More than almost any other source market for international students in Canada, Mainland China felt the brunt of the pandemic’s impact. The number of applications for Canadian study permits submitted by Chinese students fell by 65.1% in 2020, much higher than the 48.1% decline across all markets.1

In today’s ApplyInsights, I’ll be diving into the data to look at what drove such a large drop in the Chinese market and explore the possibilities for rebuilding this critical source of motivated, hard-working international students. I’ll also look at what and where Chinese students are studying in Canada and how those trends have shifted since the start of the pandemic.

Key Insights at a Glance

- The early arrival of the pandemic in China and the Chinese government’s aggressive COVID-19 containment measures led to a significant drop in Chinese students coming to Canada in 2020.

- A large number of Chinese students have been approved for a study permit but have not yet arrived in Canada, likely studying online, waiting for travel restrictions to be relaxed and COVID cases to fall.

- Institutions will need to be aggressive and strategic in their marketing and outreach efforts to capitalize on the Chinese market as it recovers.

This is the fourth article in our series exploring the top source markets for international students in Canada in 2020. We’ve previously covered Hong Kong, Algeria, and Brazil. Check back in the following weeks for future installments.

Canadian Study Permit Applications and Approval Rate – China

Let’s begin by breaking down the study permit application numbers in further detail.

Canada received 12,077 study permit applications from residents of Mainland China in 2020.2 This was down from 34,583 applications in 2019. Coupled with a 3.6% decrease in approval rate, the number of Chinese students approved for a study permit fell by 66.6% between 2019 and 2020.

Across markets, we saw a much larger 8.9% decrease in approval rate as students had difficulty obtaining necessary documentation due to COVID-19 lockdown protocols. Together with the 48.1% decline in applications, the approval rate decline led to a 55.8% drop in the number of approvals.

The following table summarizes the year-over-year changes in study permit statistics:

| 2019 | 2020 | Change | ||

|---|---|---|---|---|

| China | Applications | 34,583 | 12,077 | -65.1% |

| Approvals | 29,308 | 9,795 | -66.6% | |

| Approval Rate | 84.7% | 81.1% | -3.6% | |

| All Markets | Applications | 425,990 | 220,932 | -48.1% |

| Approvals | 256,216 | 113,304 | -55.8% | |

| Approval Rate | 60.1% | 51.3% | -8.9% |

As the table shows, China continues to boast an approval rate of over 80%. This is well above the all-markets average, which fell to 51.3% in 2020.

Canadian Study Permits Issued – China

It’s important to note that just because an applicant is approved for a study permit doesn’t mean they will be issued a study permit. Historically, this situation arose when an applicant changed their mind about studying in Canada after their study permit was approved. Occasionally, applicants were turned away at the border.

