The Australian international education sector keeps moving forward despite the challenges they have faced throughout the pandemic. Regular industry roundtables have helped create an 18-month recovery roadmap which has been shared with the Australian government. Related sectors, such as the travel industry, have also been brought onboard to ensure the plan can be rapidly implemented when borders reopen.

To evaluate what the industry is up against, I’ll be revisiting Australian student visa trends in today’s article. While I’ve previously discussed changes to Australian student visa rates, new data is now available for the full 2020/21 year.1 With this new data, I’ll be taking a look at student visa grant rates and volumes over the past five years, and I’ll check in on some of the top source countries for Australian institutions.

Key Insights at a Glance

- Total Australian student visas granted declined 32% from 2019/20 to 2020/21, though visa approval rates rose from 92% to 96%.

- Higher ed and VET institutions were relatively stable in 2020/21 with granted visa volumes falling by only 20% from 2019/20.

- More student visas were granted to students from India, Nepal, Pakistan, and the Philippines in 2020/21 than in 2016/17, showing strong sector resilience.

As we cover this student visa data, keep in mind that the pandemic affected the second half of the 2019/20 year and the entire 2020/21 year. This means that travel restrictions only partially impacted student enrollment in 2019/20, yet they were a major factor throughout 2020/21.

Australian Student Visa Grant Rates

Over the past ten years, the average Australian student visa approval rate never dropped below 90%. But it hit a fifteen-year high in 2020/21, surpassing 95% for the first time since 2006/07. This represented a 3.3 percentage point increase over 2019/20 and a 5.5 percentage point increase over 2018/19.

