In this edition of ApplyInsights, I’m sharing my observations on the top source countries for international graduate students at Canadian universities. Check out my previous blog post for a wider look at the top source countries for Canadian colleges and universities.

Here’s what this blog post will cover:

- Top source countries for master’s students by study permits issued in 2019

- Top source countries for doctoral students by study permits issued in 2019

- Trends in graduate study for international students in Canada

Just over 45,000 master’s and doctoral students received permits to study in Canada in 2019. Together, graduate students accounted for 13.8% of the Canadian international student market. Let’s take a look at which countries supplied those students.

Top Source Countries for Master’s Students

We’ll start with the master’s level. 34,485 international students received Canadian study permits for master’s programs in 2019. India and China, the dominant players in the larger Canadian international education market, led here as well.

In 2019, Indian students received 9,975 study permits and extensions to study at the master’s level. Indian nationals accounted for 28.9% of international master’s students in Canada. While significant, this actually ran behind India’s proportion of study permits across all sectors (34.6%). 7.1% of Indian students in Canada last year were master’s students.

The Canadian government issued 6,595 study permits to Chinese master’s students in 2019. This represented 19.2% of the international master’s student market in Canada, just behind China’s all-sectors market share of 21.0%. 7.8% of Chinese students in Canada last year studied at the master’s level.

France was third, with 2,865 study permits issued to master’s students. This represented 8.3% of the international master’s student market, well ahead of France’s share of the overall market (3.6%).

In contrast to India and China, nearly 20% of French nationals studying in Canada in 2019 were master’s students.

Fourth was Iran, with 2,720 study permits issued in 2019. That represented a whopping 27.8% of Iranian students in Canada. The USA rounded out the top five.

The table below lists the top 10 countries and their number of study permits issued:

| Rank 2019 | Rank 2018 | Country | # of Study Permits 2019 | Change 2018–2019 |

|---|---|---|---|---|

| 1 | 1 | China | 9,975 | +1,615 |

| 2 | 2 | India | 6,595 | +400 |

| 3 | 3 | France | 2,865 | +235 |

| 4 | 4 | Iran | 2,720 | +940 |

| 5 | 5 | USA | 1,080 | +35 |

| 6 | 7 | Bangladesh | 950 | +110 |

| 7 | 6 | Nigeria | 885 | +5 |

| 8 | 9 | Algeria | 720 | +280 |

| 9 | 11 | Morocco | 560 | +165 |

| 10 | 15 | Ghana | 455 | +185 |

Top Source Countries for Doctoral Students

The international market for doctoral students in Canada is about 30% the size of the master’s student market. This reflects the doctorate sector’s much smaller proportion of overall graduate study. Many of the countries listed above are leaders here as well, but there are some key differences, starting with the top.

China is the number one source country for doctoral students in Canada. 1,830 Chinese nationals held study permits for doctoral studies in 2019, comprising 17.3% of the international doctoral market. However, just 2.2% of Chinese students in Canada studied at that level.

Iran was a close number two, with 1,650 doctoral study permit holders in 2019. Iranian students accounted for 15.6% of the international doctoral student market in Canada. In stark contrast with China, 16.8% of Iranian students in Canada pursued a doctorate last year.

France was a distant third in the doctoral market as well, with 900 study permit holders. This was good for 8.5% of the market. 6.1% of French students in Canada in 2019 pursued doctoral studies.

The USA was fourth, with India a surprising fifth. Just 0.5% of Indian students in Canada studied at the doctoral level in 2019.

