In this edition of ApplyInsights, I’m sharing my observations on Canadian study permit trends for select countries in Southeast Asia (SEA). Together, Southeast Asian countries accounted for 4.9% of Canadian study permit approvals in 2019.1

Here’s what this blog post will cover:

- Canadian study permit approval numbers for all 11 SEA countries

- Trends in the number of Canadian study permit applications and approvals between 2015 and 2019 for residents of Vietnam and the Philippines

- The distribution of study permit approvals for Vietnam and the Philippines by study level (primary and secondary, college, university, etc.)

- The impact of the COVID-19 pandemic and my thoughts on the future of the Vietnamese and Filipino markets

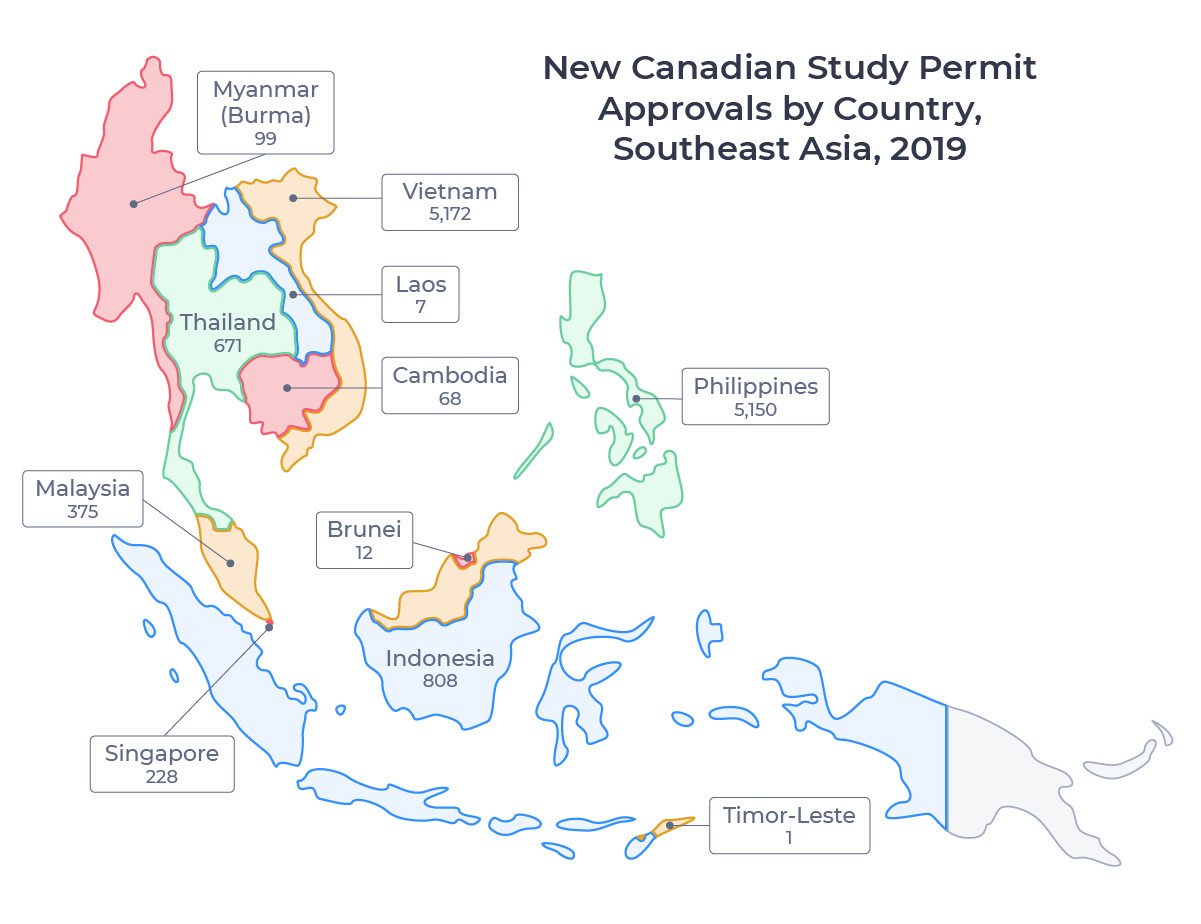

The map below shows the 11 countries of Southeast Asia2 and the number of study permits approved for students from each country in 2019:

Let’s examine these two leaders in SEA enrollment more closely.