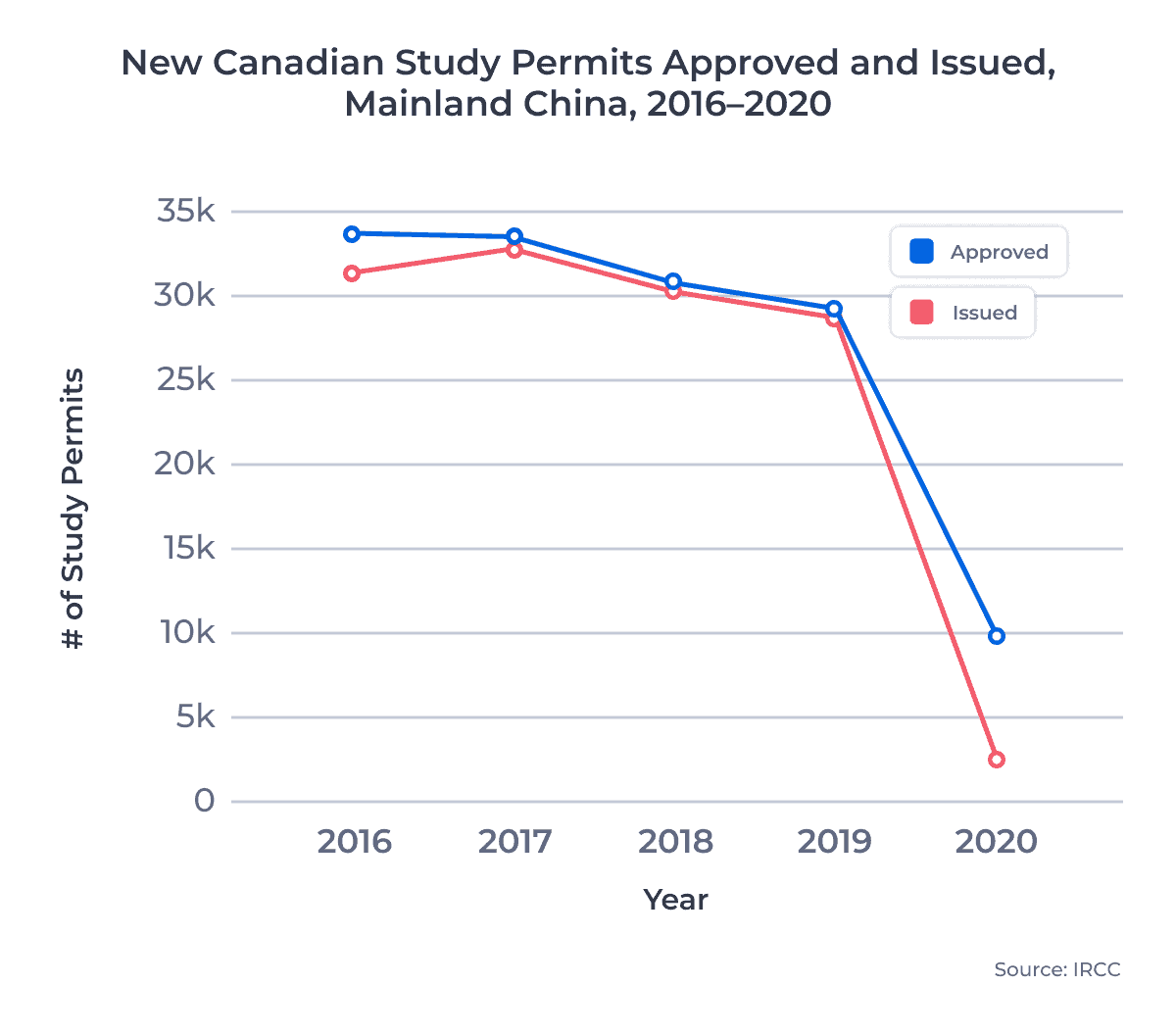

From 2016 to 2019, 95% of all study permits approved were issued. But in 2020, this rate fell to just 57% as the Canadian government permitted students to study online at Canadian institutions from abroad. Other students deferred their study until they were able to travel safely.

The chart below compares study permits approved and issued for Chinese applicants:

That changed in 2020, when just 25% of study permits approved for Chinese students were issued, less than half the all-markets average. In other words, a much larger segment of the Chinese student population elected either to pursue their studies online or wait out the pandemic. In fact, there’s a cohort of more than 7,000 Chinese students approved to study in Canada in 2020 that had not arrived onshore by the end of the year. Some of these students will likely never arrive, but those that do eventually come to Canada will be a boon to the industry.

