If you’re like me, you were eagerly anticipating yesterday’s release of findings from the Institute of International Education (IIE)’s 2021 Open Doors Report on International Educational Exchange. Each year, Open Doors provides the definitive snapshot of the state of international education in the United States.

For today’s ApplyInsights, I want to focus on some of the top-line takeaways from the report. Is the news as bad as we expected? How does it align with evidence that the US market is recovering? Let’s dig in.

Key Insights at a Glance

- New international student enrollment in the US fell by 46% from 2019/20 to 2020/21, but preliminary analysis shows a 68% rebound in Fall 2021.

- Taken together, new international student enrollment in Fall 2021 is down 10% from 2019/20.

- Shorter programs saw the most significant decline in 2020/21. New international student enrollment in non-degree programs fell by 76% year-over-year.

- Source markets that had more success battling COVID-19 saw more significant declines in their US international student populations than those who struggled.

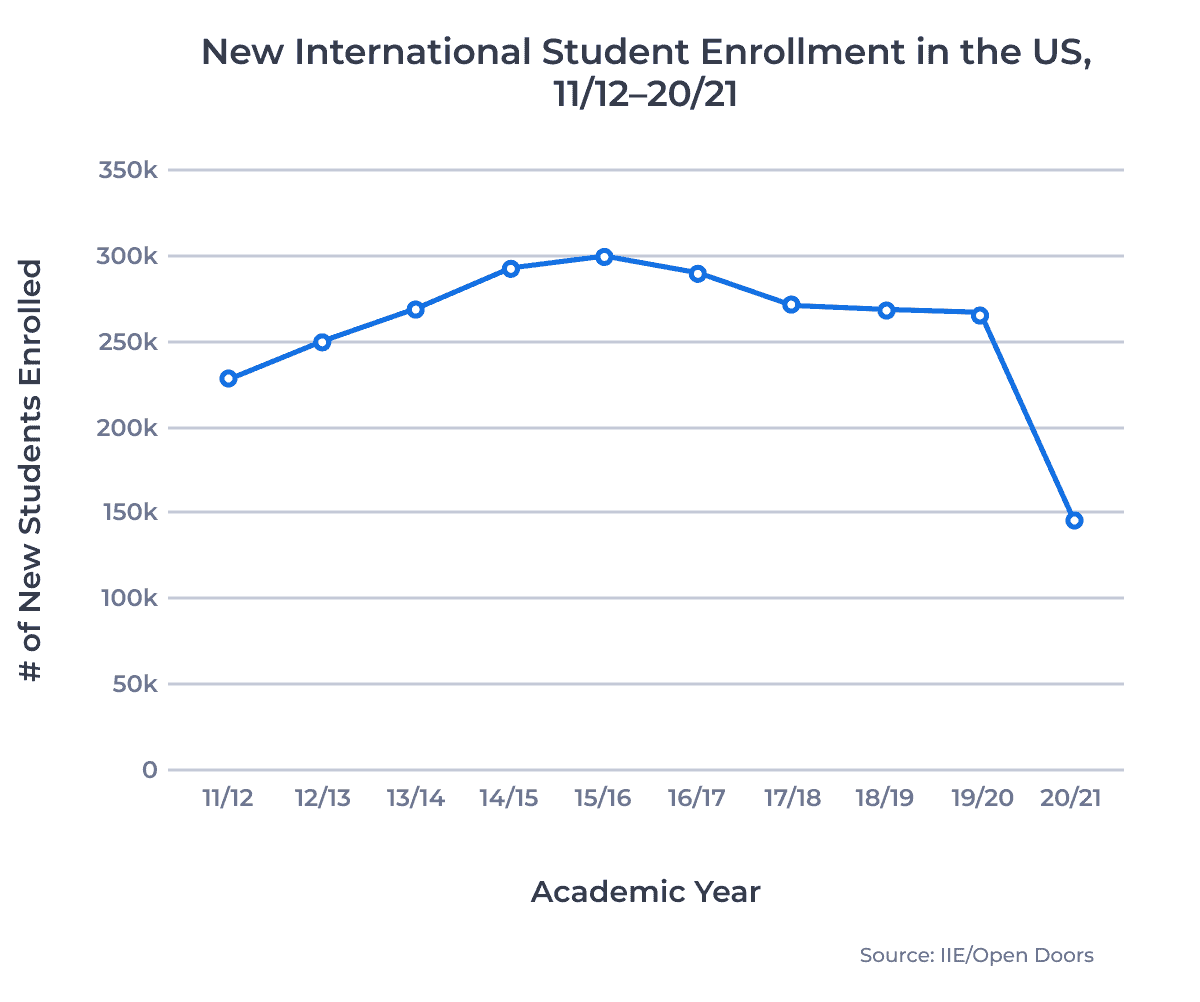

Measuring the Decline in US International Ed

145,528 international students began their studies at US institutions in the 2020/21 academic year.1 This represented a 46% drop in new international student enrollments from 2019/20. It was the biggest one-year drop in the 72 years IIE has been compiling their report.