Here’s the full top 10:

| Rank 2019 | Rank 2018 | Country | # of Study Permits 2019 | Change 2018–2019 |

|---|---|---|---|---|

| 1 | 1 | China | 1,830 | +150 |

| 2 | 2 | Iran | 1,650 | +185 |

| 3 | 3 | France | 900 | +185 |

| 4 | 4 | USA | 705 | +5 |

| 5 | 5 | India | 650 | +50 |

| 6 | 6 | Brazil | 400 | +40 |

| 7 | 8 | Mexico | 500 | 0 |

| 8 | 10 | Bangladesh | 195 | +25 |

| 9 | 9 | Egypt | 185 | 0 |

| 10 | 12 | Nigeria | 165 | +10 |

Trends in Canadian Graduate Studies

As these lists show, certain source countries punch above their weight in graduate studies in Canada, in some cases sending more master’s and doctoral students than undergraduate students. I’d like to examine a few of these cases.

Iran

Among all countries that sent at least 100 students to Canada last year, Iran had the highest percentage of graduate students. In 2019, 44.6% of Iranian students in Canada studied at the graduate level. Compared to the all-countries average of 13.8%, this is a remarkable total.

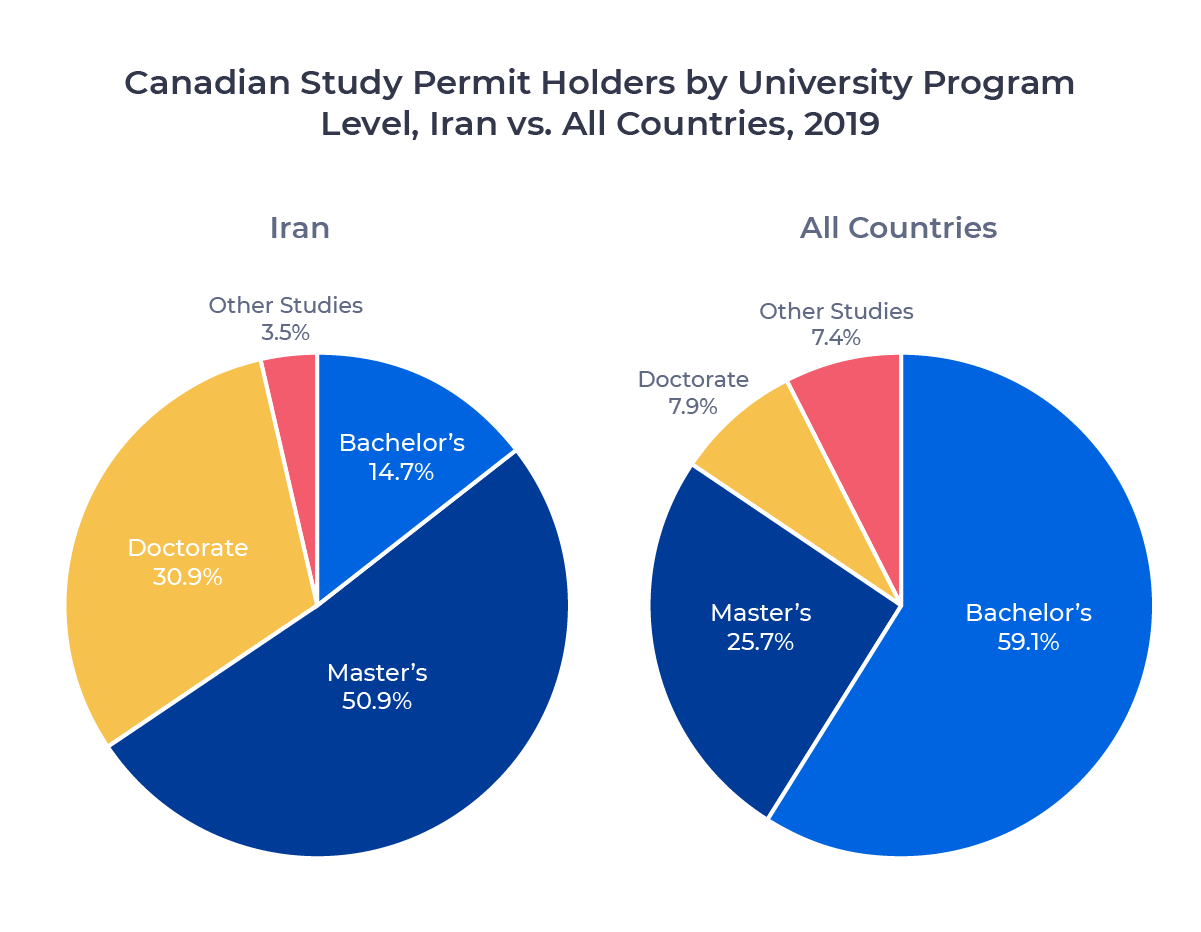

If we break down Iranian university enrollment by program level, we can see how heavily weighted it is toward graduate study:

Almost 60% of international university students in Canada in 2019 worked toward bachelor’s degrees. Among Iranian students, that number was just 14.7%. More than half of Iranian university students in Canada last year were master’s students, and over 30% were doctoral students—around two and four times the all-countries average, respectively.

What drives this disparity? Part of it is study permit approval rates, as the table below shows:

| Program Level | Applications | Approvals | Approval Rate |

|---|---|---|---|

| Bachelor’s | 764 | 388 | 50.8% |

| Master’s | 2,754 | 2,167 | 78.7% |

| Doctorate | 1,134 | 1,081 | 95.3% |

| Other Studies | 244 | 119 | 48.8% |

Iranian nationals are much more likely to be approved for a student visa1 as graduate students than undergraduate students. But they are also applying to study in Canada at a much higher rate for graduate programs. Part of this may reflect the different approval rates. Iranian students can see that they’re much more likely to be approved as graduate students, and are thus less likely to undertake the time and expense of applying as undergraduates.

However, this trend may also reflect the desirability of Iranian graduate students in Canada. Canadian graduate schools have long marketed themselves to Iranian students. They recognize that Iran’s post-secondary system is strong, with world-class institutions such as the University of Tehran and Sharif University of Technology turning out large numbers of STEM graduates, in particular.