Canadian Study Permits Issued by Province – China

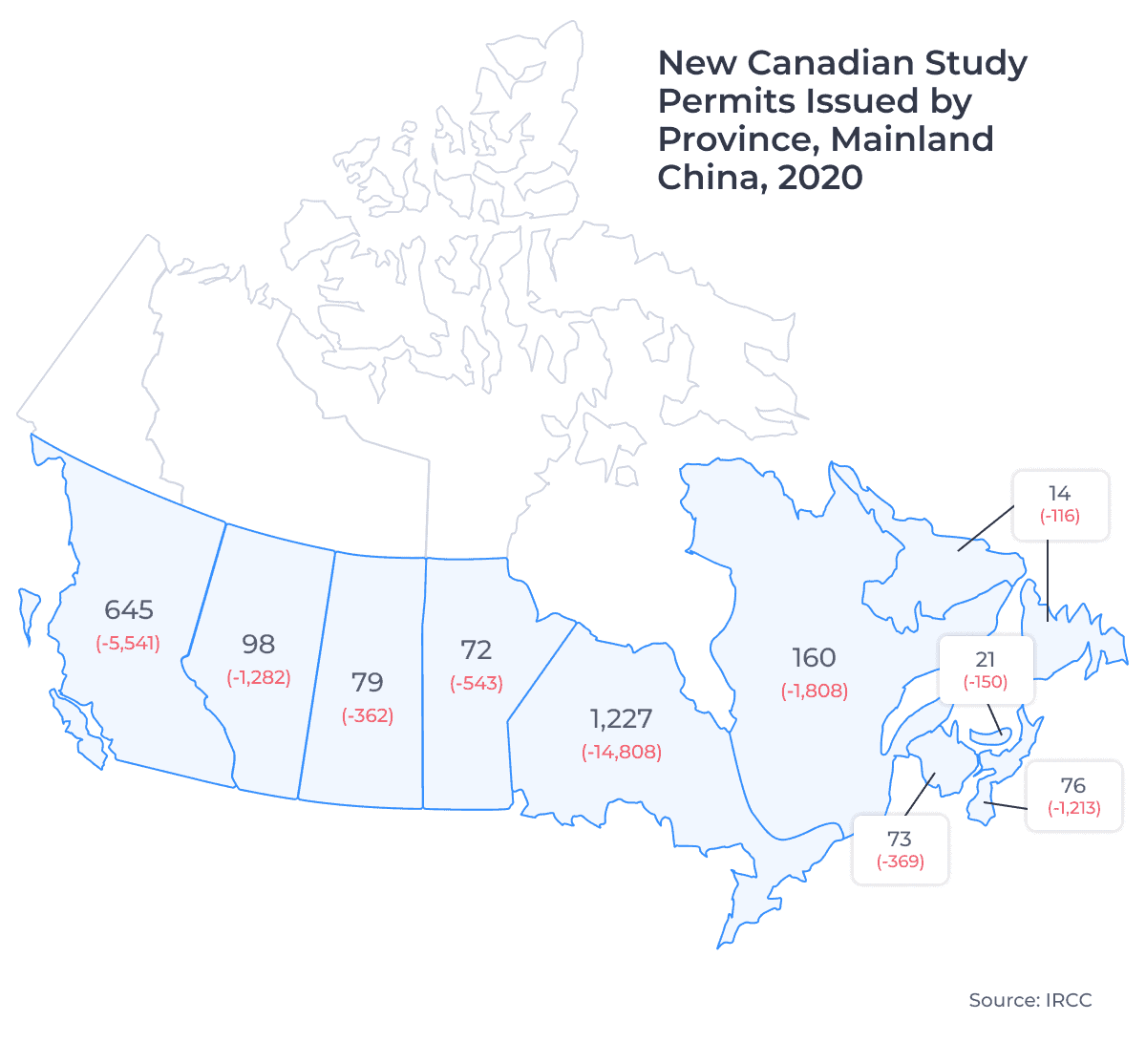

Let’s take a look at where those students who did arrive in Canada began their studies. The image below shows the number of study permits issued to residents of Mainland China for studies in each of Canada’s 10 provinces in 2020, along with the change between 2019 and 2020:

The number of new study permits issued to Chinese students in Ontario fell by 92.3%, a loss of almost 15,000 students. Ontario’s share of the new Chinese student market fell by 6.2% in 2020, mirroring a decline we saw across markets.

I’ll be watching these numbers closely as the remaining students approved for study permits in 2020 come onshore to see if these provincial trends hold.