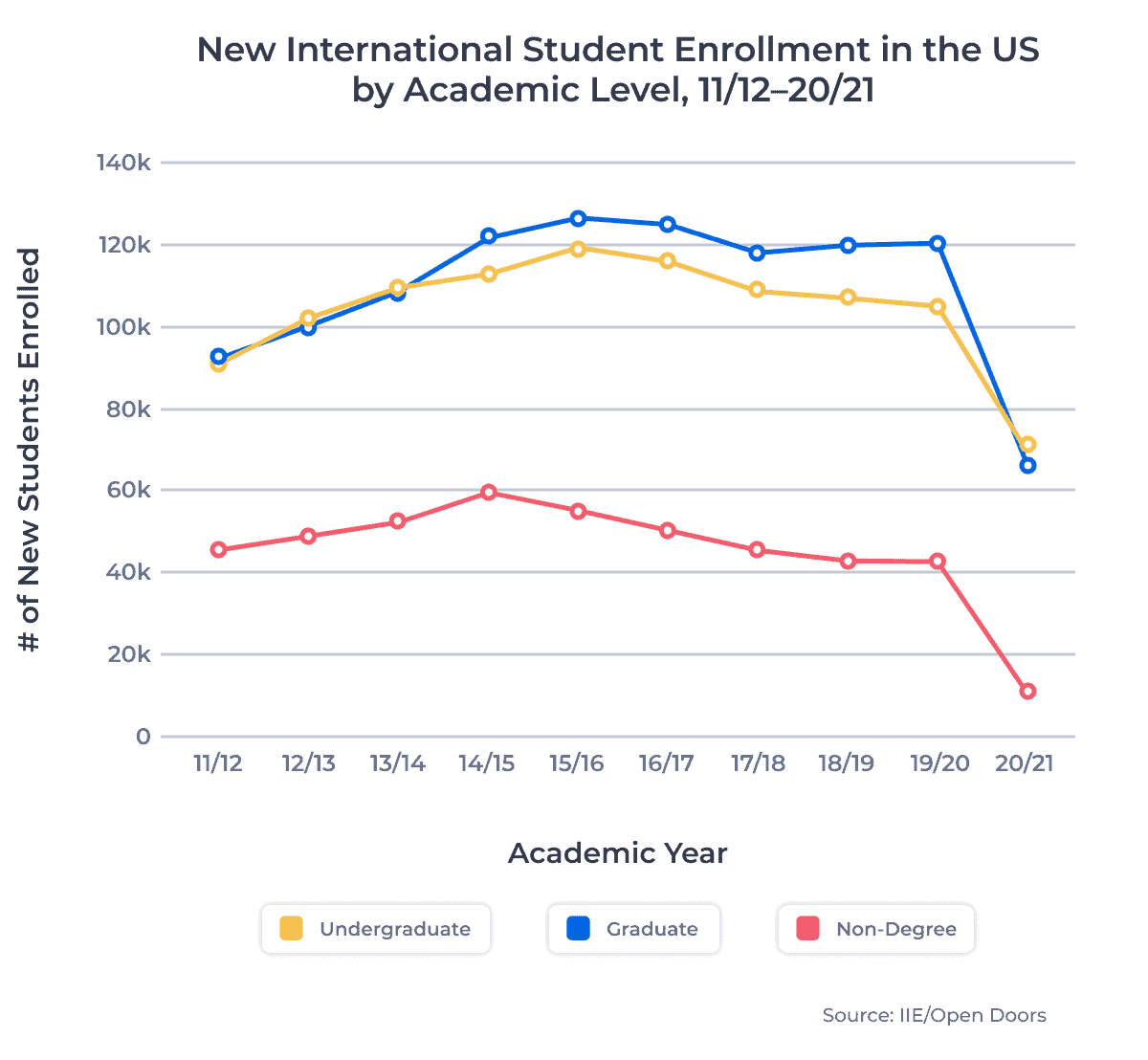

Shorter, Non-Degree Programs Hit Hardest

Shorter and non-degree programs saw the steepest declines in new international student enrollment last year, as the chart below shows:

I previously looked at the pandemic-era challenges in the IEP sector and how the sector is evolving as it emerges from the pandemic.

