In this edition of ApplyInsights, I’m sharing my observations on Canadian study permit trends for select countries in South Asia. Together, South Asian countries accounted for 45.7% of Canadian study permit approvals in 20191.

Here’s what this blog post will cover:

- Canadian study permit approval numbers for all eight South Asian countries2

- Trends in the number of Canadian study permit applications and approvals between 2015 and 2019 for residents of India, Pakistan, and Bangladesh

- Study permit approval rates for India, Pakistan, and Bangladesh by study level (primary and secondary, college, university, etc.)

- My thoughts about the future of the Indian, Pakistani, and Bangladeshi markets

Full-year data for 2020 isn’t available just yet, so I’ll be looking at 2019 numbers throughout this article. I’ll look at some initial 2020 data at the end of the article, and I plan to revisit the South Asia market throughout 2021.

The table below shows the eight countries of South Asia and the number of study permits approved for students from each country in 2019:

| Country | # of Study Permits |

|---|---|

| India | 111,195 |

| Bangladesh | 3,168 |

| Pakistan | 1,194 |

| Sri Lanka | 834 |

| Nepal | 673 |

| Bhutan | 104 |

| Afghanistan | 24 |

| Maldives | 5 |

As the table shows, India is the dominant player in the South Asian market. India alone supplied 43.4% of the total number of international students approved to study in Canada in 2019. Though much smaller, Bangladesh and Pakistan are also important source markets for Canadian institutions.

Let’s examine these three leaders in South Asian enrollment more closely.

India

India is the second most populous country in the world. It surpassed China as the number one source of new international students to Canada as of 2016. We’ve covered India extensively in previous articles, including looking at Indian student trends in Ontario and in Quebec. Recently, I looked at which Canadian provinces were the top destinations for Indian students in 2020.