Vietnam

Vietnam is the third-most-populous country in Southeast Asia, with a population of just under 100 million. It edged out the Philippines in 2019 as the top supplier of students to Canada in the region. Vietnam is the ninth-largest source country for international students in Canada overall.

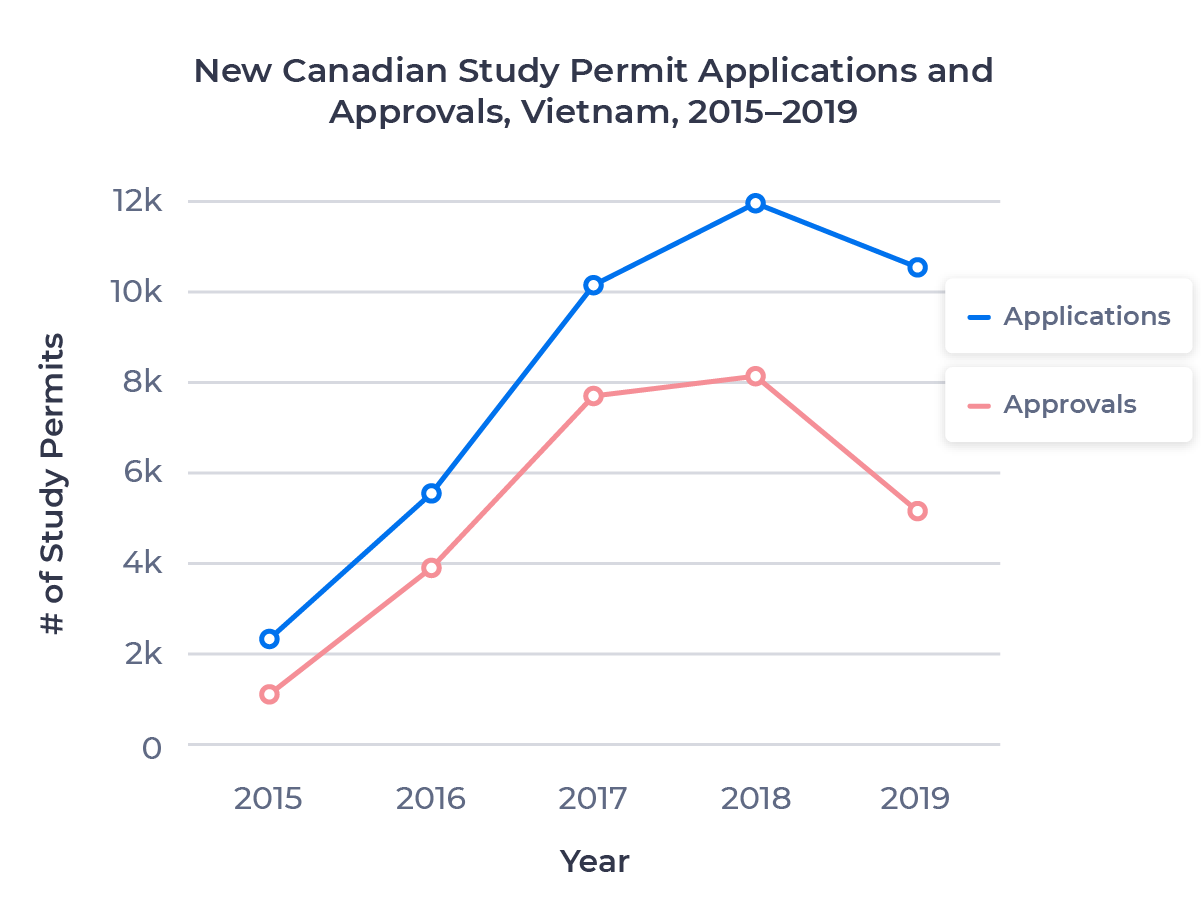

The chart below shows the growth in the Vietnamese market from 2015 to 2019:

The study permit approval numbers varied with large swings in the approval rate. Approval rates rose from 47.4% in 2015 to 70.6% in 2016, peaked at 76.0% in 2017, then declined to 48.9% in 2019. The approval rate decrease in 2019 was the second-largest decline among all source countries, and drove a 36.5% drop in approvals.

Canada Express Study and Student Direct Stream

The volatility of the Vietnamese numbers between 2015 and 2019 reflects multiple changes to how the Canadian government processed study permits over that period.

Immigration, Refugees and Citizenship Canada (IRCC) introduced the Canada Express Study (CES) program to Vietnam in 2016. CES streamlined study permit processing for Vietnamese students looking to study at participating colleges in Canada. The program required less financial documentation than the regular study permit processing stream, offered faster turnaround times, and was wildly popular.

CES drove a tenfold increase in study permit approvals for Vietnamese students for college academic programs and an 18-fold increase for language programs offered at Canadian colleges between 2015 and 2017.

In June 2018, the Canadian government introduced a new study permit processing system, Student Direct Stream (SDS), to Vietnam, the Philippines, India, and China. Its aim was to replace the CES program in Vietnam and similar initiatives in those other countries with a single program designed to expedite study permit applications for highly competitive applicants.

SDS is very similar to CES with one key exception: It requires a higher score on the International English Language Testing System (IELTS).3 English language proficiency is not as high in Vietnam as in other large source markets, and significantly fewer prospective students were eligible under SDS as were under CES. This drove more applicants to the regular stream, which has more stringent requirements for proof of funds. I strongly suspect that this caused both the reduced application volume and the drop in approval rate, particularly in 2019, as SDS was in place for the full year.