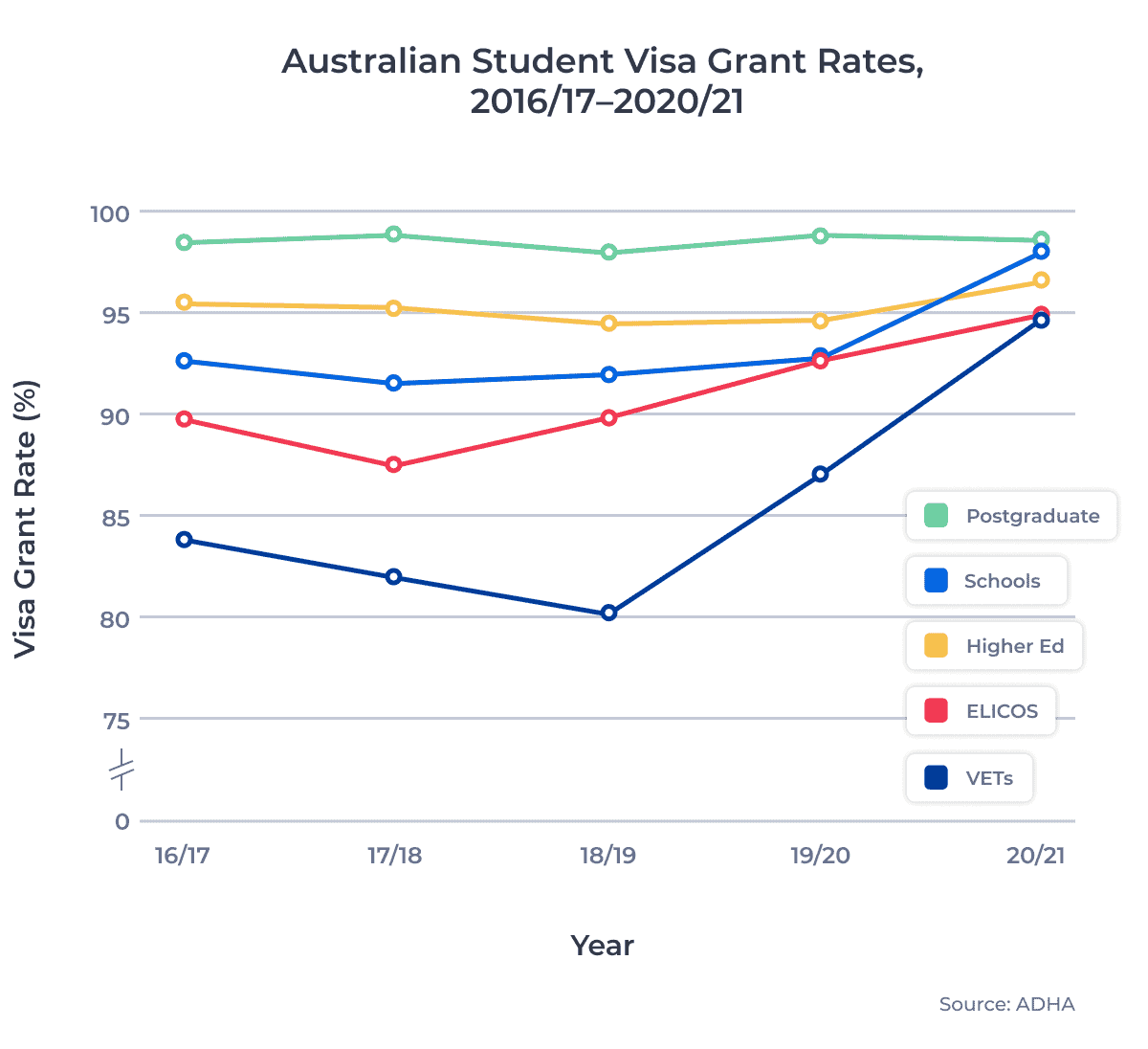

The chart below shows Australian student visa grant rates by study level over the last five years:

A major factor in these rising approval rates is the quantity of onshore students requesting visa extensions during the pandemic. In 2018/19, 62% of applicants applied from outside of Australia, indicating that they were likely new international students. In 2020/21, offshore students accounted for only 36% of all applicants.

As I covered back in April, onshore students have significantly higher Australia student visa approval rates than their offshore counterparts. In 2018/19, onshore students were approved for a student visa over 95% of the time, compared to only 87% of the time for offshore students.

However, approval rates for both groups rose in 2020/21. Onshore student approval rates hit nearly 100% in 2020/21, while offshore student approval rates climbed to 89%. This clearly demonstrates the Australian government, and Australian institutions, are keen to help current students finish their studies and allow new students to enroll.

Australian Student Visa Grant Volumes

Despite these high approval rates, visa grant volumes have fallen at Australian institutions throughout the pandemic. Ongoing travel restrictions have made it difficult for new students to get to Australia, though many have enrolled in online programs to begin their studies in the meantime.

Some Australian universities have established resource centres abroad to support international students and provide them with access to reliable internet and online libraries for their studies.