With the deterioration of the Iran-US relationship over the past few years reducing competition for Iranian students, it’s perhaps no surprise that more and more Iranian nationals are pursuing graduate studies in Canada.

Francophone Countries

As we discussed above, France is a key supplier of graduate students to Canada. But it’s not the only Francophone country sending large numbers of students to study at that level.

Algeria and Morocco also placed among the top 10 source countries for master’s students in Canada. Tunisia, Lebanon, Benin, and Togo are smaller players in the Canadian international student market, but each sent a significant proportion of graduate students to Canada. Upwards of 30% of the Canadian study permit holders from each of those countries studied at the graduate level in 2019.

With the exception of Lebanon, more than 85% of the graduate students from those countries who came to Canada to study last year studied in the province of Quebec. In other words, graduate programs are key drivers of many Francophone countries’ contributions to international education in Canada. And just as important, Canada is a significant player in the French-language graduate market, offering a unique opportunity for Francophones to experience studying abroad in their native language at a number of world-class institutions.

Summary

Graduate programs are famously selective, admitting only the most successful undergraduate students. It’s important to remember that graduate students are often highly selective as well. Graduate programs are expensive, specialized, and often a significant time commitment. When I see strong graduate numbers in international education, I know it’s a sign of a healthy market.

With international study applications rising again in Canada following changes to the post-graduate work permit (PGWP) program, I’m optimistic that we’ll continue to see a robust graduate sector in Canadian international education despite the disruption of the COVID-19 pandemic. I’ll continue to monitor the sector and provide updates as full-year data for 2020 becomes available.

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,200+ educational institutions across North America and the United Kingdom. Working with over 4,000 international recruitment partners, ApplyBoard has assisted over 100,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. The terms student visa and study permit are often used interchangeably when discussing Canadian international education and immigration. Students need a visitor visa to enter Canada, but one is often issued with an approved study permit.