.

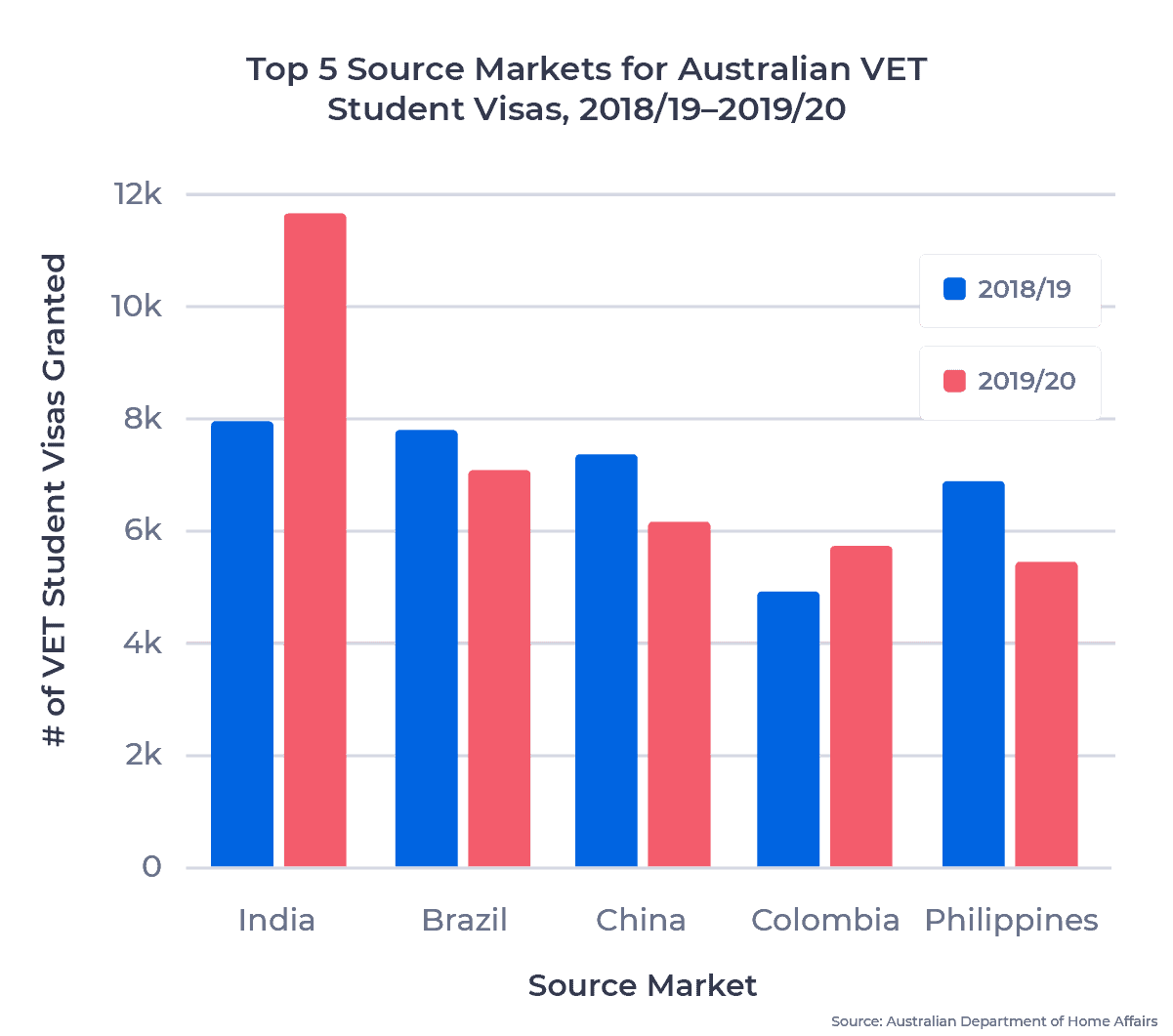

The chart below shows the number of visas granted to VET students from the top five source markets in 2018/19 and 2019/20:

India was the largest source market for VET international students in 2019/20. India’s growth as a VET student source market has been remarkable. India was only the tenth largest source market in 2016/17, but grew an incredible 440% between that year and 2019/20. India accounted for 14.3% of all VET student visas in 2019/20, in line with its all-sectors share. I’ll be watching to see if India can buck the global trend and maintain or grow its student numbers in Australia in 2020/21.

Brazil was next, with 8.7% of all VET student visas granted to Brazilian nationals in 2019/20. The total number of visas granted to Brazilian students for VET studies in 2019/20 was down slightly year-over-year (-9.4%). But Brazil remains a strong source market for Australian VETs, as nearly 10% of all international VET students came from Brazil over the 2015/16 to 2019/20 period.

