Are you planning to become an international student in Canada? It’s important to prepare for the cost of living in Canada so you can focus on your studies. To ensure you can afford what you need, it’s important to understand your spending habits. Before you travel to Canada, it’s a good idea to create both a yearly and a monthly budget. Doing this will help you ensure you can cover regular costs like groceries and large one-time purchases like a winter coat.

While the numbers below are current as of November 2025, it’s a good idea to check a cost of living calculator before drafting your own budget. Average prices can change regularly. In fact, these changes contributed to why the financial requirement for Canadian study permit applications increased in September 2025 (and will continue to change yearly).

Still deciding where you want to study? Read our blogs on the cost of living for international students in Germany and the United States. Updated posts about the United Kingdom, Ireland, and Australia are coming later this month!

Living Expenses

In 2025, Canada had the 17th highest monthly cost of living average in the world. Among popular study destinations, it was ranked more affordable than Ireland (6th), the United States (10th), the United Kingdom (11th), and Australia (13th). While it’s more affordable than some other destinations, Canada’s higher cost of living means that everything from rent to restaurant food may be more expensive than you’re used to at home.

Below, we’ve shared estimates for some essential cost of living expenses:1

When choosing where you want to study in Canada, ask yourself:

- Which province do I want to study in?

- Which institution and program is right for me?

- Do I want to live on- or off-campus?

Usually, rural areas will be more affordable than living in a city, but they often won’t have the same range of services and activities. When it comes to Canadian cities, rent in Vancouver is higher on average than anywhere else in Canada (Toronto is the second-most expensive). If you’re looking for a less expensive option, consider Atlantic Canada: Saint John in New Brunswick and St. John’s in Newfoundland and Labrador are the two most affordable major cities in Canada for renters.

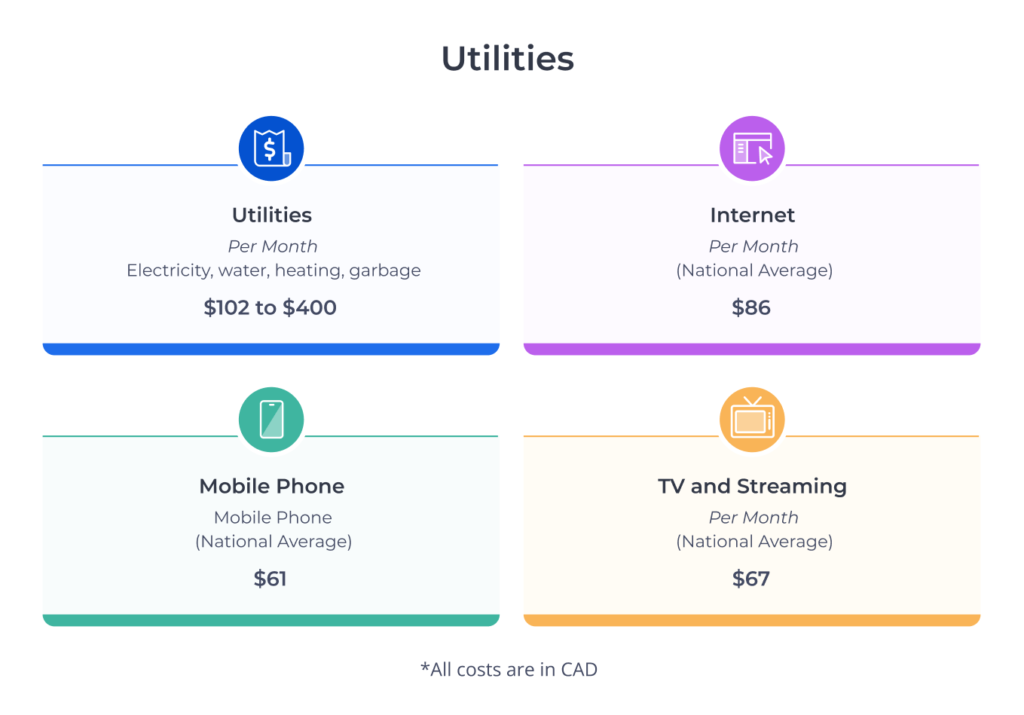

Utilities

Utility bills are often overlooked, but you need to factor them into your monthly cost of living. If you’re living on campus, your basic utilities are usually included in the price of your student housing. Typically, wifi is included, too.

