In this edition of ApplyInsights, I’m sharing my observations on Canadian study permit trends for select countries in Latin America (LATAM). Together, Latin American countries accounted for 7.0% of Canadian study permit approvals in 2019.1

Here’s what this blog post will cover:

- Canadian study permit approval numbers for all 20 LATAM countries

- Trends in the number of Canadian study permit applications and approvals between 2015 and 2019 for residents of Brazil, Mexico, and Colombia

- The distribution of study permit approvals for Brazil, Mexico, and Colombia by study level (primary and secondary, college, university, etc.)

- My thoughts about the future of the Brazilian, Mexican, and Colombian markets

Definitions of what countries make up Latin America vary. In this blog post, I’ll use the term to refer to the countries of North America, Central America, South America, and the Caribbean whose residents predominantly speak the Romance languages of Spanish, French, and Portuguese.

The map below shows the 20 countries that fit this definition, and the number of study permits approved for students from each country in 2019:

Let’s examine each of these leaders in LATAM enrollment more closely.

Brazil

Brazil is the most populous country in Latin America, with more than 200 million people. It’s the top LATAM source of international students to Canada and the fifth-largest source country overall.

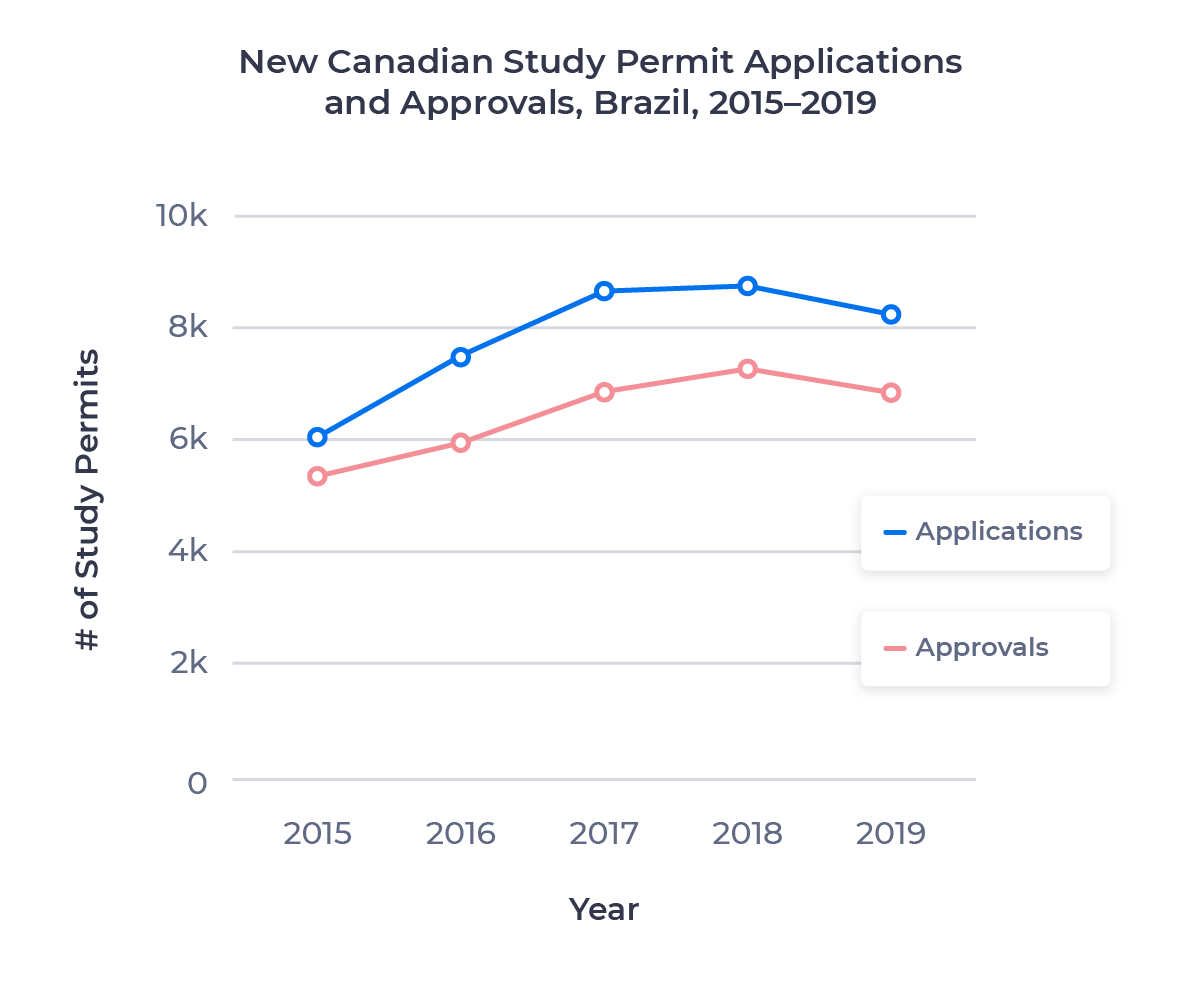

The chart below shows the growth in the Brazilian market from 2015 to 2019:

Growth in study permit approvals lagged behind growth in applications due to a drop in study permit approval rates. Approval rates fell from 89.0% in 2015 to 79.6% in 2016, then rebounded to 83.1% in 2018. With approval rates largely flat between 2018 and 2019, the decline in applications led to a 6.0% year-over-year decrease in approvals in 2019. Net growth in study permit approvals over the four-year period was 27.5%, below the 50.4% average for LATAM.

What caused this sluggish growth, and now decline, in such a high-potential market? The past twelve years have been difficult economically for Brazil, which was hit in succession by the global financial crisis of 2008, its own domestic economic crisis in 2014, and now the fallout from the COVID-19 pandemic. The result has been a shrinking middle class and a weak currency.

The Brazilian real, which hit 66 cents per Canadian dollar in August 2008, currently trades at around 25 cents.2

From speaking with our recruitment partners in Brazil, I know interest in studying in Canada remains high among Brazilian students. But the country’s struggle to contain COVID-19, coupled with its pre-existing economic challenges, portend a long recovery for Brazil’s economy that will slow the rebound in the Brazilian student market for Canadian schools.