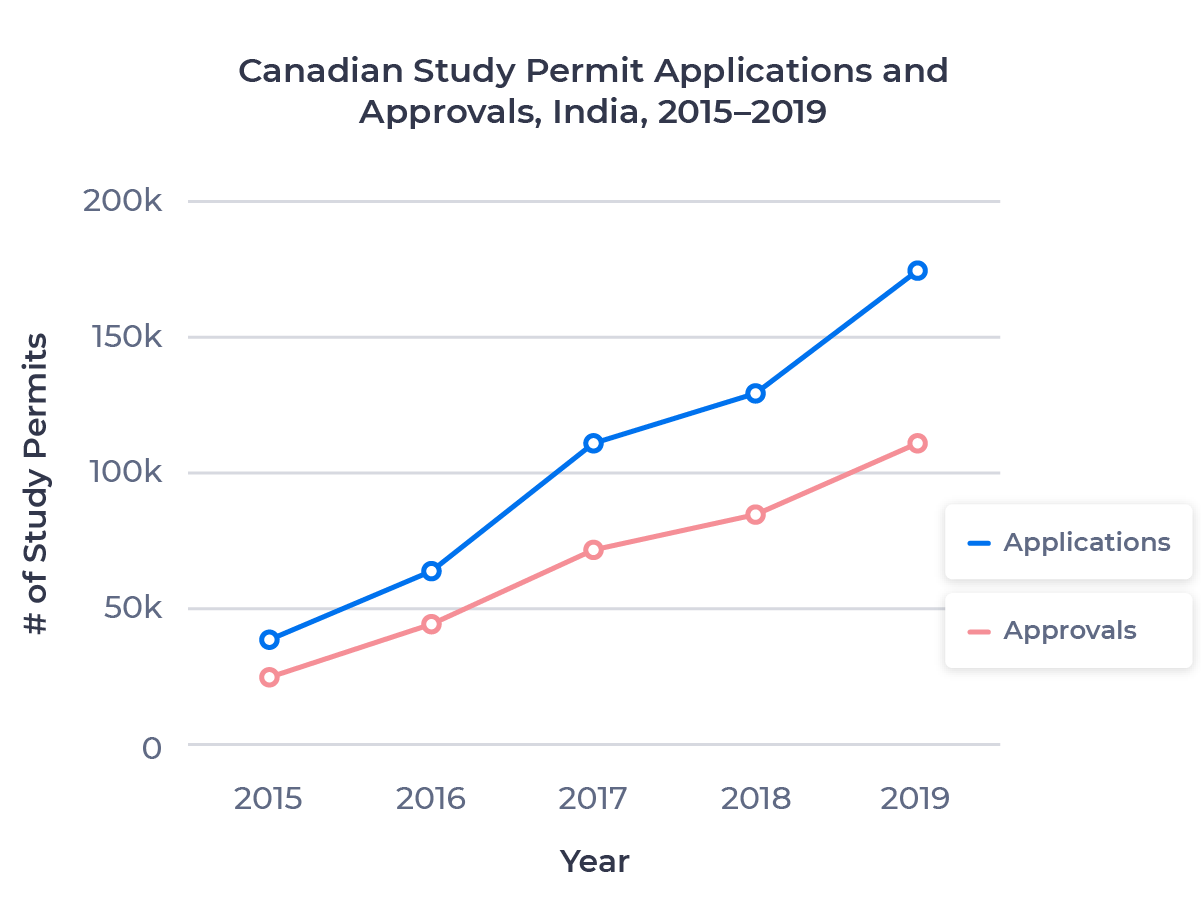

The chart below shows the growth in the Indian market from 2015 to 2019:

Let’s look at the application numbers first. India saw incredible growth every year between 2015 and 2019. The total number of Canadian study permit applications from Indian nationals rose by 350% over that period. While initial 2020 data3 has shown a significant drop in applications because of COVID-19, the post-pandemic period still looks promising.

Consistent approval rates over the 2015 to 2019 period helped study permit approval numbers keep pace with rising application volumes. This growth far outpaces all other countries. In fact, more study permits were approved for Indian students in 2019 than the rest of the top 20 source markets combined.

Post-Graduation Work Permit Program and the Student Direct Stream

The Post-Graduation Work Permit Program (PGWPP) is the main driver behind the continued growth of the Indian student market. Securing a post-graduation work permit (PGWP) after a student completes their studies is a critical step in the immigration journey and offers a path to permanent residency (PR). This makes the PGWPP a key piece of the value proposition of Canadian schools for Indian students. Growth in the Indian market and increased interest in the PGWPP resulted in a 60% increase in PGWP applications for Indian students between 2018 and 2019.

India was also one of the first four countries4 approved for the Student Direct Stream (SDS) program launched in 2018. This expedited study permit processing program quickly saw major uptake from Indian nationals. In 2019, Indian students represented 94.5% of all SDS applicants, and 54.4% of all study permits for Indian nationals were issued through the SDS program.

SDS applicants in 2019 were twice as likely to be approved as non-SDS applicants (80.7% to 40.7%).

For more information on SDS, check out our guide to the program.