China, Colombia, and the Philippines completed the top five, with each market sending more than 5,000 students to Australian VETs in 2019/20. The number of new Chinese VET students dropped 30.8% from 2017/18 to 2019/20. By contrast, the number of new Filipino VET students grew by 130% over the same period. However, both markets saw significant contraction in 2019/20. Colombia, on the other hand, has seen persistent growth since 2015/16, growing every year and achieving a total growth rate of more than 200% from 2015/16 to 2019/20.

Nepal was a significant outlier in the top 10. It dropped from the largest source market for new VET international students in 2018/19 to the seventh largest in 2019/20. However, Nepal still has a huge potential for growth post-pandemic. Despite the drop in 2019/20, the Nepali market for new VET students grew by 305% from 2015/16 to 2019/20.

The full list of the top 20 source markets for Australian VET student visas in 2019/20 appears in the table below:

| Rank 2019/20 | Rank 2018/19 | Source Market | # of Student Visas 2019/20 | Change 2018/19–2019/20 |

|---|---|---|---|---|

| 1 | 2 | India | 11,662 | +3,673 |

| 2 | 3 | Brazil | 7,072 | -730 |

| 3 | 4 | China | 6,174 | -1,201 |

| 4 | 7 | Colombia | 5,726 | +810 |

| 5 | 5 | Philippines | 5,449 | -1,442 |

| 6 | 6 | South Korea | 4,356 | -710 |

| 7 | 1 | Nepal | 3,523 | -5,308 |

| 8 | 9 | Thailand | 3,332 | +207 |

| 9 | 8 | Malaysia | 3,213 | -483 |

| 10 | 11 | Indonesia | 2,446 | -233 |

| 11 | 10 | Taiwan | 2,405 | -462 |

| 12 | 12 | United Kingdom | 2,241 | +60 |

| 13 | 13 | Italy | 2,054 | -14 |

| 14 | 14 | Japan | 1,670 | -111 |

| 15 | 17 | Vietnam | 1,578 | +380 |

| 16 | 21 | Pakistan | 1,408 | +732 |

| 17 | 15 | Spain | 1,371 | -260 |

| 18 | 19 | France | 1,144 | +104 |

| 19 | 18 | Chile | 1,121 | +74 |

| 20 | 16 | USA | 952 | -369 |

Australia Student Visas in 2020/21

The early impacts of the COVID-19 pandemic are clear in the 2019/20 student visa numbers. The general decline of most source markets, especially for higher education, reflects the impact of travel restrictions and other pandemic policies. But looking at 2020/21 Australian student visa data for July 2020 through January 2021, some trends have begun to emerge.

Student visas for tertiary education (excluding ELICOS) were down 32.1% from July 2020 to January 2021, compared to July 2019 through January 2020. VET numbers remained particularly strong, down only 24.6%, compared to a 36.3% decline in higher education student visas.

While enrollment rates for Indian, Chinese, Nepali, and Brazilian students fell 20 to 30%, Colombian student enrollment dropped only about 2%. On the other end of the scale, South Korean, Malaysian, and Filipino student enrollment all fell by around 50%.

The Future of Australian Tertiary Education for International Students

China, India, and Nepal remain critical markets for future growth for Australian tertiary institutions. But Latin America is also a high-potential market, with more and more Latin American students expanding their educational journeys to include studying abroad.

The Southeast Asian market has also grown significantly in recent years for many study abroad destinations, and Australia’s close proximity makes it an attractive destination for students pursuing tertiary education.

Australia has been lauded as a global success story during the downturns associated with the pandemic. The Australian government also recently announced that international students will be part of their vaccination program. Some Australian universities are even implementing permanent online learning solutions, in an attempt to reach more students and expand the global footprint of Australian institutions. There are some pressing issues, though. Around 30% of Australia’s international students are stuck outside of the country with no clear timeline for their return. The drop in international enrollment has had a serious economic impact as well, decreasing the value of Australian education exports7 by $8.8 billion in 2020 compared to 2019.

Despite these issues, Australia is a strong and growing market, and I can’t wait to cover it in more detail. Keep an eye out for more articles on the Australia market in the coming weeks. Later this month, I’ll be looking at Australian student visa acceptance rates by source country.

Published: March 1, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of the Australian Department of Home Affairs. All data reported according to Australian governmental financial years, which span from July of one year to June of the next year. (For example, July 2019 to June 2020 was the 2019/20 year.) The data used for this article includes subclass 500 and subclass 570 to 576 visas granted to primary applicants only.

2. In the Australian context, “course” refers to the academic program that the student chooses to pursue.

3. Tertiary study includes VET and higher education courses (including postgraduate).

4. The Other Studies sector includes Foreign Affairs and Defence Sector student visas, as well as Non-Award sector student visas.

5. The Schools sector includes primary, secondary, and senior secondary schools.

6. Higher education courses include all courses resulting in the conferral of bachelor’s or master’s degrees, or PhDs.

7. Educational exports include tuition fees, rent, travel, food, clothing, and other costs paid by international students who are studying at Australian institutions.