Study Permit Approvals by Study Level – Brazil

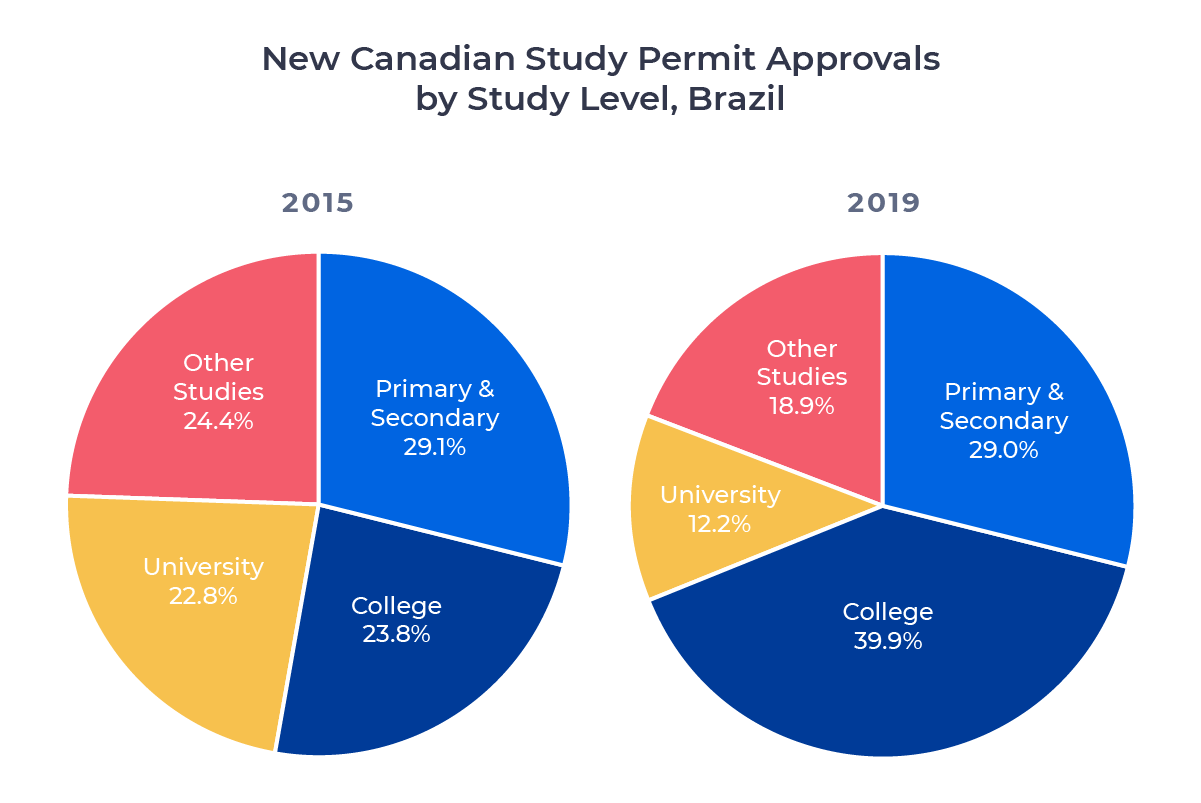

What are Brazilian students studying in Canada? Let’s compare the distribution of study permit holders in 2015 and 2019 by study level:

The significant segment of primary and secondary students, largely unchanged between 2015 and 2019, reflects the large number of mature students coming to Canada from Brazil with families in tow. A decrease in English as a Second Language (ESL) program enrollment drove the decline in the Other Studies category, which also includes French as a Second Language (FSL) and certain Quebec-based training and vocational programs.

Mexico

Mexico is the second-largest LATAM country by population, with almost 130 million people. It’s the number two source of Canadian students from Latin America and the eleventh-largest supplier of students to Canada overall.