Study Permit Approval Rates by Study Level – India

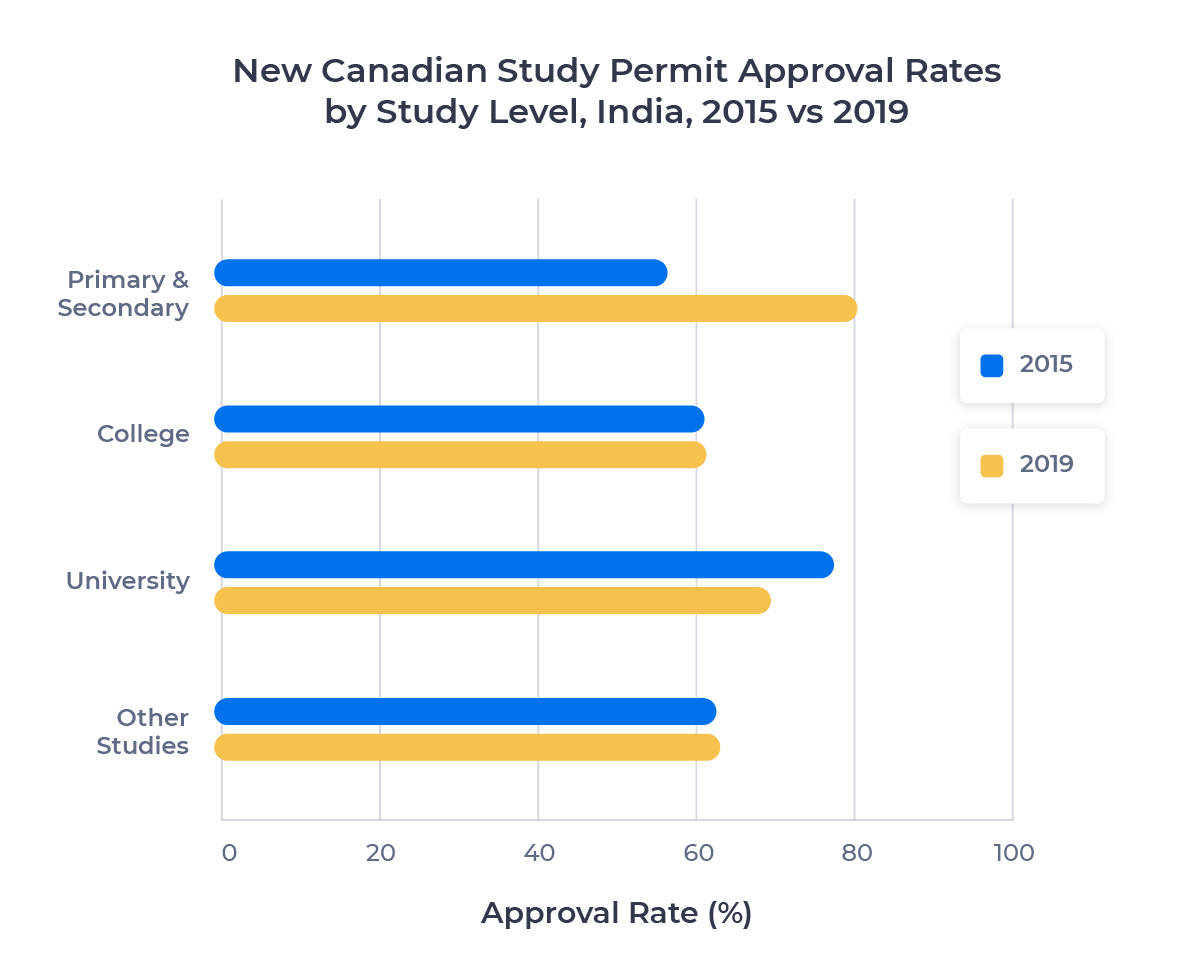

How often are Indian students approved for study permits in Canada based on study level? Let’s compare study permit approval rates in 2015 and 2019 by study level:

While approval rates for college and Other Studies5 stayed stable, primary and secondary approval rates increased by 23.8%. However, these applicants are only a small part of the Indian applicant pool. In 2019, only 4% of all applications from Indian nationals were for primary and secondary study levels. By contrast, college applications represented 65.8% of all those submitted by Indian students.

The decrease in university level approval rates could be a result of insufficient visa support services for students. In speaking with our recruitment partners in India, I’ve heard that visa support services and financial concerns are poised to be the main barriers for Indian student enrollment in 2021.

Bangladesh

Bangladesh is the third-largest South Asian country by population, with almost 165 million people. It’s the second-largest source of Canadian students from South Asia, and the 14th-largest supplier of students to Canada overall.