Study Permit Approvals by Study Level – Vietnam

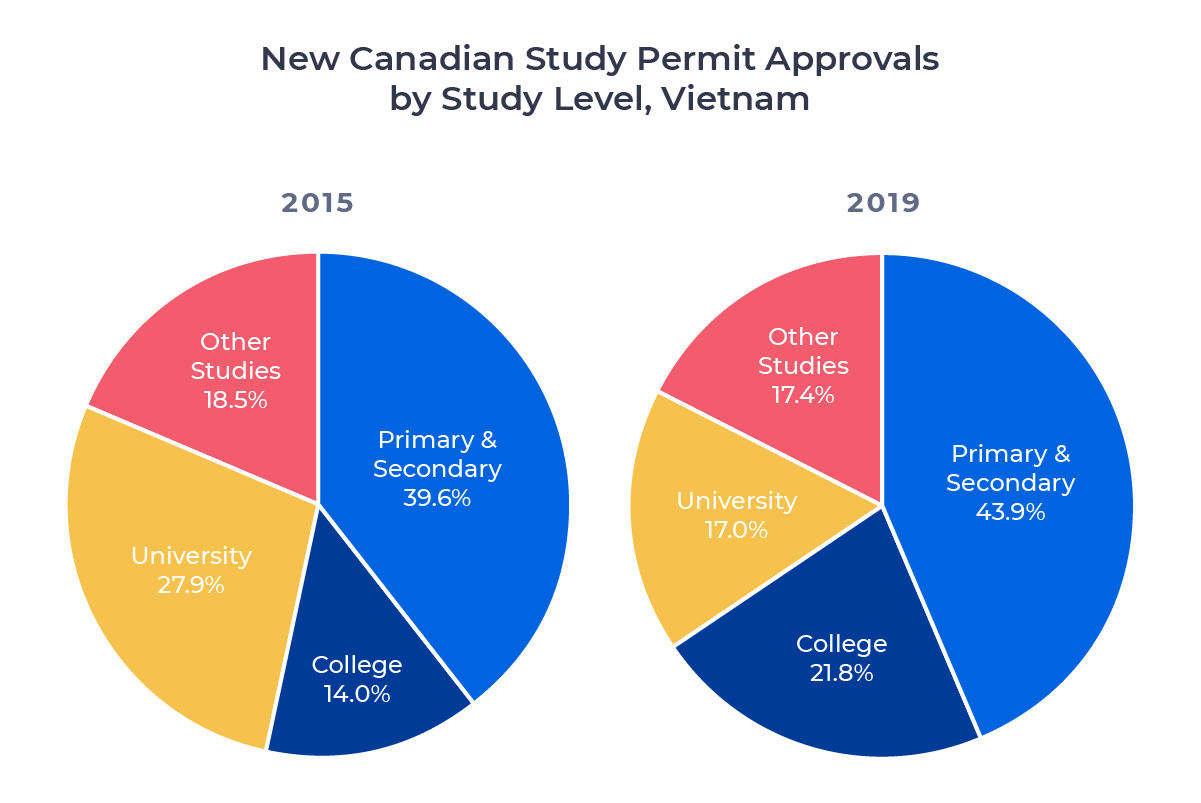

What are Vietnamese students studying in Canada? Let’s compare the distribution of study permit holders in 2015 and 2019 by study level:

A significant number of Vietnamese parents choose to send their children to Canada for secondary school, as well. These students made up just under 40% of study permit approvals issued to Vietnamese students in 2019, one of the largest proportions among the top 25 source markets for Canadian international students.

Philippines

The Philippines is the second-largest Southeast Asian country by population, with almost 110 million people. It’s the number two source of Canadian students from SEA and the tenth-largest supplier of students to Canada overall.