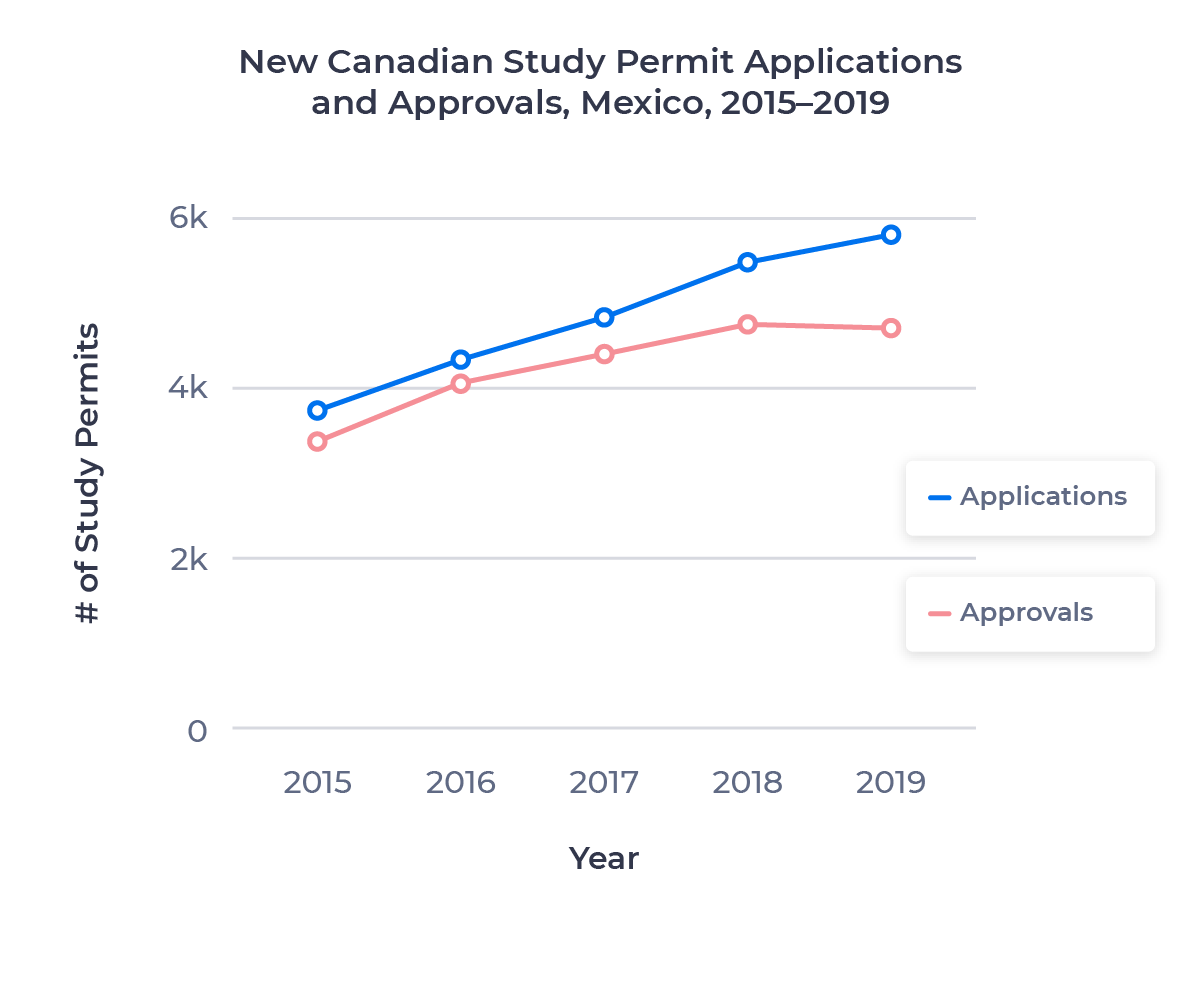

The graph below shows the growth in the Mexican market from 2015 to 2019:

Study permit approvals jumped 19.9% in 2016, helped by a 3.2% increase in approval rate. But 2016 marked an approval rate peak at 93.8%, and Mexico’s approval rate declined to 81.0% by 2019. This gradually eroded growth in approvals as well, with Mexico actually recording a year-over-year decline of 1.1% in 2019. Net growth in study permit approvals between 2015 and 2019 was 38.7%, also better than Brazil but short of the 50.4% benchmark for LATAM.