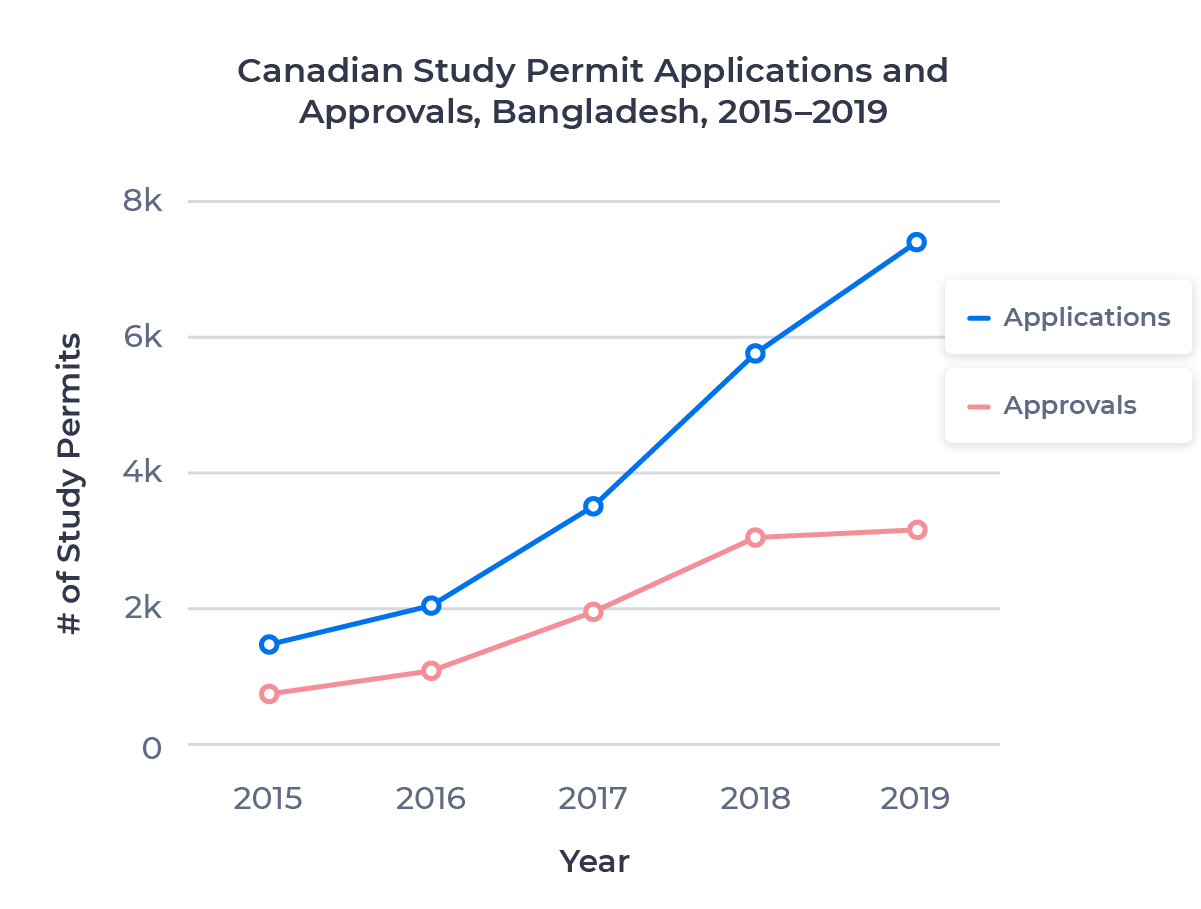

The graph below shows the growth in the Bangladeshi market from 2015 to 2019:

Study permit applications from Bangladeshi nationals rose by more than 400% from 2015 to 2019. In 2018, study permit application volumes increased by 65% year-over-year.

Study permit approvals did not increase at the same pace due to small decreases in approval rates between 2015 and 2018. In 2019, overall approval rates for Bangladeshi students fell to 42.9%. This represented a drop of over 10% from 2018, limiting the increase in approved study permits to 120.

In speaking with our recruitment partners in Bangladesh, I found that as with Indian students, the PGWP is a significant draw for Bangladeshi students who are looking to eventually attain permanent residency (PR). Study permit approval rates have remained relatively low for Bangladeshi nationals, and until recently there was limited knowledge of Canada in the market.