At the graduate level, master’s programs saw the most significant decline by far. Total enrollment (as distinct from the new enrollment data above) at the master’s level fell by 21%, compared to just 3% for doctoral programs. Remarkably, professional programs actually saw a 6% increase. This reflects a trend we’ve seen across destination markets where students have been more willing to move ahead with their study abroad plans for longer programs, perhaps because they are more committed to those programs.

The number of students pursuing Optional Practical Training (OPT) declined from 2019/20 to 2020/21, dropping for the first time in 20 years. This was driven in part by students leaving the program to return home during the pandemic. But growth rates for OPT had been declining for four years pre-COVID-19 alongside the fall in new student enrollment, and OPT was due to contract even without the pandemic.

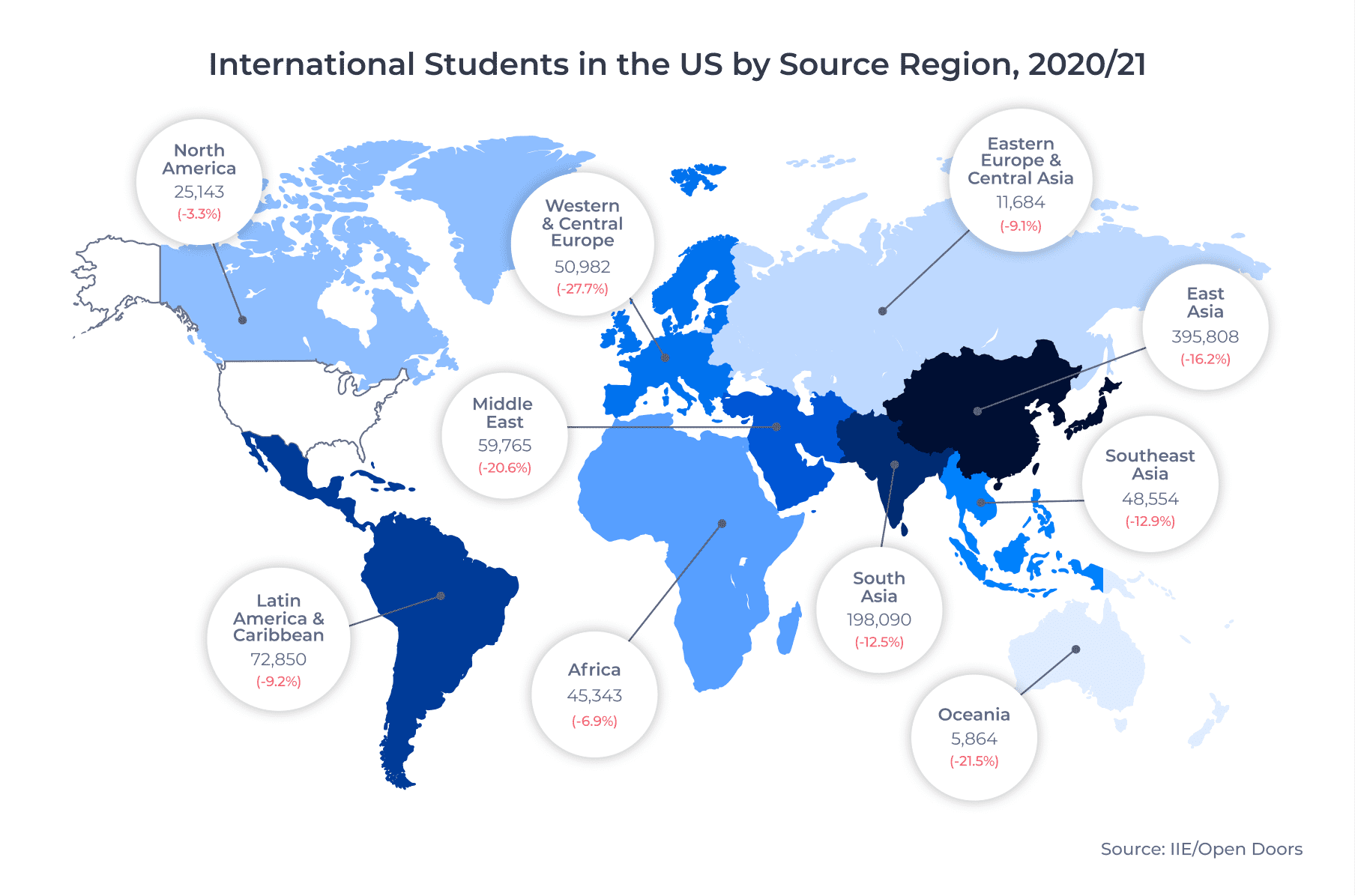

Which Source Markets Saw the Largest Declines?