Study Permit Approvals by Study Level – Mexico

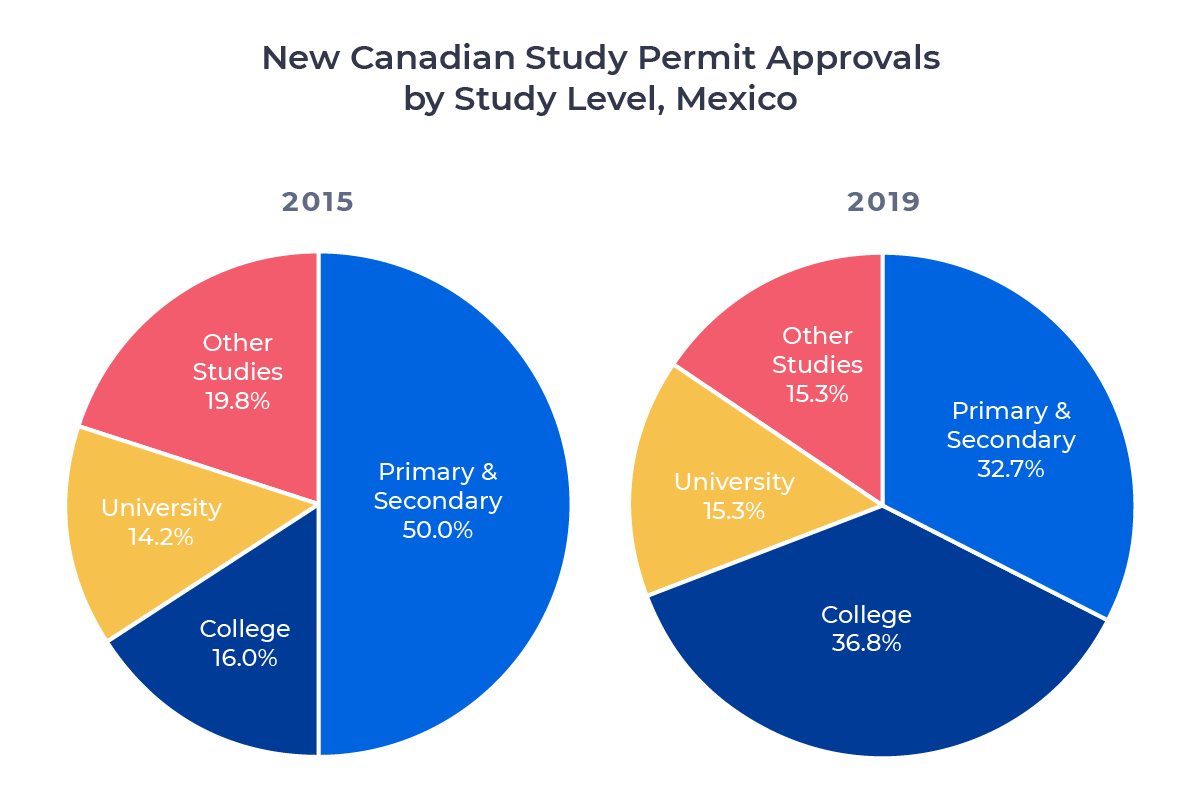

The charts below show the distribution of study permit approvals by study level for Mexican students in 2015 and 2019:

Turning to higher education, the number of study permit approvals for Mexican students in Canadian college programs tripled between 2015 and 2019. This drove much of the growth in the Mexican student market in Canada. Approval numbers for the university market increased 48.8%, while Other Studies rose just 7.5% and actually lost market share.

Why the explosion in college studies? Like Brazilian students, Mexican students are strongly motivated by the immigration pathway, and many see college programs as a more affordable means of taking the first steps on that journey.

Colombia

The third-most-populous country in Latin America, Colombia has a population of just under 50 million. It’s Latin America’s third-largest supplier of students to Canada and the twelfth-largest source country for international students in Canada overall.