But, recent immigration policy and political rhetoric in the US have driven more Bangladeshi students to consider Canada for their studies. We’ll have to wait and see what impact the election of US President Joe Biden has on Canadian study permit application rates for this market in 2021 and beyond.

Study Permit Approval Rates by Study Level – Bangladesh

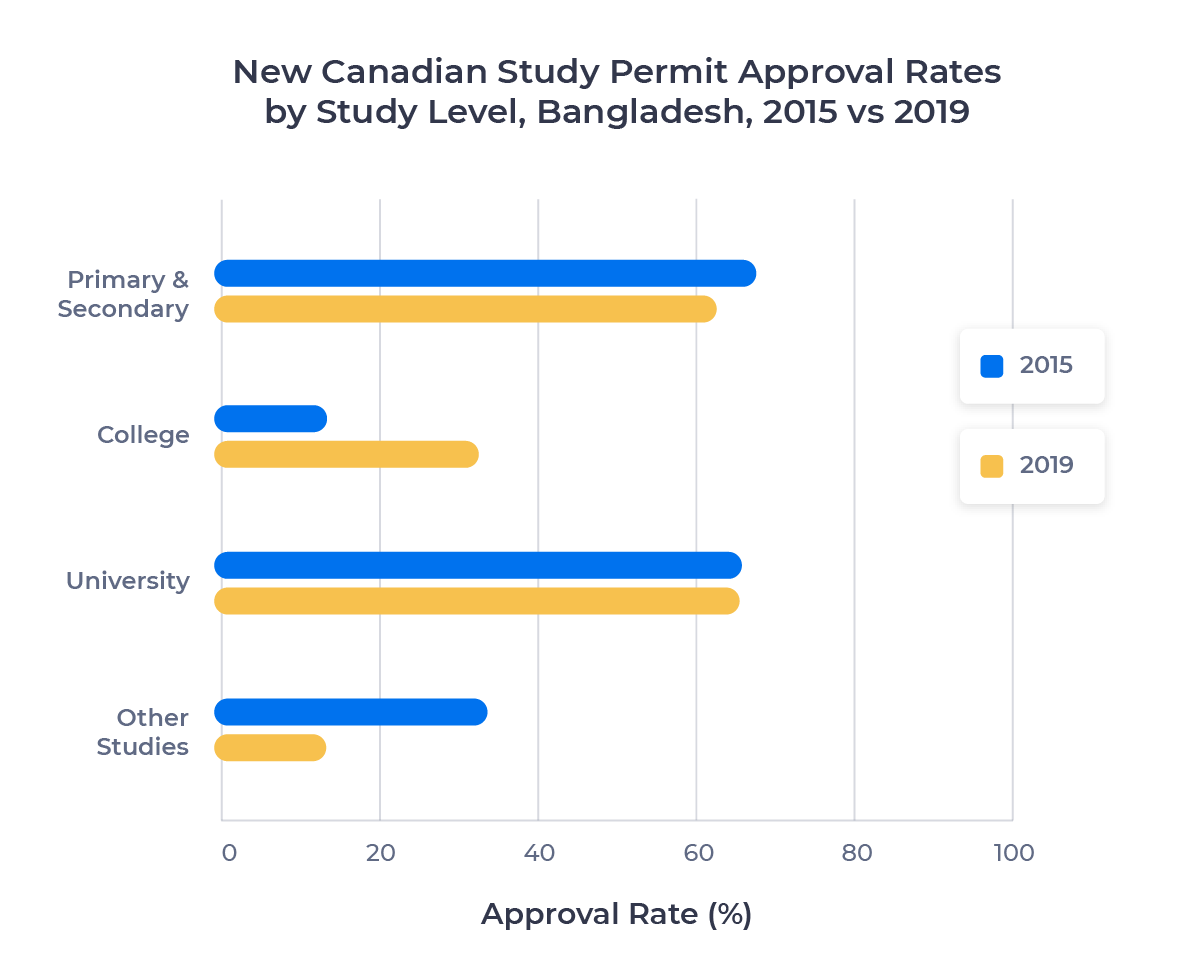

The chart below shows the study permit approval rates by study level for Bangladeshi students in 2015 and 2019:

Approval rate trends for Bangladeshi students were almost the opposite of India. Approval rates have remained stable for primary and secondary students, as well as university students. But college and Other Studies approval rates are on different trajectories. Other Studies approval rates fell by 21.7% over the four year period, while college approval rates went up by 19.2%.