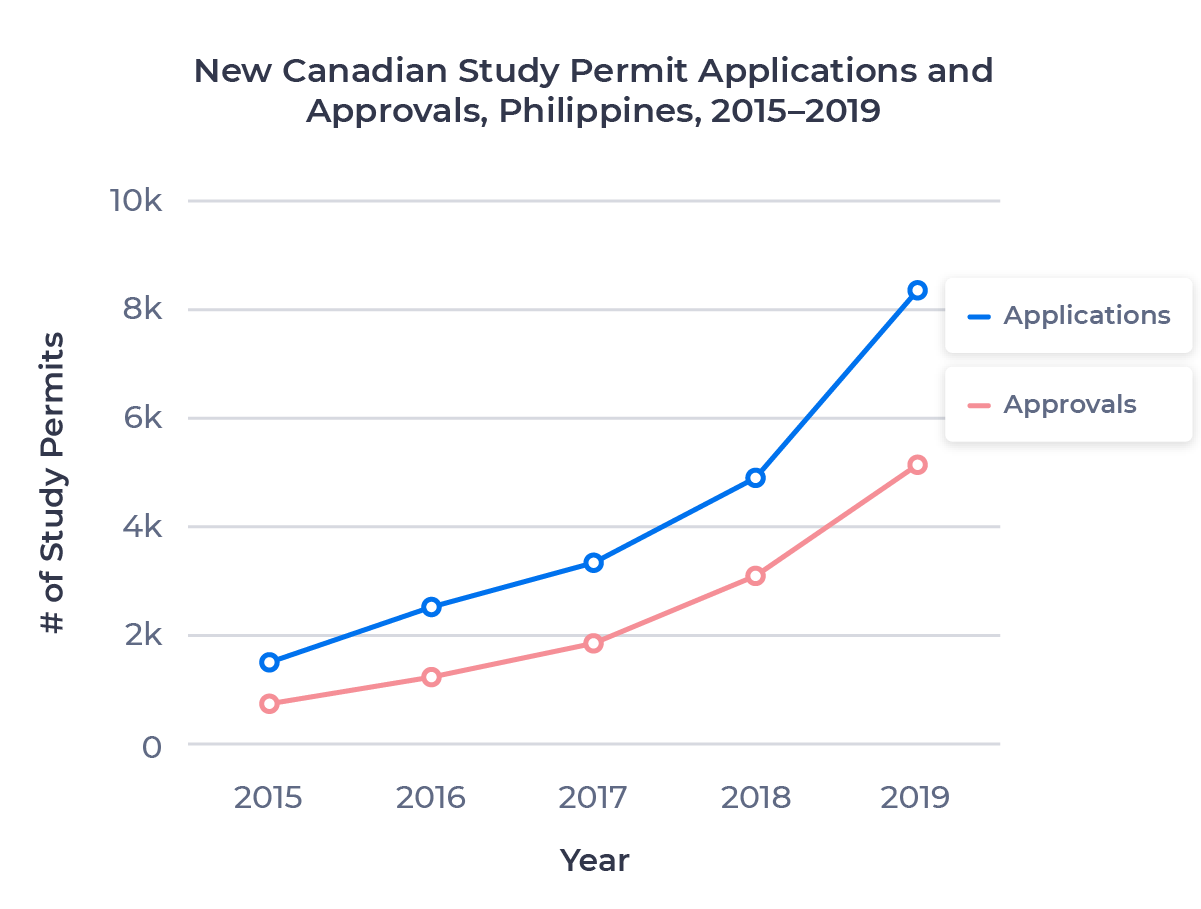

The chart below shows the growth in the Filipino market from 2015 to 2019:

Study permit approvals rose even faster, up more than 600% over the same period. A steady rise in approval rates for Filipino applicants drove this increase. Rates peaked at 63.0% in 2018 before falling 1.6% in 2019.

From speaking with our recruitment partners in-market, I know that most Filipino students see studying abroad as the first step in their immigration journey. They are looking for a pathway to permanent residency (PR) in their destination country. Canada’s generous Post-Graduate Work Permit Program (PGWPP) sets it apart from other English-speaking study abroad destinations, and we can point to interest in the PGWPP as driving the growth in applications from the Philippines.

Though the advent of SDS in the Philippines in 2018 coincided with ongoing growth in the market, uptake was not high, and approval rates under SDS were actually lower than under the regular stream.