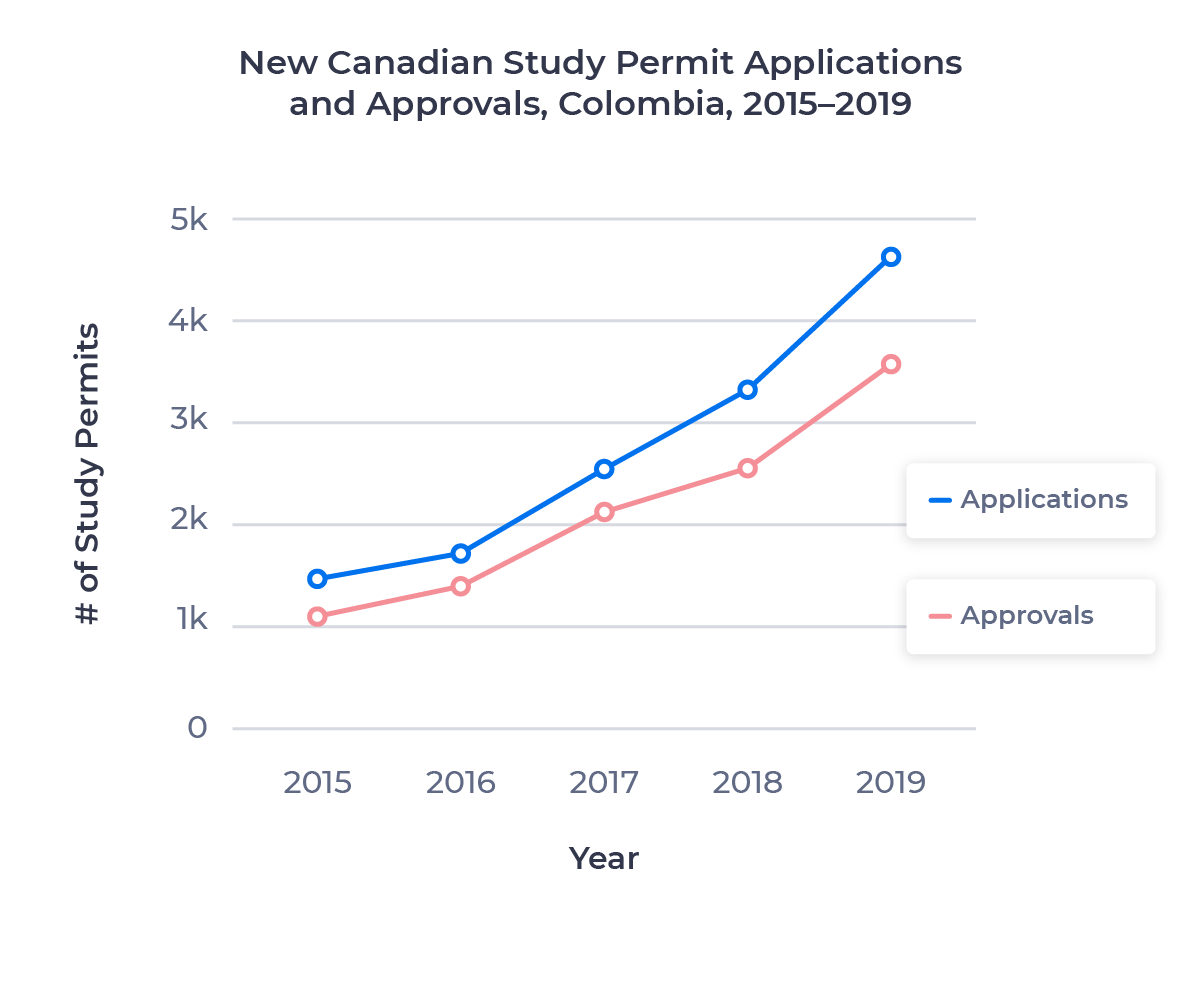

The Colombian market exploded between 2015 and 2019, as the chart below shows:

Study permit approvals rose even faster, up more than 225% over the four-year period. Approval rates rose from 73.9% in 2015 to peak at 83.1% in 2017 before settling in at 77.4% over the past two years.

Colombia has experienced an economic boom over the past decade, led by a strong resources sector and the fastest-growing information technology industry in the world. This has increased social mobility and grown the market for international education in Colombia considerably. The growth of the IB program in Colombia has also helped to position students to pursue post-secondary studies abroad.

The Colombian government responded promptly to the COVID-19 crisis, implementing proactive transmission mitigation measures and providing significant financial assistance for hard-hit businesses and sectors. While these factors, and Colombia’s underlying economic tailwinds, don’t ensure a quick rebound in the Colombian market post-COVID-19, I’m optimistic. Look for Colombia to surpass Mexico as the number two LATAM source market in the next two years and continue to expand its impact on international education in Canada going forward.