The Open Doors data also revealed significant regional imbalances in student inflows to the US. The map below shows the total number of students studying and working in the US by source region in 2020/21, and the percentage change year-over-year:

Africa saw the smallest drop among all regions at only 6.9%. Eastern Europe and Central Asia were next at 9.1%, followed by Latin America and the Caribbean at 9.2%.

In general, regions that had more success battling COVID-19 saw more significant declines, perhaps reflecting students’ reluctance to travel to the US during the early stages of the pandemic, when the country struggled to contain the disease. One notable exception was Canada. The Canadian international student population in the US declined by just 3.3% in 2020/21.

Canada vastly outperformed the other top markets, as the table below shows:

| Rank 19/20 | Rank 20/21 | Source Market | # of Students 19/20 | # of Students 20/21 | Change |

|---|---|---|---|---|---|

| 1 | 1 | China | 372,532 | 317,299 | -14.8% |

| 2 | 2 | India | 193,124 | 167,582 | -13.2% |

| 3 | 3 | South Korea | 49,809 | 39,491 | -20.7% |

| 4 | 5 | Saudi Arabia | 30,957 | 21,933 | -29.2% |

| 5 | 4 | Canada | 25,992 | 25,143 | -3.3% |

The US lost more than 55,000 Chinese students and over 25,000 Indian students in a year, but on a percentage basis, China and India actually slightly outpaced the average. South Korea saw a 20.7% drop and a loss of 10,000 students, while Saudi Arabia’s student population in the US continued to plummet. There are now fewer than half the number of Saudi students in the US that there were in 2015/16, when the Kingdom curtailed the popular King Abdullah Scholarship Program.

Bangladesh, Pakistan Resist Decline, Primed to Grow

The table below shows which source markets saw the smallest drop in their international student populations in the US between 2019/20 and 2020/21:2

| Rank 19/20 | Rank 20/21 | Source Market | # of Students 19/20 | # of Students 20/21 | Change |

|---|---|---|---|---|---|

| 17 | 14 | Bangladesh | 8,838 | 8,598 | -2.7% |

| 5 | 4 | Canada | 25,992 | 25,143 | -3.3% |

| 22 | 18 | Pakistan | 7,939 | 7,475 | -5.8% |

| 11 | 10 | Nigeria | 13,762 | 12,860 | -6.6% |

| 23 | 19 | Colombia | 7,787 | 7,107 | -8.7% |

| 6 | 6 | Vietnam | 23,777 | 21,631 | -9.0% |

| 29 | 29 | Russia | 5,293 | 4,805 | -9.2% |

| 10 | 9 | Mexico | 14,348 | 12,986 | -9.5% |

| 20 | 17 | Indonesia | 8,300 | 7,489 | -9.8% |

| 25 | 21 | Venezuela | 6,855 | 6,122 | -10.7% |

Alongside Canada, Bangladesh (-2.7%), Pakistan (-5.8%), and Nigeria (-6.6%) led the way. ApplyBoard modelling has shown these to be among the highest-growth-potential markets worldwide. US schools would be well served to increase their recruitment efforts in these markets if they aren’t already as the markets transition from diversity plays to major players in international education.

Looking to the Future of US International Ed

IIE’s recently released Fall 2021 International Student Enrollment Snapshot shows that the industry is already beginning to recover from the shock of the pandemic. IIE observed a 68% increase in the number of new international students enrolling at US institutions, including students abroad enrolling in online-only programs. On net, the number of new international students for Fall 2021 was down around 10% from pre-pandemic totals.

Here at ApplyBoard, we’ve been seeing huge US application numbers since early 2021. In fact, from March to October 2021, US applications on our platform spiked by 750% compared to the same period in 2020. While it will take time for the US international student market to reach the heights of the later Obama years, we could be looking at full pandemic recovery by 2022/23.

The US is a market I’m extremely optimistic about, and we’ll have more coverage of Open Doors on ApplyInsights in the following weeks, and in early 2022 when IIE releases the full report. Stay tuned!

Published: November 17, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United States, the United Kingdom, and Australia. Working with over 7,500 international recruitment partners, ApplyBoard has assisted more than 200,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of the Institute of International Education (IIE). Please note that the IIE changed its definition of international student this year to include students studying remotely from their home country. Previous editions of the report included only student visa holders.