Canadian Study Permits Issued by Study Level – China

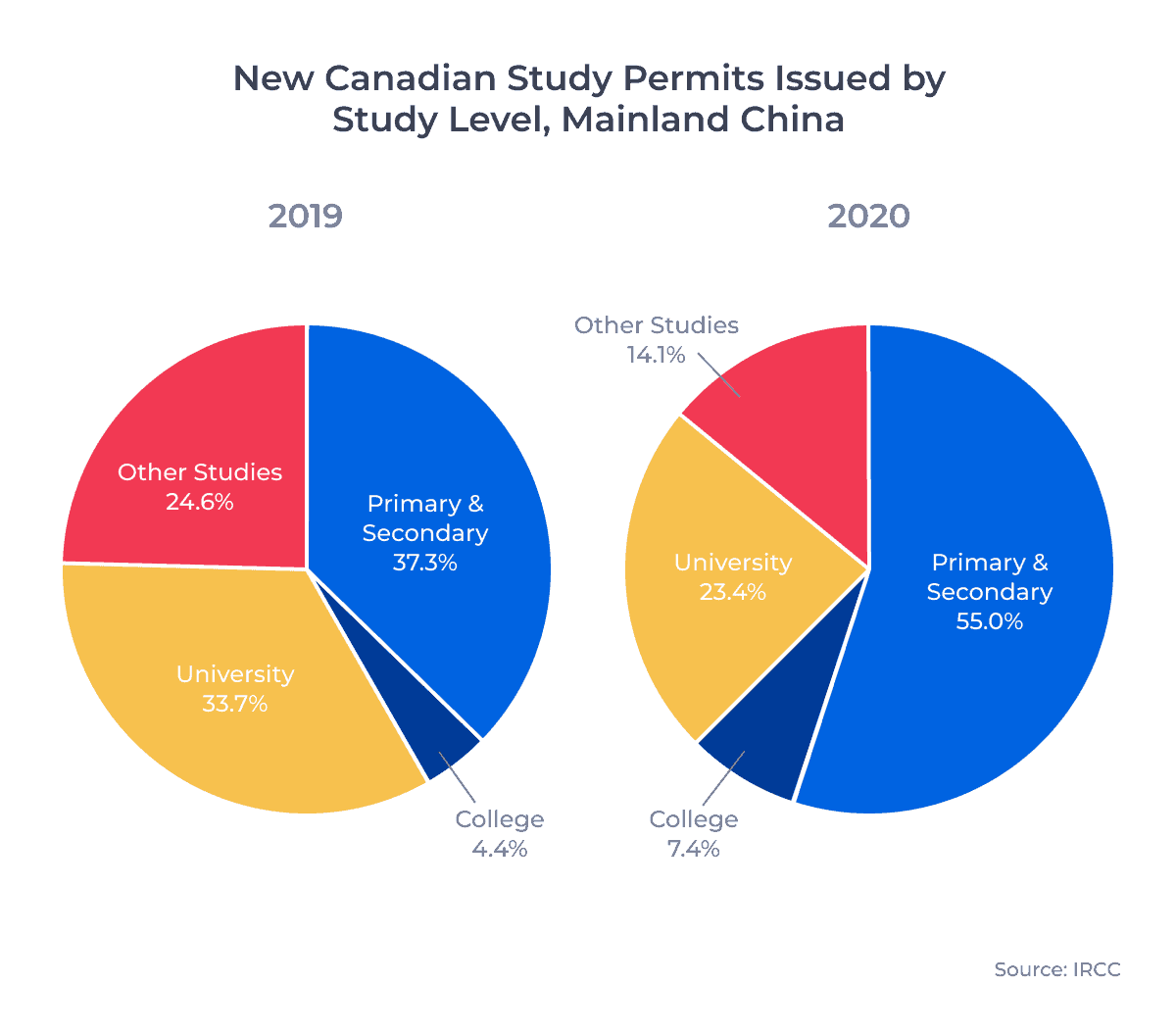

Next, let’s take a look at what those students are studying. The charts below show the change in the distribution of study permits issued to Chinese students by study level in 2019 and 2020:

These numbers are somewhat misleading, however. Study permit applications and approvals for university students actually decreased much less than issued numbers relative to other study levels. In other words, while fewer university students actually came to Canada from China in 2020, interest and enrollment in these programs remains high.

The number of study permits issued to primary and secondary students declined by 87%. This relative resilience meant that primary and secondary studies accounted for a much larger proportion of the Chinese students who actually came to Canada in 2020. In fact, more than half of the study permits issued to Chinese students in 2020 went to primary and secondary students.

Study permits issued to Chinese college students declined by 86%, the smallest decrease across study levels. Though college remains a small piece of the Chinese market, the sector nearly doubled its market share from 2019 to 2020, rising from 4% to 7%. Look for this number to fall again as more students come onshore, however: applications and approvals for college actually declined further than for university.