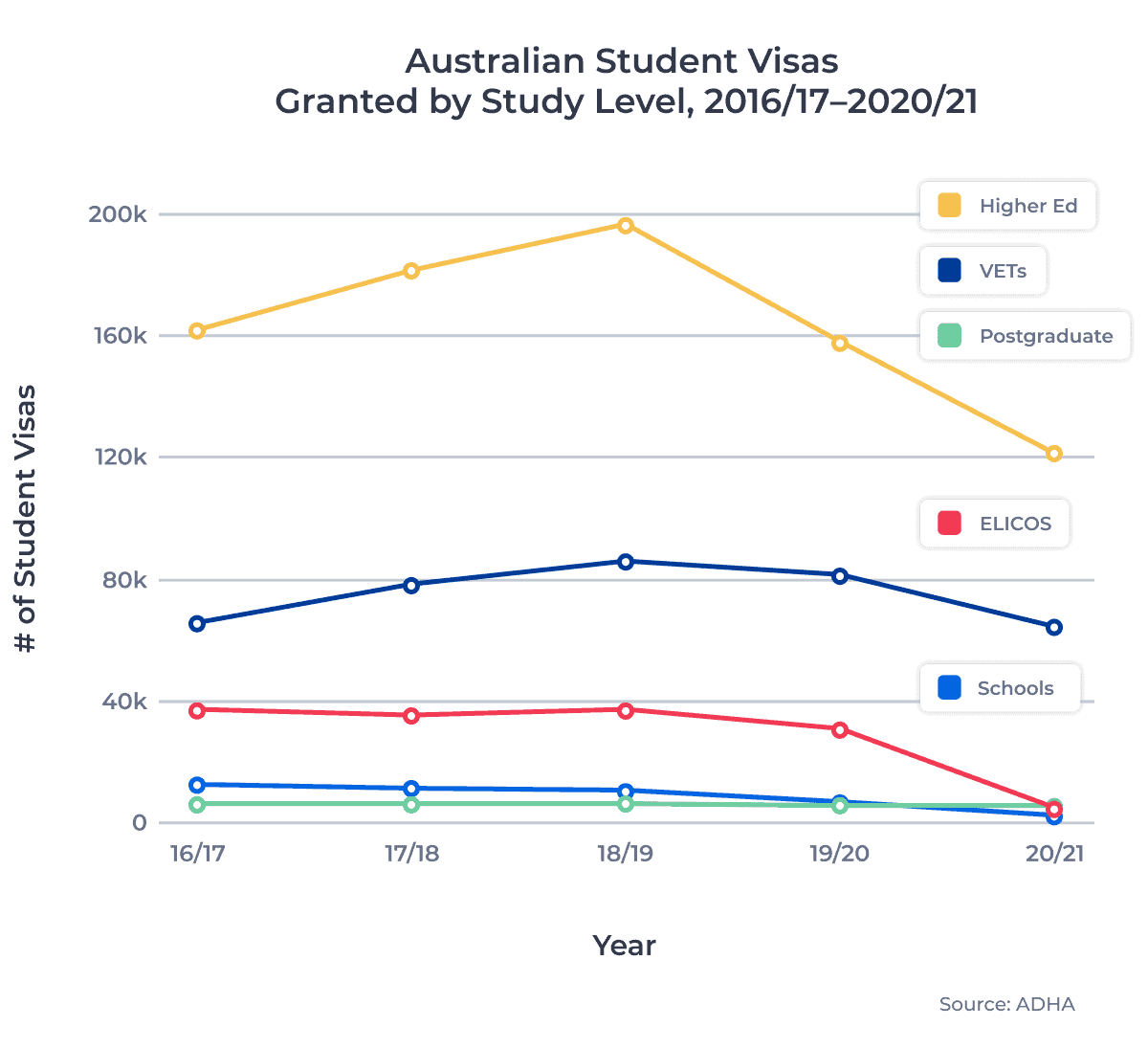

The following chart shows the number of Australian student visas granted to students by study level in the last five years:

Other sectors remained more resilient throughout 2019/20 and 2020/21. Comparing student visas granted in 2016/17 and 2020/21, the VET and postgraduate sectors experienced more moderate declines than other sectors. The relative stability of the VET sector is noteworthy given that VET students accounted for over 25% of all student visas granted over the past five years. Even with pandemic conditions taken into account, the VET sector only saw a 25% decline in granted student visa volumes from 2018/19 to 2020/21. The higher ed sector did not fare quite as well, shrinking by 39% over the same period.

Top Source Markets for Australian Institutions

When I last compared the VET and higher ed sectors in Australia, I noted that source market diversity has helped keep the VET sector stable during the pandemic. Australian universities have largely been reliant on just three source markets—China, India, and Nepal—for almost 75% of their international students since 2016/17.

Such strong reliance on only a few markets is not sustainable long-term. However, I expect that continued growth of the Indian and Nepali markets will help enable rapid VET and higher ed recovery post-pandemic.