Living off-campus? Your monthly rent may include some or all of your main utilities, though almost never Internet/wifi. It’s important to know if you have to pay utilities separately, and if you do, which ones, and how often.

Common utilities include:

- Water

- Heating

- Electricity

- Internet

These bills may go up or down depending on how many roommates you have, as well as your location, lifestyle, and local climate. Depending on the city or province you live in, some utilities may have additional charges for service delivery:2

As you move in, ask your landlord or apartment manager what the average cost of utilities is. This can help you understand if your bill is way lower or higher than what people usually pay. If it’s higher, something in your home might need a repair, like drafty windows letting heat out—speak to your landlord or apartment manager if this is the case!

No matter where you’re living, you’ll need to pay for your mobile phone, too. When you arrive in Canada, research different phone companies and ask about their packages for international students. You may be able to get special benefits or a discounted price.

Some international students will also need health and travel insurance. Learn about how international students can get health insurance in Canada!

Leisure

Studying abroad isn’t just about receiving an excellent education: it’s also about the experiences and fun you’ll have. That’s why it’s wise to save part of your budget for leisure activities:3

Consider what brings you joy. If you love live music, save your leisure budget for a special concert. Or, if you enjoy seeing the newest movies in theatres, budget for that instead.

The great thing is that this section is completely dependent on you. If you had an expensive month last month, stay in for a few Friday nights. Or, use the campus gym instead of splurging on a fancier gym membership. Remember, balance is key.

From thrifting to volunteering, here are some of our top tips for making the most of your student budget.

Transportation and Academic Supplies

It’s good to estimate how much you’ll spend getting around your community. Classes may be nearby, but you’ll need to do grocery runs, too. Depending on where you live in Canada, you may travel by train, bus, rideshare car, bike, taxi, or on foot:4

Check if your academic institution offers student discounts for public transit. At some institutions, a full transit pass is built into your tuition fees. In those cities, just tap your student card to ride the bus or metro. Another bonus to living on campus is that in many cities, you’ll be within walking distance of most shops and services.

Tip: Public transit is cheaper than taking a rideshare (like Lyft or Uber), but transit can take more time. Consider doing your class readings while on transit to use that time wisely.

You can save money on academic supplies by being organized and resourceful. Start searching for textbooks as soon as you receive your reading list for the semester. Try to rent books if you can. Or, buy them second-hand from your academic institution’s bookstore, Facebook Marketplace, or Kijiji.

If you’re buying books from someone online, be safe: go with a friend to do a porch pick-up or meet somewhere public on campus.

Want to save on writing supplies? Reuse pens, paper, and binders where you can, and go to campus job fairs to find free stationery.

Learn about part-time jobs in your new community at a campus job fair! These strategies can help you stand out to employers.

We hope the estimates above will help you as you begin budgeting for your study journey to Canada. It’s never too early to start planning!

Take the next step: explore the ApplyBoard platform to find a program that fits your goals.

FOOTNOTES:

1. Sources: Dalhousie University et al, “Canada’s Food Price Report 2025, 15th edition (food). Western University – International Student Services, “Making a Budget” (laundry). Erin Pepler, Macleans, “The Crisis in Student Housing” (on-campus housing). Numbeo, Cost of Living in Canada (off-campus housing). HEC Montreal, Sample Budget (personal care).

2. Sources: Numbeo, Cost of Living in Canada (utilities, phone, Internet). Information Technology & Innovation Foundation, “The Online Streaming Act will Cost Canadians.” Jan. 14, 2025 (TV and streaming).

3. Sources: Eventbrite, “The Nightlife Industry: How Much Do People Spend on a Night Out?” (night out). Numbeo, Cost of Living in Canada (beer, coffee, eating out, movie, gym). Western University – International Student Services, “Making a Budget” (entertainment, clothing).

4. Sources: Western University – International Student Services, “Making a Budget” and HEC Montreal, “Sample Budget” (books and supplies). EduCanada, “Prepare your budget to study in Canada.” (transit)