College approval rates had a major impact on the number of Bangladeshi students who came to study in Canada in 2019. Nearly one-third of applicants in 2019 applied for college studies, but despite rising approval rates, only 12.8% of approved study permits were for college students.

University continues to attract the largest pool of students from Bangladesh, where a degree is viewed as a better qualification to secure PR.

Even though only 48.2% of submitted applications were for university studies, almost 75% of approved study permits for Bangladeshi students were at the university level.

Pakistan

Pakistan has a population of over 220 million and is the fifth most populous country in the world. It is South Asia’s third-largest supplier of students to Canada and the 23rd-largest source country for international students in Canada overall.

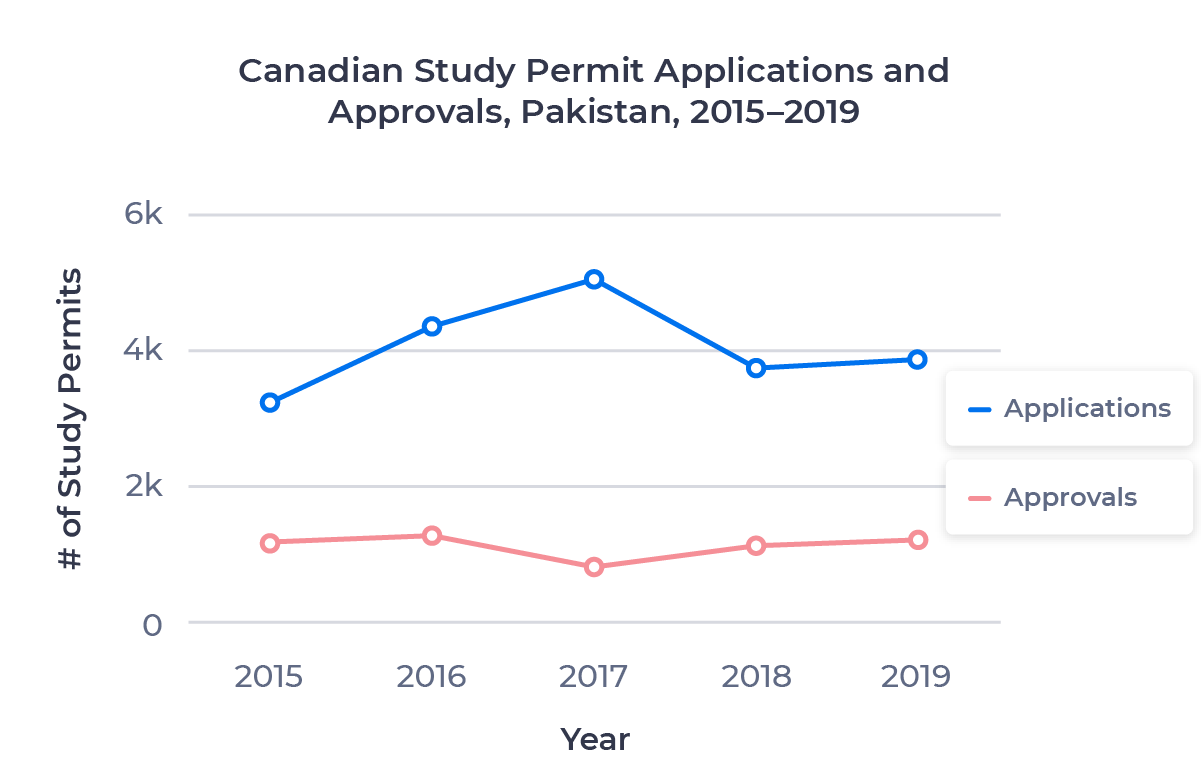

The Pakistani market saw some volatility between 2015 and 2019, as the chart below shows:

Study permit applications from Pakistani nationals fell by 33% in 2018. This was likely due to lower confidence in the market regarding the likelihood of permit approval after a drop in the approval rate in 2017. As a result, application volumes for Pakistani students rose only 19.2% overall from 2015 to 2019.