Study Permit Approvals by Study Level – Colombia

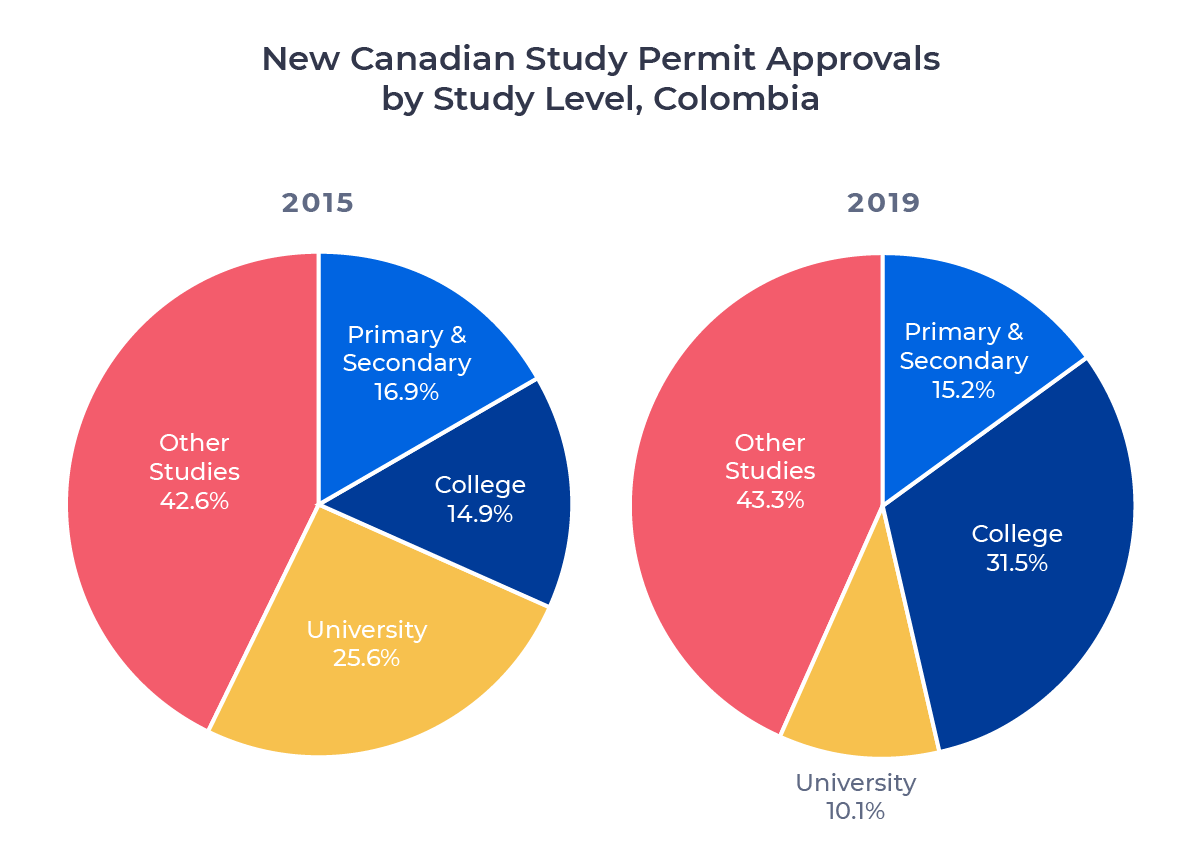

The charts below show the distribution of study permit approvals by study level in 2015 and 2019:

The primary and secondary and Other Studies sectors largely held on to their market share, posting strong growth over the period. Primary and secondary numbers increased almost 200%, as many Colombian students coming to Canada brought their children with them. Study permit approvals for Other Studies programs grew 230%, driven largely by growth in ESL programs.

One thing our recruitment partners are hearing from their students is growing interest in language training programs offered at colleges and universities. These programs are convenient for students, as students can apply to them in conjunction with academic programs and transition from the language program to the academic program without needing to obtain a second letter of acceptance. With this in mind, I’ll be keeping an eye out for slower growth or even a decline in study permit numbers for Colombian students attending independent language training schools.

Looking Forward

LATAM has long been a top target market for Canadian schools for a few reasons:

- Latin American students are highly interested in immigration opportunities, which Canada offers through the study permit to PGWPP to PR pathway.

- Canada is closer geographically to Latin America, and thus cheaper to travel to, than the UK or Australia.3

- A number of LATAM economies have been seen as emerging, with the potential for a growing middle class with the funds and interest to send students abroad.

We can point to the growth in the college market as one product of these factors. But among the top three LATAM source countries for international students to Canada, only Colombia has really seen the growth the industry has envisioned over the past five years. As the two largest LATAM countries, Brazil and Mexico will remain markets of focus moving forward, but it’s unlikely we’ll see the kind of explosive growth schools are hoping for without real shifts in the economic situation in those countries.

While the remaining markets in Latin America are much smaller than these three, I know they’re on the radar for many schools as long-term growth opportunities. I’ll cover some interesting trends in these smaller countries in a future ApplyInsights.

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. In his role as Co-Founder and Chief Marketing Officer (CMO) at ApplyBoard, he leads the International Recruitment, Partner Relations, Sales Enablement, Sales Operations, and Marketing teams along a shared mission to educate the world. Meti has been instrumental in building partnerships with 1,200+ educational institutions across North America, the United Kingdom, and Australia. Working with over 4,000 international recruitment partners, ApplyBoard has assisted more than 120,000 students in their study abroad journey.

Meti was honoured in 2019 by Forbes, being named to three Top 30 Under 30 lists, including Education, Immigrants, and Big Money. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All application and approval numbers for new permits only. Please note that students from many Latin American countries do not need a study permit to study in Canada for less than six months, and these students are not captured in the data. Data courtesy of Immigration, Refugees and Citizenship Canada (IRCC) unless otherwise noted.

2. Currency data courtesy of Morningstar.

3. Though even closer to Latin America than Canada, the US doesn’t offer the same pathway to permanent residency.