Early COVID-19 Outbreak, Aggressive Containment Reduced Chinese Student Migration

While these numbers are startling, they’re not completely out of line with what we’ve seen in other source markets. There are also some clear explanations for why China’s decline was so steep and why we can be optimistic that the market will recover post-pandemic, though it will likely take time.

COVID-19 struck China early, and the Chinese government responded quickly to contain the outbreak.

In China’s Hubei province, cases of COVID-19 were recorded in late December 2019. As early as January 2020, China began enacting rigorous containment measures.3 Many other countries, including Canada, didn’t begin to see the full effects of the pandemic until March 2020.

As a result, the pandemic disrupted the movement of Chinese students to Canada much earlier than students coming from other markets. 40% fewer study permits were issued to Chinese nationals between January and March 2020 than were issued over the same period in 2019. In contrast, all other markets saw average growth of 8% year-over-year across those three months, in line with pre-pandemic forecasts.

Chinese border closures and travel restrictions have been extremely strict.

In March 2020, the Civil Aviation Administration of China (CAAC) implemented the so-called “Five One” policy. This policy permitted each Chinese airline just one flight per week to a given country. Foreign airlines were likewise allowed just one flight on one route to China each week.

The CAAC has gradually added flights and relaxed other restrictions over the past year. But in the interim, the policy had an immense chilling effect on travel to and from China, with as few as 20 international flights per day landing in Chinese territory.

Chinese students are particularly concerned about safety while studying abroad.

As part of the QS International Student Survey (ISS), researchers asked prospective international students to rank the most important factors when choosing a destination country. 57% said that a country should be safe and welcoming for international students, ranking as the top response given.

For Chinese respondents, that number was even higher.4 81% of prospective international students from China said that a country should be safe and welcoming for international students, well above the next most popular responses, high-quality teaching (69%) and the country’s reputation as a study abroad destination (61%). Likewise, when QS asked Chinese students to rank what worried them the most about studying in a different country, safety (66%) topped the list.

Looking Forward

Travel restrictions and safety concerns shouldn’t persist post-pandemic, meaning the outlook for the Chinese market is improving. However, underlying indicators for the market present their own challenges.

China’s 18-to-24-year-old cohort has been declining since 2010 and is projected to continue to fall. At the same time, the improving quality of domestic Chinese institutions has led more students to stay in China. We’ve also seen strong interest from Chinese students in Japan, Singapore, and South Korea—study abroad destinations that are cheaper and much closer to home.

The good news is that China’s middle class is continuing to grow, and even if outbound student numbers are on the decline, China remains a large and influential international student market. Even so, schools will have to be aggressive, flexible, and strategic to continue to bring in Chinese students at volume. This means setting clear recruitment goals over both the short and long term.

When targeting Chinese students, institutions should consider the following:

- Leverage your Chinese alumni network for influencers in China who can speak to students about the quality of your programming and the experience of studying abroad at your institution.

- Work with a partner institution or organization to reach students via critical domestic social media channels such as WeChat.

- Emphasize the inclusiveness and community nature of your institution In your marketing materials targeted at China.

- Have admissions officers reach out to students to suggest alternative programs for students who don’t meet the qualifying criteria for their program of choice.

Interested in working with ApplyBoard to bolster your recruitment in China? Contact our China team at china@applyboard.com.

Published: May 31, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United, the United Kingdom, and Australia. Working with over 5,000 international recruitment partners, ApplyBoard has assisted over 150,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. Statistics used in this article for new study permits only. Note that this data does not capture Chinese students who graduate from Canadian secondary schools and go on to post-secondary education in Canada. Based on ApplyBoard internal data, most of these students chose to continue studying in Canada during the pandemic. All data courtesy of Immigration, Refugees and Citizenship Canada (IRCC), except where noted.

2. All statistics for Mainland China only. Check out our article on Hong Kong for my thoughts on that resilient market.

3. Source: The Lancet, China’s Successful Control of COVID-19, October 8, 2020.

4. Source: QS, What You Need to Know to Recruit in Mainland China, February 24, 2021.