Study permit approvals stayed relatively flat between 2015 and 2019, with a notable dip in 2017. Over the five year period, approvals only rose by 1.0%. This is tied directly to overall approval rate changes. From a high of 37.3% in 2015, approval rates for Pakistani students fell to 16.1% in 2017 before recovering to 31.2% in 2019.

In speaking with our recruitment partners in the field, I’ve heard that the initial increase in applications, from 2015 to 2017, was largely driven by Canadian Prime Minister Justin Trudeau’s stated positions and announcements on skilled immigration. However, study permit approval rates did not increase in-kind and the market became less confident. But there is still a lot of interest from Pakistani students in studying in Canada and this growing population has potential for explosive future growth.

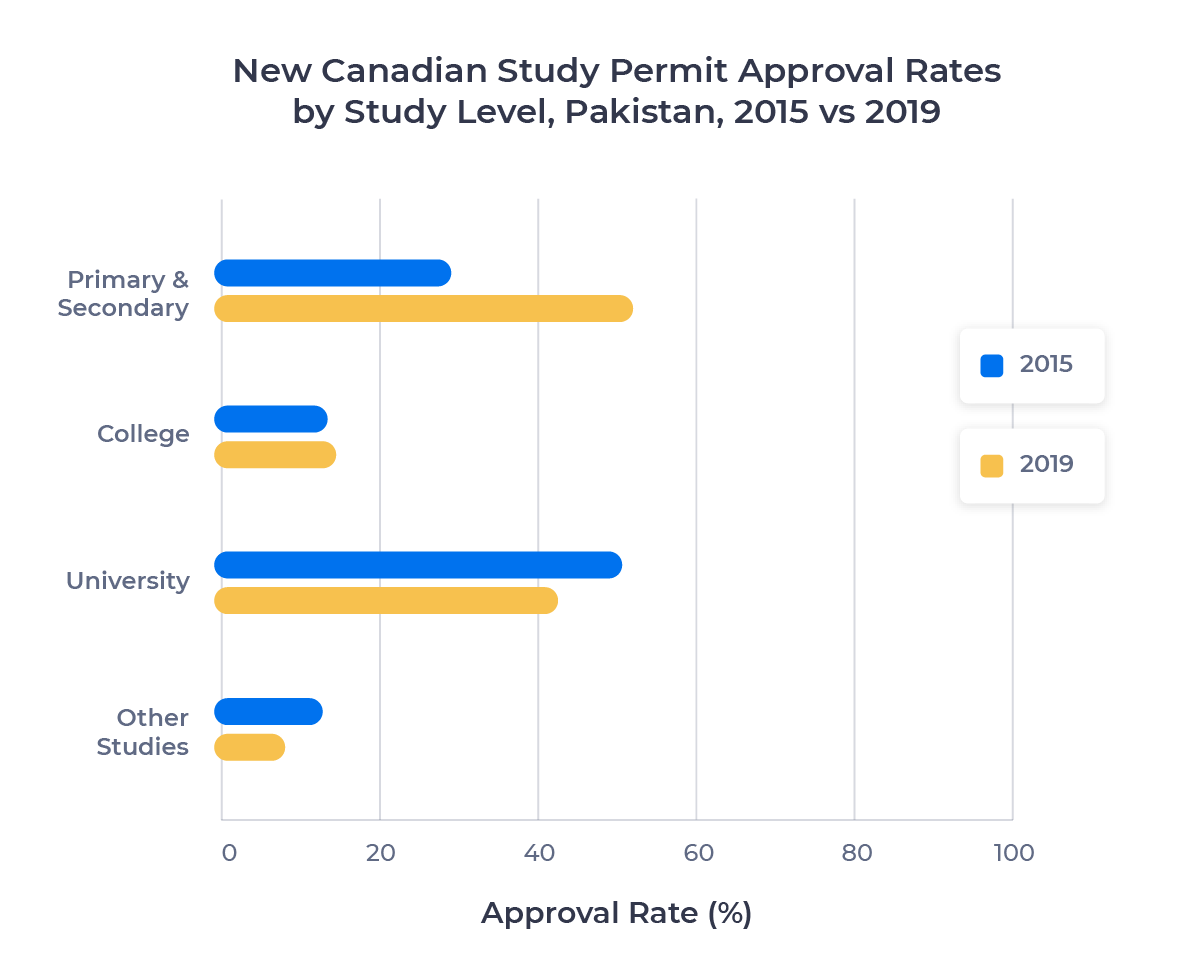

Study Permit Approval Rates by Study Level – Pakistan

Let’s take a look at study permit approval rates by study level for Pakistani nationals in 2015 and 2019:

Approval rate trends for Pakistani students mirror the trends for Indian students. College and Other Studies approval rates stayed relatively stable. But primary and secondary approval rates increased while university approval rates decreased. Between 2015 and 2019, university study permit approval rates fell by 8.3%. Primary and secondary approval rates rose by 13.0%.

The drop in university approval rates is what kept overall Pakistani student approval numbers low. 53.4% of 2019 study permit applications were for university studies, compared to only 6.6% for primary and secondary. Undergraduate and master’s degrees are highly valued in Pakistan, and low university approval rates have slowed market growth.

Even so, the future is bright for Pakistani applicants. Pakistan was added to the SDS program in July 2019. The study permit approval rate for Pakistani students increased by a modest 1.3% from 2018 to 2019. If approval rates continue to trend upward, we could see Pakistan surpass Bangladesh for the second-largest South Asian market in a few years’ time.

Looking Forward

South Asia is a top target market for Canadian schools, and not just because of India’s explosive growth:

- Indian, Bangladeshi, and Pakistani students are highly interested in university level studies and pursuing PGWP to PR immigration opportunities.