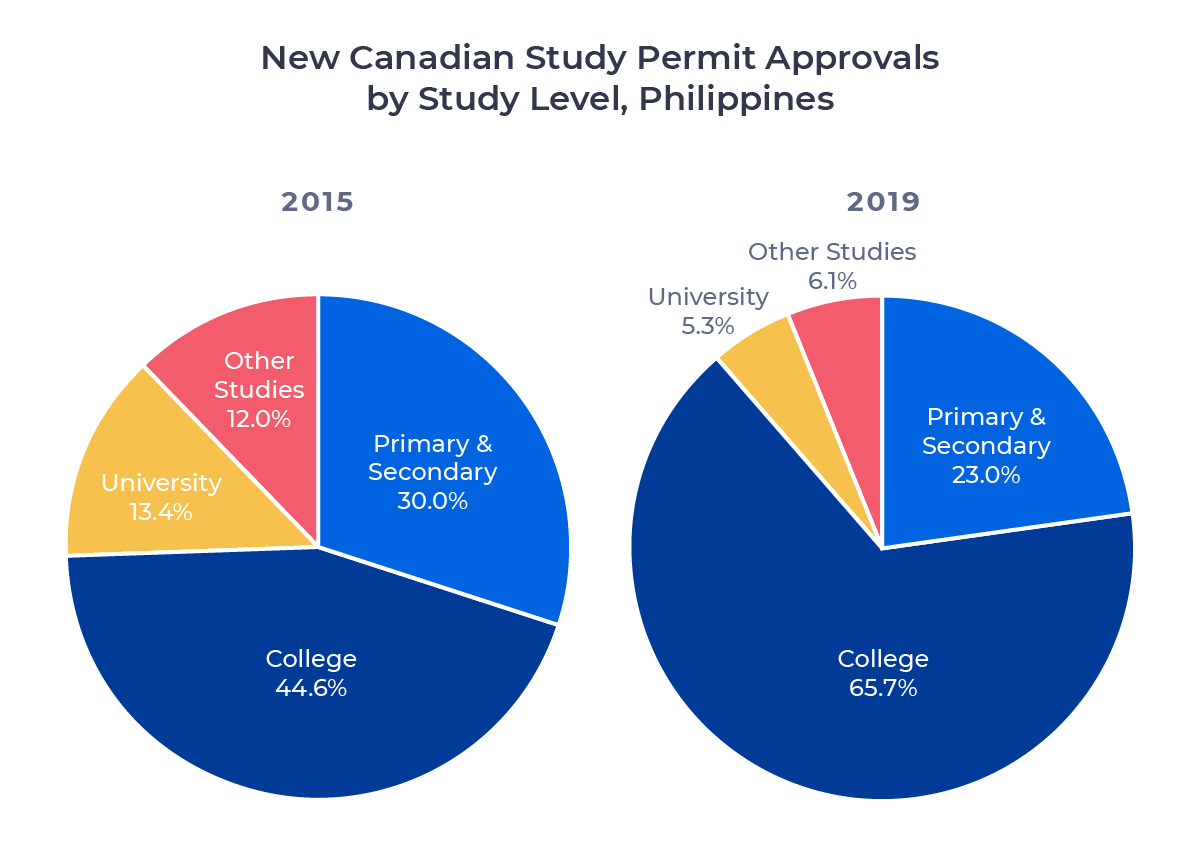

Study Permit Approvals by Study Level – Philippines

The charts below show the distribution of study permit approvals by study level for Filipino students in 2015 and 2019:

Though the primary and secondary sector lost market share with the explosion of college students, this sector grew rapidly between 2015 and 2019 as well. 15.6% of study permit approvals for Filipino students in 2019 went to primary students, many of them children of those college students. As I noted in our recent ApplyInsights article on Canada’s international mature students, Filipinos were the second-oldest applicants on the ApplyBoard Platform in 2019, at 31.8 years.

Looking Forward

The COVID-19 pandemic drove a decline in applications across source markets as well as a drop in approval rates, as students had difficulty obtaining necessary documentation due to lockdown protocols.

Vietnam has been a rare pandemic success story. Early border closures, aggressive contract tracing, and widespread mask adoption have helped to limit the total number of cases to under 2,000.4 Based on IRCC data from January to July,5 Canada has seen a slightly larger-than-average decline in applications from Vietnam. In speaking with our recruitment partners in the country, I know many parents have elected to keep their children close to home during this uncertain time.

In contrast, the Philippines has struggled to control the virus, with more than 400,000 cases. A slightly above-average percentage of Filipino students have elected to move forward with their study plans, perhaps reflecting the greater mobility of the older Filipino demographic.

Recently, a pair of studies from Navitas found that a country’s openness and students’ ability to access the destination are now their top considerations in choosing where to study abroad. With Canada’s borders once again open to international students, and its favourable pathway to permanent residency remaining a strong pull factor, the outlook for the Vietnamese and Filipino markets remains bullish.

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. In his role as Co-Founder and Chief Marketing Officer (CMO) at ApplyBoard, he leads the International Recruitment, Partner Relations, Sales Enablement, Sales Operations, and Marketing teams along a shared mission to educate the world. Meti has been instrumental in building partnerships with 1,200+ educational institutions across North America, the United Kingdom, and Australia. Working with over 4,000 international recruitment partners, ApplyBoard has assisted more than 120,000 students in their study abroad journey.

Meti was honoured in 2019 by Forbes, being named to three Top 30 Under 30 lists, including Education, Immigrants, and Big Money. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All application and approval numbers for new permits only. Data courtesy of Immigration, Refugees and Citizenship Canada (IRCC) unless otherwise noted.

2. Per the geographic regions published by the United Nations Statistics Division.

3. CES required an IELTS score of 5.0 overall and a minimum of 4.5 in each of the four language skills. SDS requires a 6.0 in each skill.

4. Per the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University.