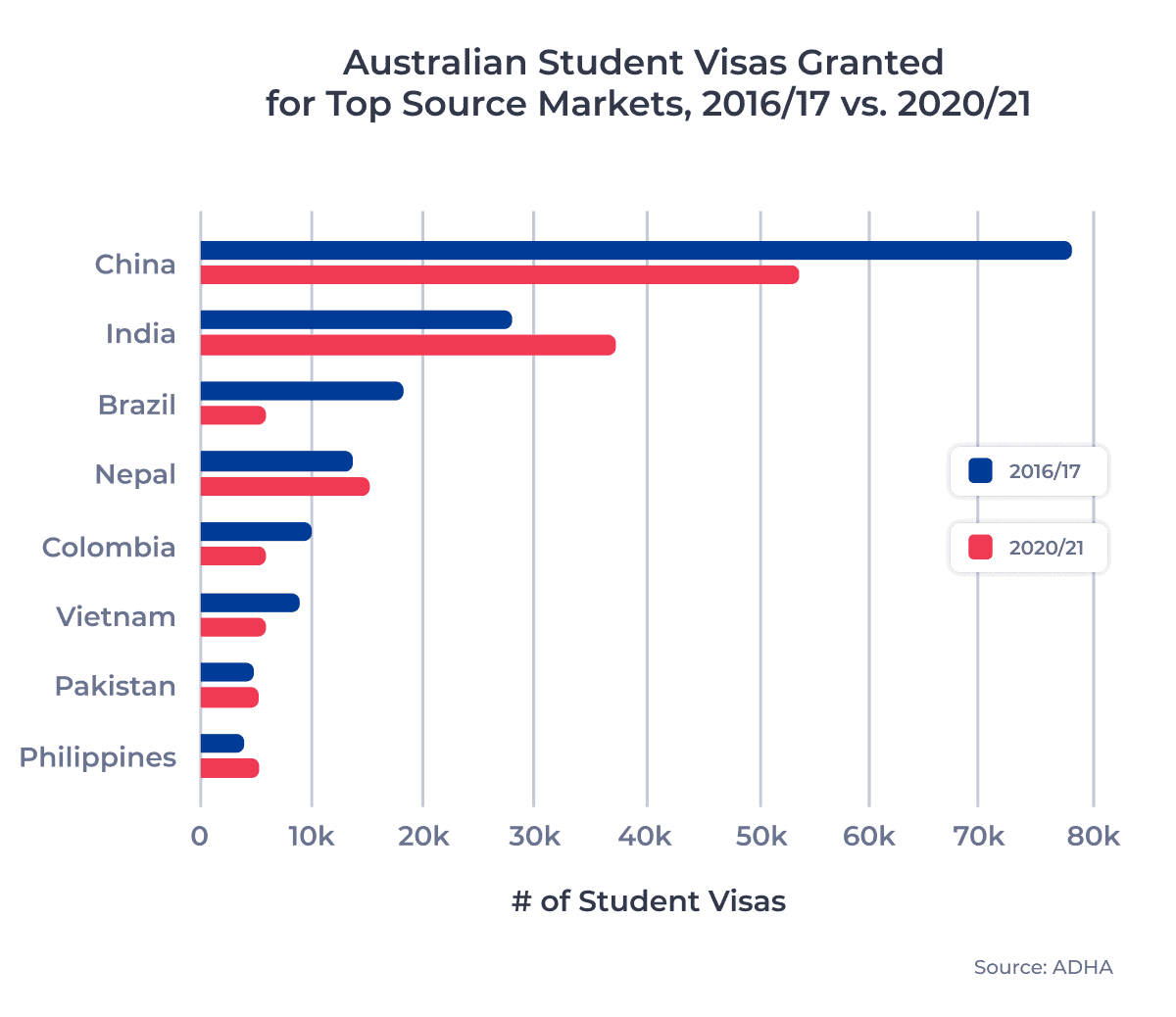

The chart below shows how many student visas were granted to international students from Australia’s top source countries2 in 2016/17 and in 2020/21:

Other top source markets—such as Brazil, Colombia, and Vietnam—also saw student visas decline from 2016/17 to 2020/21. In the case of Brazil and Colombia, these decreases are largely responsible for the drop off seen in Australia’s ELICOS sector. A critical aspect of learning English abroad is exposure to the language in day-to-day settings, and border closures made this type of study impossible in 2019/20 and 2020/21.

I expect that Australian institutions will look to new and established student markets post-pandemic to help drive rapid recovery. I anticipate that pent-up demand from Indian, Nepali, and even Chinese students will result in a student surge when travel resumes. But other growing markets, such as Pakistan and the Philippines, could provide a key source of new students in 2022 and beyond.

Planning for a Brighter Future

Australian institutions and governments are well aware of the challenges presented by their prolonged border closures. The industry has been bombarded by negative news, budget cuts, and now the rising COVID-19 Delta variant.

These factors have all led to the establishment of the International Education Industry Roundtable, a group of Australian learning institutions and organizations. The group is advocating for the adoption of an 18-month national plan which demonstrates clear support for the international education sector and which enables rapid sector response to government travel policies. If the group’s proposals are accepted by the Australian government, the government would agree to:

- Prioritize travel for students from low-risk countries (and continuing education students) and allow those students to test alternative vaccine policies and quarantine protocols

- Expand travel prioritization and pandemic policy alternatives to VET, ELICOS, and schools students if the low-risk student tests succeed

- Waive visa fees and streamline visa renewal processes for new and current students

- Coordinate a national marketing campaign to promote and reinforce Australia’s education brand

It’s too early to say how exactly the Australian government will react to these proposals. But it’s clear that Australian institutions are doing everything they can to prepare for the return of international students as soon as possible.

Next month, I’ll be chatting with some of our partner schools in Australia about their post-pandemic plans. Check back here to find out what they’re doing to support current students, how they plan to recruit new students, and what their thoughts are on Australia’s recovery roadmap.

Published: August 25, 2021

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Meti Basiri

Meti Basiri

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at ApplyBoard, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,500+ educational institutions across Canada, the United States, the United Kingdom, and Australia. Working with over 7,500 international recruitment partners, ApplyBoard has assisted more than 200,000 students in their study abroad journey. Follow Meti on LinkedIn for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. All data courtesy of the Australian Department of Home Affairs (ADHA). All data reported according to Australian governmental financial years, which span from July of one year to June of the next year. (For example, July 2019 to June 2020 was the 2019/20 year.) The data used for this article includes subclass 500 and subclass 570 to 576 visas granted to primary applicants only.

2. Top source countries include all countries with over 5,000 students granted an Australian student visa in 2020/21.