- Pakistan and Bangladesh are both underrepresented in the international student population in Canada, based on their populations.

- Pakistan and India are both part of the SDS program, and knowledge about Canadian institutions is growing in Bangladesh after years of UK/US dominance.

COVID-19 has definitely suppressed the market in 2020. Approved study permit numbers6 are significantly lower for all source markets. But I think that Indian and Bangladeshi study permit applications will rise once again post-pandemic. With such a large population, Pakistan also has the potential for substantial market growth. It’s very likely that even during the pandemic, South Asia will remain the largest source market for international students studying at Canadian institutions.

Though the other source markets in South Asia are much smaller than these three, Sri Lanka and Nepal have populations of over 20 million. This means that they are also underrepresented in the Canadian international student population and could be long-term growth opportunities. We’ll check back in on some of these smaller markets in a future ApplyInsights.

Published: January 25, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. In his role as Co-Founder and Chief Marketing Officer (CMO) at ApplyBoard, he leads the International Recruitment, Partner Relations, Sales Enablement, Sales Operations, and Marketing teams along a shared mission to educate the world. Meti has been instrumental in building partnerships with 1,200+ educational institutions across North America, the United Kingdom, and Australia. Working with over 4,000 international recruitment partners, ApplyBoard has assisted more than 120,000 students in their study abroad journey.

Meti was honoured in 2019 by Forbes, being named to three Top 30 Under 30 lists, including Education, Immigrants, and Big Money. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All application and approval numbers for new permits only. Data courtesy of Immigration, Refugees and Citizenship Canada (IRCC) unless otherwise noted.

2. Per the geographic regions published by the United Nations Statistics Division.

4. The other countries were China, Vietnam, and the Philippines.

5. Includes English as a Second Language (ESL) and French as a Second Language (FSL) programs, as well as Quebec-based vocational programs and other studies.

6. Based on study permit data from January 2020 to October 2020.